Huge profits in subprime have forced specialty dealers/lenders to take on huge risks, which have come back to nest. But prime auto loans are in good shape.

Written by Wolf Richter of Wolf Street.

Subprime doesn’t mean “low income,” it means “bad credit.” This means a history of taking on too much debt and not paying those debts and other obligations as agreed, which caused the FICO score to fall into the subprime category.

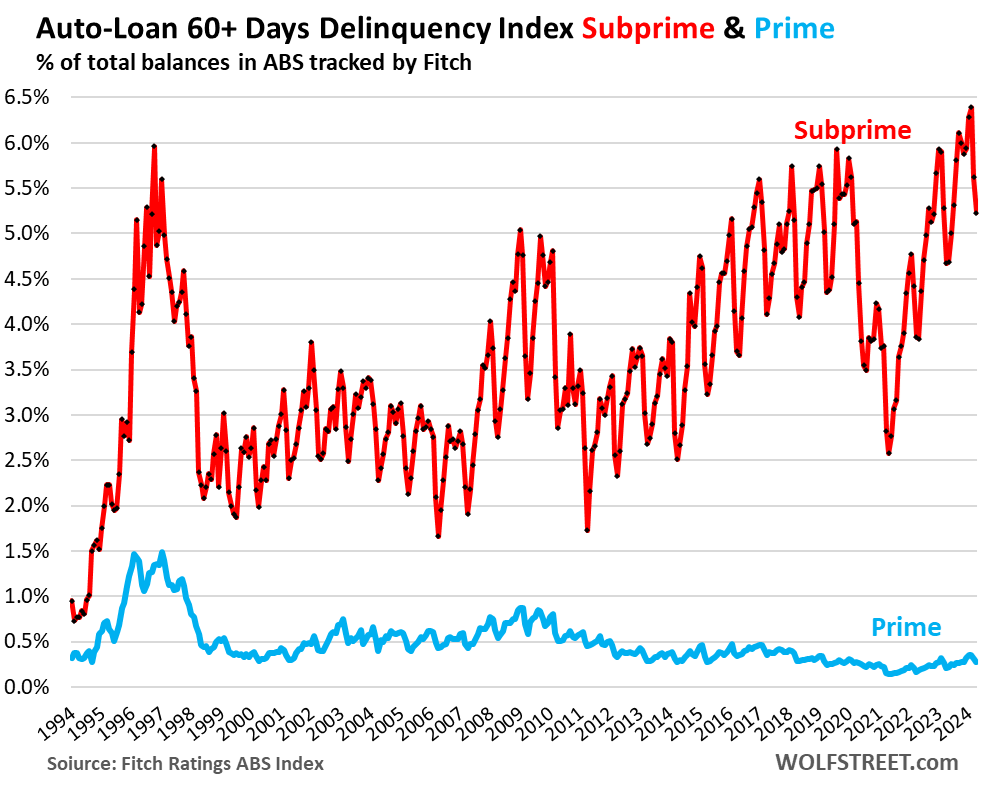

In addition, subprime auto loans are in trouble after briefly getting out of trouble due to the free month era. According to the Fitch Subprime Index, which tracks securitized auto loans, 5.23% of subprime auto loans were 60 days or more past due in April, the worst April on record for April 2020. This slightly exceeded the previous record. Asset-backed securities (ABS) rated by Fitch.

The index is seasonal, reaching a high in January or February and a low in April or May each year, as many borrowers receive relief during tax refund season. The delinquency rate for February 2024 was 6.4% (red), the highest month ever. However, Prime Auto Loan is in good condition (blue).

Every April since 2006.

Subprime delinquencies increased from 2015 to 2019 as subprime lending became very aggressive, with numerous scandals, huge losses, and in 2018, some subprime specialty dealers/finance companies owned by PE companies went bankrupt. It had already increased over the years. We’re kind of used to subprime drama because it was a hot topic back then, and we take it in our stride.

The problem is, subprime is a business with huge profit margins on car sales and dizzying interest rates on car financing, so specialized companies have to pay big to make those profits. It’s about taking a risk, and for some, it ends in failure. Risk collapses when it comes back to roost.

Subprime is only a small part of used cars, Does not affect new cars.

In auto loans, almost all subprime loans are for used cars, and most of them are for older used cars. The sweet spot is about 10 years. It’s very difficult to finance a new car with a subprime credit score.

According to Experian, about 61% of used car buyers pay cash. Of the 39% borrowing to buy a car, subprime borrowers accounted for about 14% of the loan origination. This means that approximately 5.5% of all used car buyers (those paying cash and those financing) receive subprime loans. It’s a small, specialized, high-risk, high-return corner of the overall used car market.

Subprime’s share was higher before the pandemic, but this is a sign that subprime lending will tighten in 2023, as always happens when delinquencies pile up.

Price and confusion.

However, used car prices skyrocketed by about 55% from 2020 to 2021, and people took out large loans to finance these very expensive used cars. Since the beginning of 2022, used car prices have shed nearly half of their rise, but they remain extremely high and interest rates are rising rapidly. These moves have completely changed the used car business.

A subprime specialty dealer/lender chain owned by a small number of PE firms will collapse in 2023, and the largest publicly traded subprime dealer/lender, Carmart, will reveal major problems, and the company’s stock price will decline despite a booming stock market. has plunged nearly 50% since mid-August.

Investor losses are not that severe.

The subprime business is a business in which dealers/lenders securitize subprime auto loans into asset-backed securities (ABS) and sell investment-grade tranches of those ABS to pension funds and other yield-seeking institutional investors, with less risk. It depends on whether you can sell expensive junk. -The rating tranche where investors seeking higher yields are the first to suffer losses.

Fitch’s subprime auto loan annualized net loss index has recovered from its free money lows but has not reached new highs and remains in its pre-pandemic range, which is somewhat surprising. Fitch speculated that there may have been a financial crisis due to some factor. Overdue rotation. When delinquent borrowers are about to lose their cars, they start making payments again and rotate through other debts, such as credit cards.

They are essentially juggling arrears to keep their cars in a position to stay viable, which helps keep losses within normal limits.

Investors earn a higher yield from the less risky rated portion of the ABS that loses money first, and that yield compensates the investor for taking on the credit risk, but it doesn’t always work out.

This subprime problem accelerated the overall delinquency.

According to this week’s New York Fed Household Debt and Credit Report, the 30+ day delinquency rate for all auto loans (30 days instead of 60 days in the Fitch index) rose to 7.9% in the first quarter, the highest since 2010. It was the best. Many borrowers who fall 30 days late eventually start making payments again, but never reach the 60-day stage tracked by Fitch.

Due to high vehicle prices, the burden of car loans is high..

Rising car prices have caused auto debt to skyrocket, but debt levels have largely kept pace with increases in disposable income over the past few years, and the ratio remains high.

Please note that only about 80% of new car purchases and 41% of used car purchases are financed, which can place a heavy burden on those who provide financing.

As we have seen above, the problem arises in the subprime segment, where cars are sold at huge profit margins and therefore at very high prices, with customers paying too much compared to what they are getting. will be carried out.

Disposable income is income from all sources, excluding capital gains, less taxes and social insurance contributions. This is the income that consumers have left over to spend on car payments and everything else.

This concludes our series on consumer credit for the first quarter.

Earlier this week, we discussed credit cards, mortgages, HELOCs, and the overall credit health of not-so-drunk sailors.

Credit card delinquents: delinquencies, balances, encumbrances, available credit, and “over-limits”

The arrival of HELOCs in household debt: Mortgages, delinquencies, and foreclosures

Household debt, arrears, repossession and bankruptcy: Gone are the days of free money for not-so-drunk sailors.

Enjoy reading and supporting Wolf Street? You can donate. I appreciate it very much. Click on the beer and iced tea mugs to see how.

Would you like to receive email notifications when new articles are published on WOLFSTREET? Sign up here.

![]()