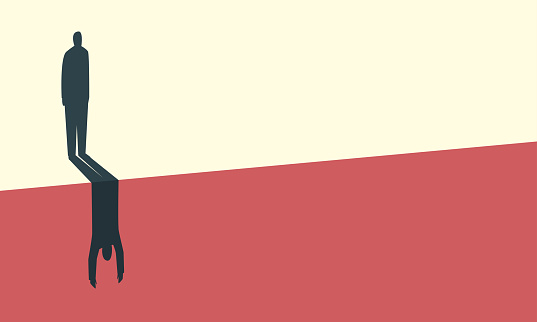

Debt can cast a lasting shadow on your life long after you’ve made your final payment. It may arouse feelings of anxiety, Feeling trapped in a cycle of financial insecurity.

Even though debt often comes with emotional strain, many Americans internalize that struggle. According to a recent survey, approximately 62% of Americans avoid conversations about money. (Hey, do you have any podcasts for them?) The complex feelings of guilt and shame over incurring debt may make it difficult for some people to open up about their financial situation.

But Michael Arsenault, author of the new book, “I finally bought a pair of Jordans.” He opens up about his personal journey with private student loan debt. His collection of essays explores, in part, the psychology of debt and how it continues to shape his life.

“Marketplace Morning Report” host David Brancaccio spoke to Arsenault about the importance of going private and getting rid of the emotional debt that many people carry.

David Brancaccio: Part of it is about emotional debt. But let’s start with money debt. Are you financially poor, but you ended up taking on student loan debt?

Michael Arsenault: I had private student loan debt, which is a very specific type of debt that affects many Americans, especially Black college graduates. I owed her 6 figures and he had to pay nearly $1,200 a month from $800 for a little over 10 years.

Brancaccio: But you paid it off. In theory, just knock yourself out now. But have you noticed that something still lingers, like a haunted ghost?

Arceneaux: It’s really hard to escape from that. What I tried to write about in my new book is to find a way to further remove the shame that I’ve carried with me for so long. To really think about how to treat ourselves without being tainted by materialism or, again, shame.

Brancaccio: So, if a man wants to buy Jordans to add a stylish bounce to his step, and he has enough money, then he should buy Jordans. But there’s a part of you that tells you not to do that. Where does that voice come from?

Arceneaux: The truth is, they have been constantly admonished since the 1990s, especially for many poor black working class people, especially black people. For example, if you don’t have enough, you don’t deserve the great things that others do.

But thinking about the psychology of debt and how much it affected every aspect of my life, some of it really stuck with me. So I became so scared that I couldn’t handle myself. I have to worry about the next bill, the next crash, or what’s going to happen next.

Finally, I gave myself a reprieve. I know I’m not where I wanted to be, but I’ve done everything well on my own. So for me to get those J’s was a good way to say, “You’re going to be okay.” Therefore, I encourage others to do the same.

Brancaccio: On this subject of the counseling psychology industry, you pointed out that the industry itself is set up to be exclusive.

Arceneaux: Generally speaking, I think Americans have a hard time getting there. By design, it is a privilege that many people cannot afford to access and must pay for the treatment itself. Usually not cheap.

Many who could have benefited the most are unable to access it. So I don’t want to punish people who don’t go down that path. People are making the most of the tools they have. If you want more people to receive therapy, give them more tools. Please pay for my treatment. (just kidding.)

There’s a lot going on in the world. For everything, Marketplace is here for you.

You use the Marketplace to analyze world events and communicate how they affect you in a factual and approachable way. We rely on your financial support to continue making that possible.

Your donation today powers the independent journalism you depend on.. For as little as $5 a month, you can help sustain our marketplace. This allows us to continue reporting on the things that matter to you.