AUD/USD outlook

The AUD/USD recent rally appears to be stalling ahead of the 50-day SMA (0.6663) as it struggles to extend a string of highs and lows from last week, with the Reserve Bank of Australia ( RBA) interest rate decisions could have an impact. The central bank is expected to maintain its current policy and thus do little to support the exchange rate.

AUD/USD likely to fail the 50-day SMA test

AUD/USD is trying to recover from its May high (0.6818) after hitting new year-to-date lows (0.6459) last week, but June is likely to rise if the exchange rate manages to rise above its monthly high. A starting range of 1.5% could set the stage for a larger recovery. low (0.6485).

joining David Song in order to Weekly Fundamental Market Outlook webinar.register here

FOREX.com Economic Calendar

However, the central bank is expected to keep the official cash rate (OCR) at 3.85% in June, and it remains to be seen if the governor will make a policy decision, so the RBA meeting could drag out the AUD/USD pair. have a nature. Philip Lowe & Co supports a wait-and-see approach in the coming months as the board plans to follow a “narrow path of steadily lower inflation and rising unemployment but below pre-pandemic levels” policy.

Meanwhile, AUD/USD could broadly follow the negative slope of the 50-day SMA (0.6663) as the Reserve Bank of Australia (RBA) appears to be at or nearing the end of its rate hike cycle. But central banks may take additional measures to combat inflation. “Inflation was expected to reach the upper end of the target band by mid-2025.”

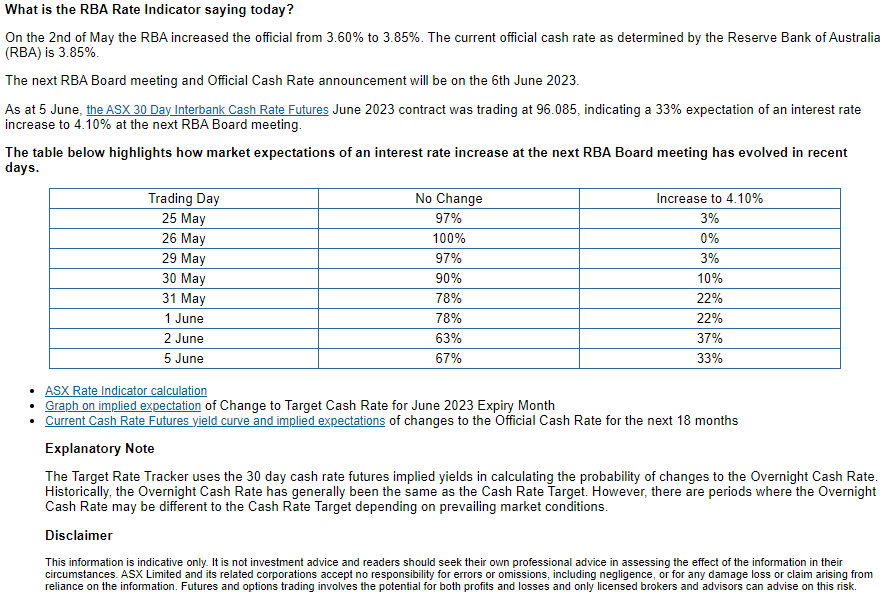

Source: ASX

As a result, the ASX RBA rate benchmark has a ‘no change’ probability of more than 60%, and AUD/USD may try to reverse further its fall from May, so another surprise rate hike is likely. It could provoke a bullish reaction for the AUD. The all-time high (0.6818) remains possible if Lowe and others maintain the possibility of introducing higher interest rates.

That said, AUD/USD may try to trade above the 50-day SMA (0.6663) as long as it stays above the monthly low (0.6485), but if the exchange rate struggles, the moving averages may try to trade above. may go negative. Press on the indicator.

Australian Dollar Price Chart – AUD/USD Daily

The chart was created by strategist David Song. AUD/USD on TradingView

- AUD/USD has risen for three days after hitting a year-to-date low (0.6459) at the end of May, with the exchange rate poised to close again above the 50-day SMA (0.6663). may be traded beyond 0.6600 (23.6% Fibonacci retracement) handle.

- A break/close above 0.6660 (50% Fibonacci retracement) provides more room to move towards the 0.6780 (38.2% Fibonacci retracement) to 0.6820 (23.6% Fibonacci retracement) region, while the AUD/ USD may track the negative slope of the moving average. If you can’t push it back over the indicator.

- A close below the 0.6600 (23.6% Fibonacci retracement) handle could push AUD/USD back towards the 0.6510 (38.2% Fibonacci retracement) to 0.6550 (61.8% Fibonacci retracement) area, leading to the next The area of interest could come near the May low ( 0.6459).

Additional market outlook

Post-NFP USD/JPY Rally Focuses on June Opening Range

Gold Price Rebound Brings 50-Day SMA Test

— By David Song, The Strategist

Follow @DavidJSong on Twitter