don’t stop

summary

I’ve recently written several articles about senior loans and CLO bond ETFs. I’m bullish on these securities and funds because of the strong above-average dividend growth they offer investors. Even after looking back at past articles, I still don’t understand, The differences between these asset classes are very clear, so I thought I would write an article focusing on them.

Senior secured loans are variable rate loans made by banks to medium-sized, high-risk businesses.

A CLO is a collection of senior loans with similar variable interest rates. This is somewhat of a simplification.

Both asset classes have floating interest rates, so interest rate risk is very low. Both are performing well, above average, and have increased their dividends due to recent Federal Reserve interest rate hikes. CLOs appear to have higher yields, at least the riskier CLOs.

CLOs are more complex than senior loans.complexity is That in itself is a risk and makes these securities and funds more difficult to analyze.

Senior loans carry higher credit risk than most CLOs, except for the riskiest ones (equity tranches). However, for most CLO ETFs, lower credit risk does not translate into lower realized volatility.

CLOs have multiple tranches, giving investors more flexibility and the ability to more easily focus on funds with their desired risk and return profile. More conservative investors may look to AAA-rated CLOs and CLO funds, while more aggressive investors may prefer those rated BBB.

In my opinion, both the Senior Loan and CLO Bond ETFs have similarly strong value propositions, and both are buys. CLOs appear to be better online, but their complexity makes it difficult to know for sure.

As a general disclaimer, everything herein applies to: largely Senior loans, CLO debt tranches, and funds that invest in these securities. There are certainly exceptions, but not many.

Senior Loans and CLOs – Overview

Before we address the similarities and differences between these two asset classes, we will provide an overview of these two asset classes.

Companies may issue bonds to fund expansion plans, business operations, potential mergers, and more. Some bonds are issued as senior secured floating rate loans. The debt is senior to other debt, is secured by the company’s assets, and pays a variable interest rate that is generally tied to SOFR, which is actually the Federal Reserve Board rate.

senior loan teeth the above debt. Senior Loan ETFs invest directly in such debt.

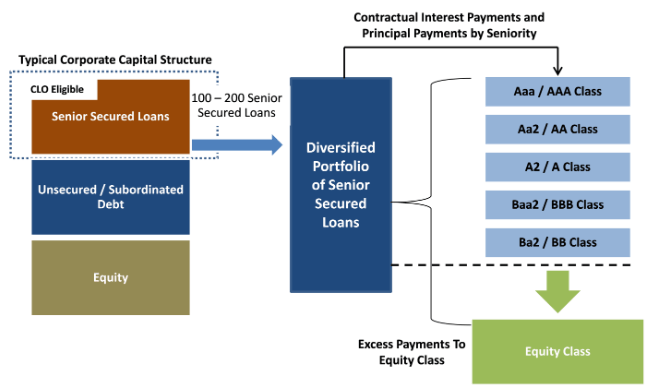

Senior loans may be consolidated into a CLO. Each CLO, or bundle of senior loans, is divided into tranches. Proceeds from the senior loan will be used to pay all tranches. Payments are at a variable rate and terms are similar to senior loans. The senior tranche is paid first and the junior tranche is paid last. CLO ETFs invest in these tranches and receive payments in return. A quick explanation of how CLO is configured.

Stanford Chemist – In Search of Alpha

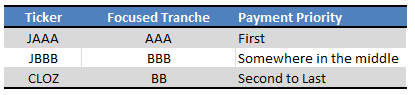

There are ETFs that focus on specific CLO tranches. The rest of this article will focus on three things:

Fund Applications – Graph by Author

To summarize briefly, senior loans are corporate loans with variable interest rates, and CLOs are bundles of senior loans. Obviously, there are many similarities between senior loans and CLOs, but there are also some important differences. Let’s take a look at these, starting with the differences.

Senior Loans and CLO Debt ETFs – Differences

Payment priority

If a default occurs, senior loan investors will see a reduction in their income and principal repayments. As an example, the benchmark senior loan ETF, Invesco Senior Loan ETF (BKLN), has a fairly large investment in loans from Peraton Corporation. If Peraton defaults on the loan, BKLN’s income will decline, leading to a cut in its dividend. BKLN’s stock price should also fall.

The situation is different for investors in CLO tranches and CLO bond ETFs. As an example, let’s assume that Peraton’s loans are bundled with his CLO and that the Janus Henderson AAA CLO ETF (JAAA) invests in his AAA tranche of said CLO. If Peraton defaults on the loan, all Loss and dividend reductions apply to the most junior tranche, in this case the equity tranche. JAAAA is focused on his AAA rated tranche, so no loss. In other words, JAAA’s dividends will have priority over the dividends of other CLO tranches/CLO investors.

When there are no stock investors, all Losses and dividend reductions will affect the BB tranche. Once that tranche is extinguished, the losses fall into her BBB tranche. In reality, investors in CLO debt tranches rarely experience default.Just to be clear, in this paragraph he is only discussing CLO bond ETFs, senior loans are do not have Prioritize in the same way.

credit risk

Senior loans tend to have higher default rates. Range of 2.0% to 3.0%, higher than average, but still quite low in absolute terms. The default rate at the beginning of this year was 0.85%, well below average due to strong economic fundamentals and (historically) low interest rates. Defaults have been increasing throughout the year and are expected to reach +2.5% in the second half of this year.

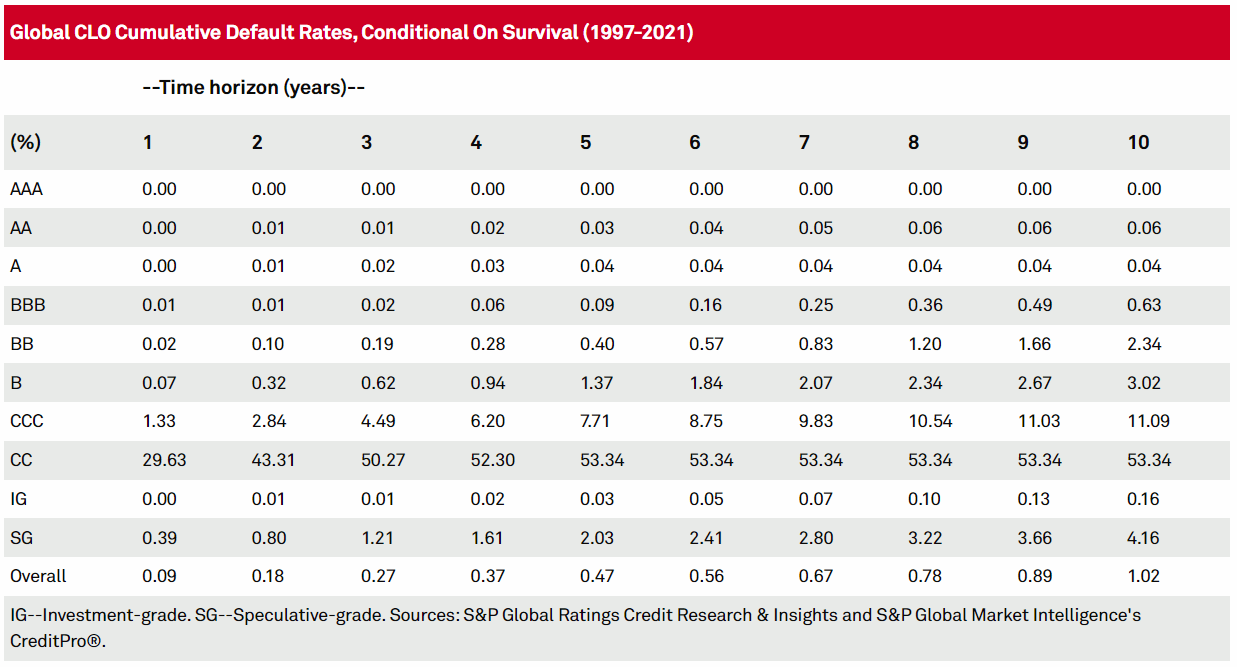

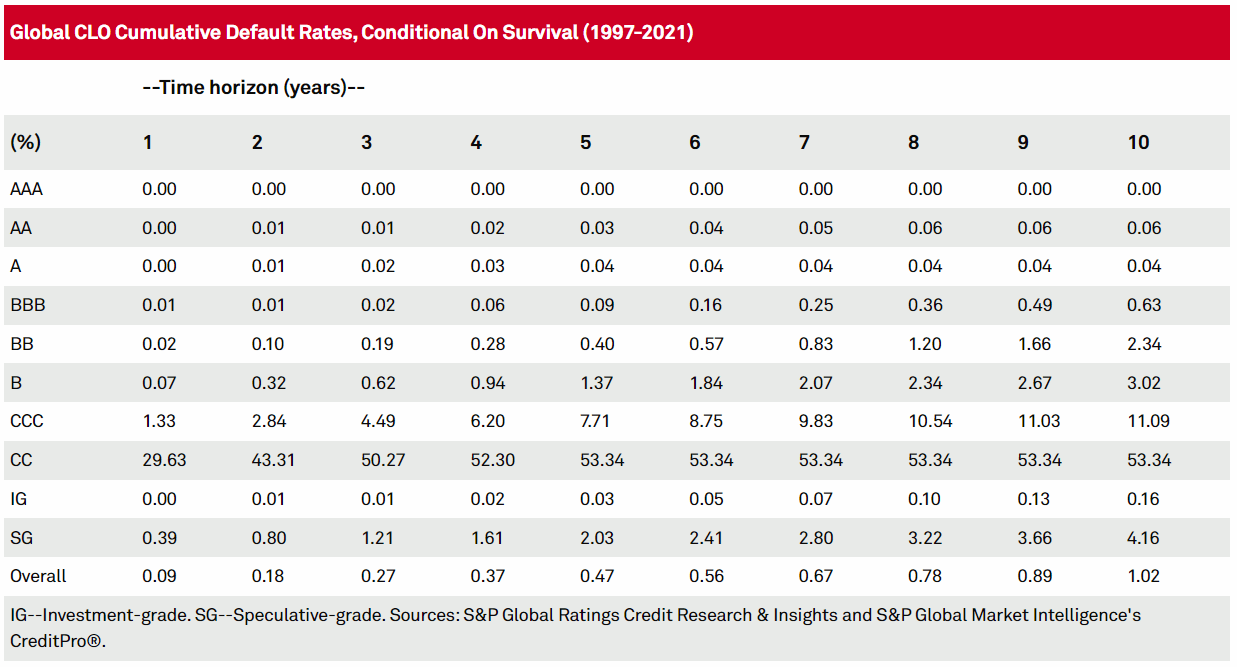

CLO debt tranches and ETFs have very low default rates. This is because the equity tranche bears losses first and in practice generally bears losses. all loss. According to S&P, the annual default rate for A-rated tranches is 0%. The default rate for BB rated tranches is only 0.02%. This is a very low figure, much lower than the figure for senior loans themselves. I think the more junior CLO tranches have higher default rates. do not have These are explained in this article.

S&P

CLO Tranche – Increased Investor Flexibility

The existence of CLO tranches and the existence of ETFs focused on different tranches allows investors more flexibility in their investment/preferred risk-return profiles. Risk-averse investors can focus on more senior tranches/ETFs, including JAAA. More aggressive, yield-seeking investors can focus on more junior tranches/ETFs, including CLOZ.

There are several senior loan funds, so investors can Several These securities are flexible, but not very flexible. However, funds that focus on other floating rate securities may also work.

complicated

Senior loans are generally simple investments. CLOs are not. Complexity is a risk in itself and makes these securities and funds more difficult to analyze.

Senior Loans and CLO Debt ETFs – Similarities

Steady growth in dividends

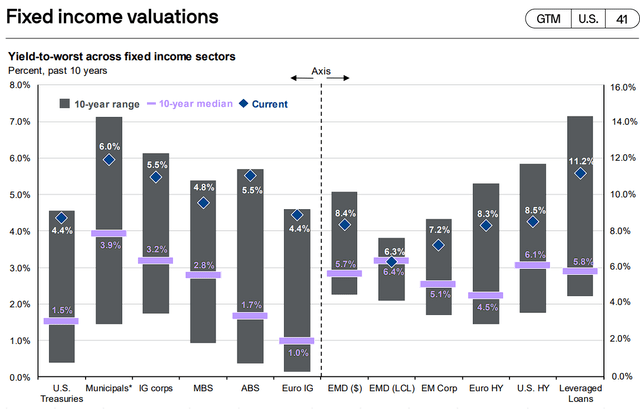

The senior loan is of It is currently the highest-yielding bond on the market, yielding 11.2%. These are the best dividends on the market and are much higher than the historical average.

JP Morgan Market Guide

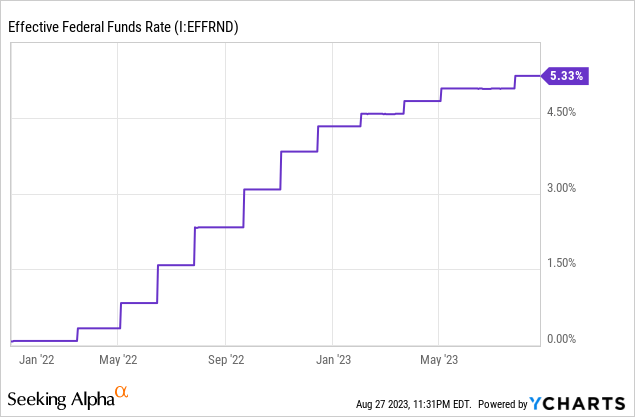

The above is almost entirely due to the recent Fed rate hikes. Keep in mind that senior loans are variable rate loans, and the coupon rate will increase if the Fed raises rates. The Fed is raising interest rates. Really Been active for the past two years. The base interest rate has increased by 5.25% since the beginning of 2022, and further hikes are possible.

Data by YCharts

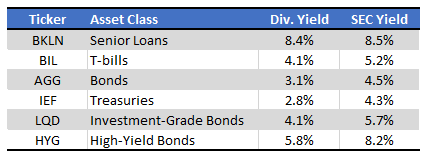

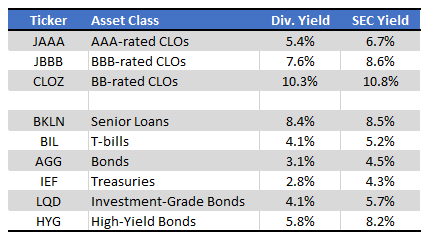

Senior loan ETFs also boast high dividend yields, with the benchmark Invesco Senior Loan ETF (BKLN) having an SEC yield of 8.5%, higher than most other fixed income asset classes.

Fund Applications – Graph by Author

BKLN’s yield is slightly lower than the underlying asset class/JP Morgan data because higher Fed rates affect investment markets and the ETF takes time to reflect that.

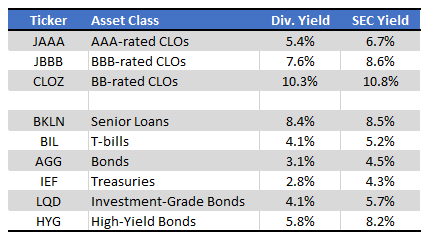

CLO bond ETFs also offer high yields, but they rely somewhat on focused tranches. As expected, stocks focused on higher quality and more senior tranches have lower yields. Remember, the senior tranche is senior so it gets paid first to minimize losses.

Fund Applications – Graph by Author

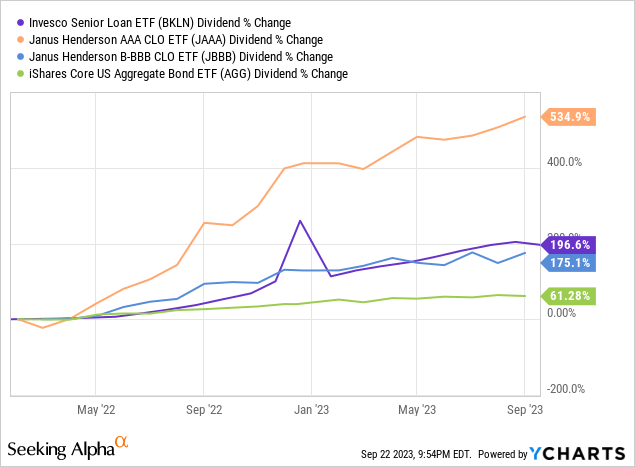

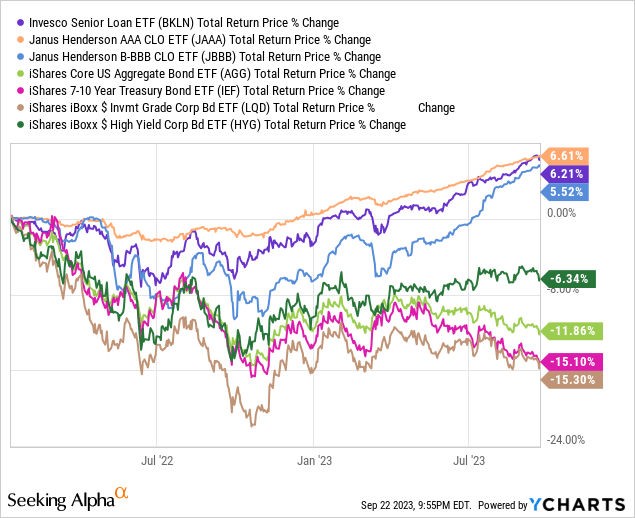

From the results above, both senior loans and CLO bond ETFs very Dividends have increased significantly since the beginning of 2022 due to Fed rate hikes. We have excluded Panagram Bbb-B Clo ETF (CLOZ) from the chart below as it is still too young and does not have a track record of significant dividend growth.

The Senior Loan and CLO Bond ETF offers the best dividends in the fixed income market. These are great benefits for the fund and its investors, making them strong buys in my opinion.

Extremely low interest rate risk

Both the senior loan and the CLO debt tranche have floating interest rates, which significantly reduces interest rate risk. As seen above, when the Fed raises interest rates, dividend growth tends to be rapid and strong. As is the case with most of these ETFs, performance tends to be very strong starting in early 2022, when the Fed starts raising interest rates.

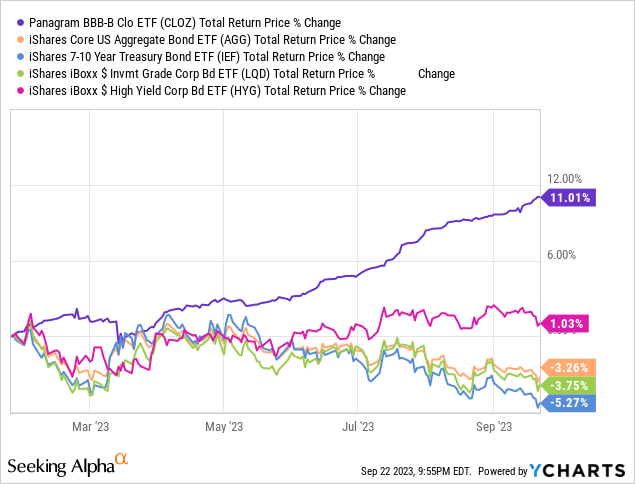

CLOZ is a very young fund, founded in early 2023, but it has performed well since its inception.

Both Senior Loan and CLO Bond ETFs have very low interest rate risk, which means they outperform when interest rates rise. With the Fed significantly slowing/pausing the pace of rate hikes, investors are unlikely to benefit in the short term, but they will definitely benefit in the long term.

Value proposition and investment theory

All issues of tranches, credit risk, and complexity aside, senior loans and CLOs both have a similar value proposition and investment thesis. Both offer investors strong dividend growth, variable interest rates with extremely low interest rate risk, and both have outperformed over the past two years. This is a strong value proposition and makes these investments very similar to each other.

Senior Loans and CLO Debt – Important Considerations

CLO debt tranches have lower default rates than senior loans. Regarding senior loan default rates, the current 0.85% compared to just 0.02% for BB rated tranches. Long-term default rates are higher in both cases, but senior loans remain riskier.

S&P

CLO bond yield is very Investment grade BBB rated tranches have slightly higher yields and higher credit risk than high-yield corporate bonds. The yield for the BB rated tranche is many more.

Fund Applications – Graph by Author

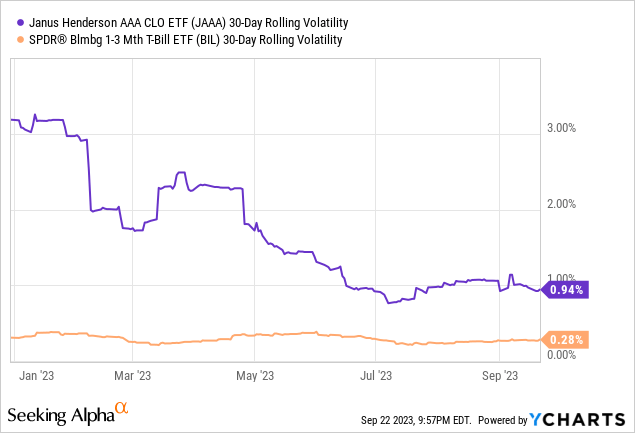

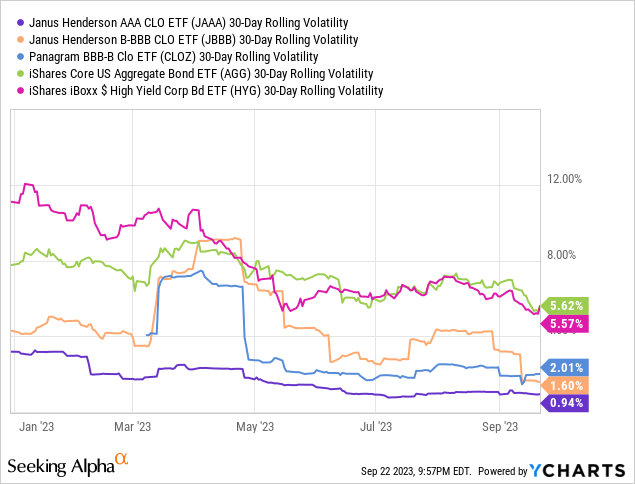

Based on the above, it can be said that CLO bond ETFs have excellent risk return. However, the catch is that most CLO bond ETFs trade with more volatility than expected. For example, JAAAs are approximately four times more volatile than short-term securities, even though they both carry similar levels of credit and interest rate risk.

However, the overall volatility of these ETFs is still fairly low.

In my opinion, CLO bond ETFs are a stronger investment opportunity than senior loan ETFs due to their relatively lower credit risk and better risk-return characteristics. Still, these are largely similar securities and funds with similar value propositions.

conclusion

Both senior loans and CLO debt tranches offer investors strong growth dividends, are variable rate, and have outperformed since early 2022. In my opinion, both are strong investment opportunities and buys.