Orvon Arya/E+ via Getty Images

Ubiquity (New York Stock Exchange: UI) show excellent returns overall, but a deeper look reveals that equity returns are driven by heavy use of debt. The company has been generous with share buybacks and dividends in the past. Not sustainable in the long run. Going forward, the company’s options will be limited and the priority will be to strengthen its balance sheet, which could undermine the very nature of its earnings. High valuations are still too optimistic about the future, so it’s very likely that investors will find better returns elsewhere.

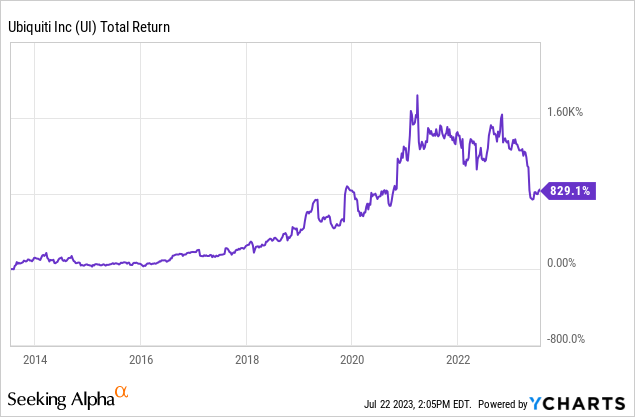

performance

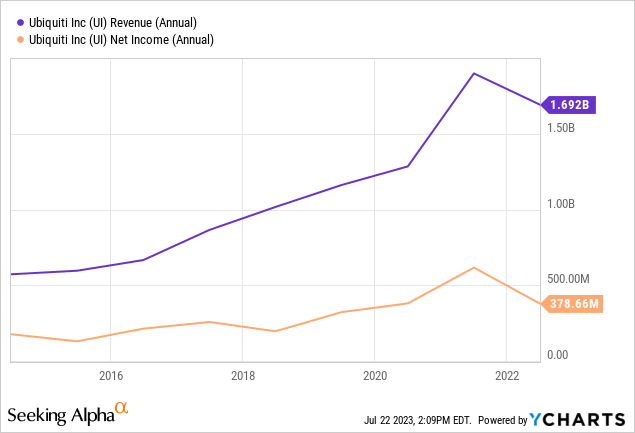

Over the last 10 years, the company has been profitable by more than 800%, backed by good revenue and net profit growth. We saw a decline in both of these last year, followed by a decline. Stock price. But most of those earnings were boosted by dividends and share buybacks.

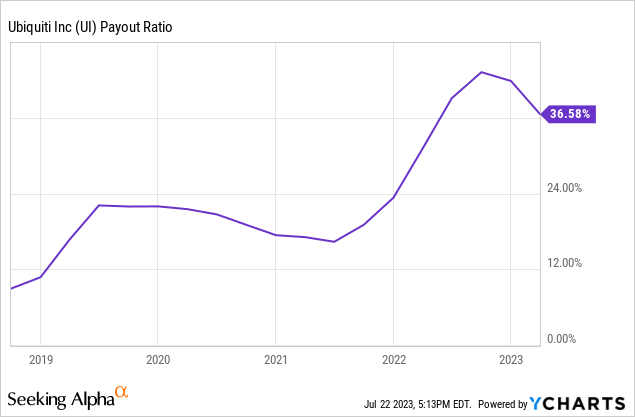

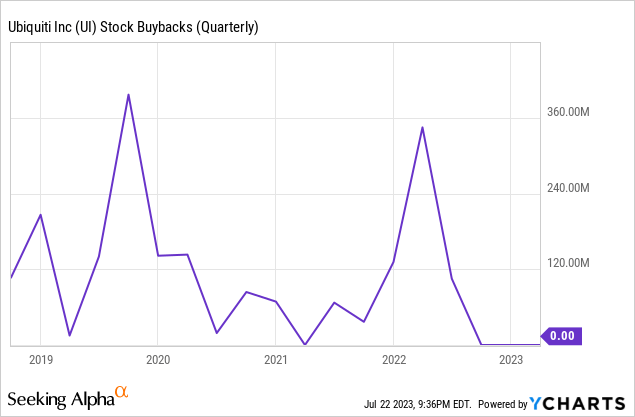

A high payout ratio indicates that the majority of profits are paid out to shareholders in the form of dividends. The company has also been fairly aggressive with share buybacks, and has managed to reduce its share count by more than 20% over the past five years.

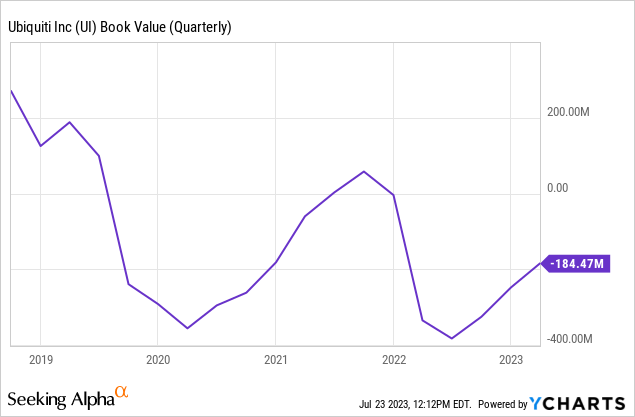

role of debt

Generally, I like this move of a company when it’s funded by excess operating cash flow and cash flow allows it to continue to be funded. However, high debt levels are a concern. Debt can play many roles in a business, and we are especially wary of negative equity after dividends and share buybacks. Internal cash flow certainly isn’t enough to cover the company’s dividends and share buybacks (in 2022 alone, the company spent nearly $750 million, more than double OCF).

Cash flow statement snapshot (We are looking for alpha finance pages)

Looking at operating cash flow, debt, share buybacks, and dividends through the lens of a company’s capital, there is a clear imbalance here.

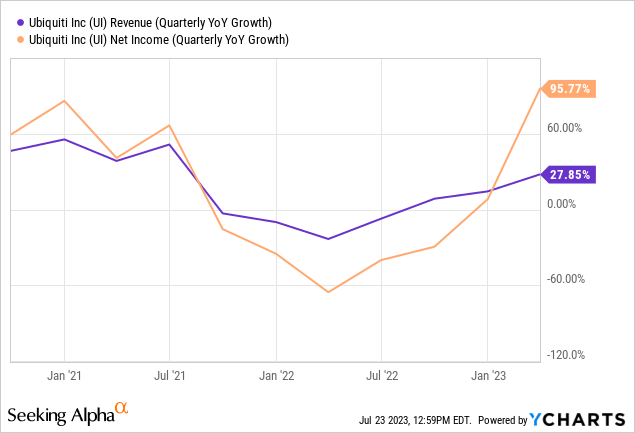

most recent quarter

It’s encouraging that the company is prioritizing its balance sheet and improving its capital base. The most recent quarter saw an increase in revenue and net income, which was largely possible as the company was emerging from his 2022 recession.

2022 has been a bad year for multiple reasons, including the supply chain crisis and the impact of the pandemic. So this will return to the levels last seen in 2021. It would be wise to be cautious and wait for the next few quarters to see where this trend is headed.

detached evaluation

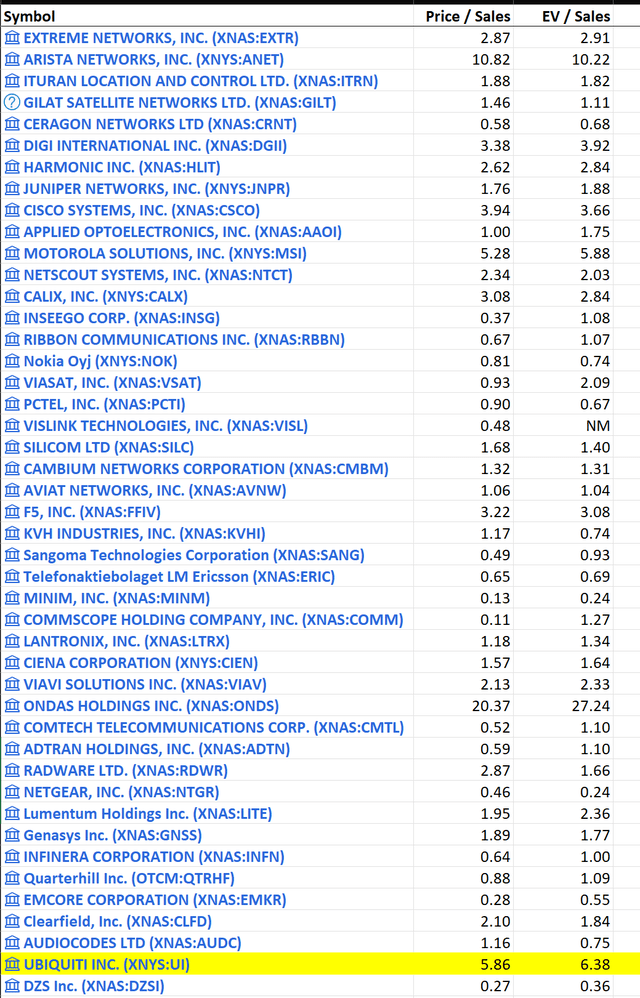

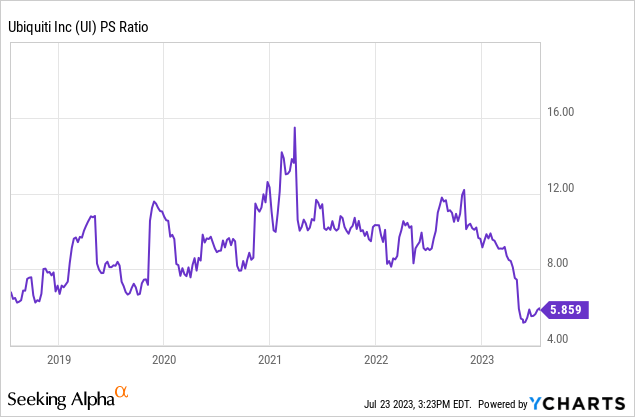

Considering the company’s current financial situation, the company’s current valuation cannot be justified. As we saw earlier, negative shareholders’ equity means that the book-to-book ratio becomes irrelevant. The company’s earnings haven’t fully recovered, and it’s now trading at 28 times earnings.

Cross-industry sales comparison (Seeking alpha)

The industry PS average is 2x and EV/sales average is 2.3x. With a current sales multiple of 5.8, the market sees more potential in the company’s stock than its peers. If this expectation is not met, valuations may reset again (there was one instance of a significant valuation reset in 2023, but valuations are still far from par)

tie it all together

I would rate this company as a “sell”. The company’s staggering earnings in the past have been fueled by its generous share buybacks and dividends. It turns out that the company has become increasingly indebted in the process, but there are limited options the company can consider going forward. Pursuing the same options as before to increase returns to shareholders may not be feasible, as public equity is limited and increasing dividends will further strain the company’s finances. In my opinion, the only option is to grow the company organically, but at the moment there is no concrete way to say if that will happen (it might even happen). claimed that harsh economic forecasts may affect ubiquity). From a sales and profitability standpoint, the trend has been flat over the last few years, which again isn’t too encouraging. Just because valuations have recently reset doesn’t mean we can’t see the next one. The company is still overvalued and a mediocre quarter would reset the valuation again. With valuations more in line with industry averages, it wouldn’t be surprising if the stock price corrected by more than 50%.

When is this paper wrong?

The company’s recovery from a bad year has been very strong, and if it continues to do so, it could significantly improve its financial health.company Offers Wired and wireless network infrastructure and supporting software that is closely related to worldwide Internet usage. The high cost and long lead times of wired networks limit their use in underserved areas, whereas wireless networks are a more attractive option for providing broadband access in both emerging and developed regions. The company’s focus on wireless solutions leaves a huge market to serve. If Ubiquiti’s solution is preferred over its competitors, there’s a good chance the company will see the growth it needs to justify its current share price.