By Helena Kelly, Dailymail.Com Consumer Reporter

Updated 20:48 05 June 2023, 21:06 05 June 2023

Workers increased their retirement savings this year after experts warned that less than half of Americans feel safe leaving their jobs.

The latest data from leading provider Fidelity Investments found that average 401(K) and IRA balances increased 4 percent and 5 percent respectively in the first three months of the year.

A typical employee now has $108,200 in a 401(K) and $109,000 in an IRA, up from $103,900 and $104,000 last year.

Analysts said the trend is being driven by employer contributions and Generation Z (ages 11 to 26), who are more cautious about saving than older generations.

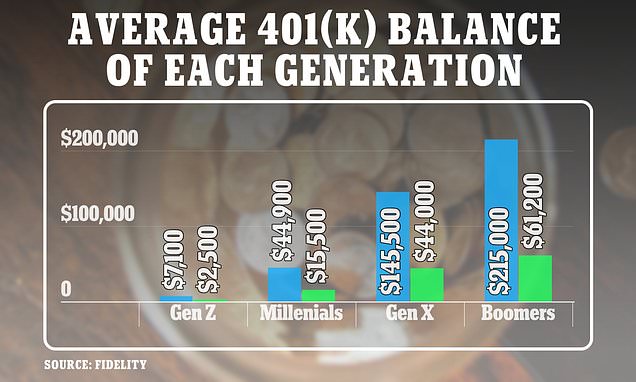

Generation Z savings have surged 34 percent this year compared to the same period in 2022. So their average 401(K) balance is now $7,100.

Millennials (ages 27-41) have about $44,900 in accounts, and Gen X (ages 42-58) have account balances of $145,500.

Meanwhile, baby boomers aged 59 to 77 held an average of $215,000 in 401(K).

The surge in Gen Z savings is due to the fact that young people generally save less, so the increase accounts for a larger percentage change.

Additionally, it has long been documented that this younger generation is more financially savvy than their elders.

This is partly because they grew up during the 2008 economic crisis and became more conservative financially.

Separately, a study by CFA Institute and the Financial Industry Regulatory Agency (FINRA) found that cryptocurrencies are sparking broad interest in investing and saving across generations.

However, the data also revealed a gap between the average and median retirement pots. For example, the average Gen Z 401(K) balance was $7,100, while the median was $2,500.

The difference suggests that a handful of high-income savers are pushing the average higher.

Kevin Barry, President of Workplace Investments at Fidelity Investments, said: “Retirement savers are growing, as evidenced by employers’ efforts to increase account balances, improve savings rates, and help employees prepare for the future. It is reassuring to see a positive return,” he said.

Both an IRA and a 401(K) are tax-advantaged retirement accounts, but the former is opened separately by the account holder. A 401(K) is opened and administered by an individual employer.

Experts have repeatedly warned of the U.S. retirement crisis as the pandemic and ongoing high inflation hit household savings.

Fidelity said in March that only 29% of its employees were on track to a happy retirement, down from 38% in 2020.

Another report from the provider found an average The value of the 401k pot dropped 20% from $130,700 in the final quarter of 2021 to $103,900 in the same period last year. The cause of the decline was stock market turmoil and inflation.

This has forced a record number of retirees to return to work, creating what has been described as the ‘great retirement’.

But according to a new Fidelity report, savings are on the rise thanks to better market conditions and more contributions from employers.

Employer contributions hit a record 4.8% in the first three months of the year.

The majority of US workers rely on an employer-provided 401K as a retirement plan.

Auto-enrollment means that a portion of a worker’s paycheck is credited directly to the 401k from their paycheck, which is then paid in equal or partial equality by the employer.

Most employers take advantage of the 3% default contribution, according to financial industry regulators.

However, workers are encouraged to increase these contributions, especially as their salaries increase.

And it’s important that employees start saving as soon as possible to increase the time it takes for their money to grow through compounding interest. Compound interest means that you earn interest on both the money you originally put in and the interest you’ve already accrued.

For example, a $10,000 investment with a 10% annual return will be $11,000 after one year. The following year, instead of the original amount he applied 10 percent interest on $11,000.

So after 10 years, the $10,000 pot will grow to $25,937.

The findings come after it was revealed that wealthy CEOs of America’s biggest companies will receive monthly net retirement benefits worth up to 38 times their employer’s average annual salary.

Researchers have found that retirement savings in the United States are “doubled” as business owners spend billions of dollars even though many employees have not saved a single dollar on their 401(K). “Heavy standards” are occurring.

And the problem is exacerbated by the huge tax incentives given to retired executives, who are often given “deferred compensation” (aka “top hat”) plans with many tax incentives.

Executives from the top five S&P 500 companies held a combined $8.9 billion in tax deferred accounts at the end of 2021, according to the Institute for Policy Studies and Employment’s “A Tale of Two Retirees” report.

In one of the most extreme cases, Walmart CEO Doug McMillon was found to have $169 million in his deferred compensation account at the end of 2022.

This is enough to generate monthly retirement checks worth $1,042,300, which is approximately 38 times the median employee annual salary (currently $27,136).