champion

prologue

In Microcap Review, I would like to write about Microcap stocks in SA. Today we are going to talk about Kingsway Financial Services (New York Stock Exchange: KFS). The company is a US holding company with a portfolio of extended warranty businesses. Berkshire Hathaway Energy (NYSE:BRK.A) (New York Stock Exchange:BRK.B) thereby acquiring small, profitable companies run by early-career managers. I think it’s an interesting concept and the performance is improving rapidly. But Kingsway is starting to look expensive based on its fundamentals, and my view on the stock is neutral at this point. Let’s check.

Business overview and financial situation

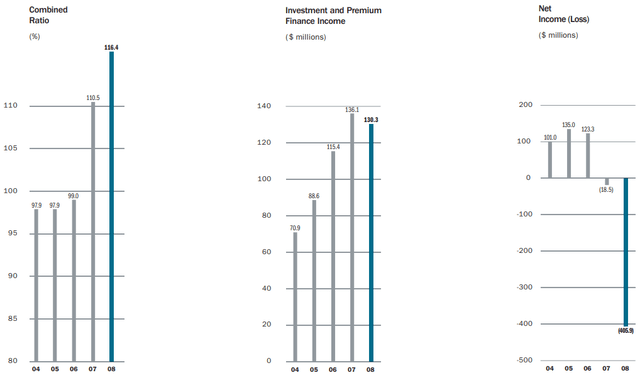

Kingsway was founded in 1989 as a specialty insurance company pursuing a rapid growth strategy. We specialize in niche areas such as long haul trucking, high risk drivers and risk protection for US home builders and California craftsmen. Gross premiums written soared from $659.5 million in 2001 to $1.85 billion in 2007. However, the company posted large losses during the Great Recession when many of its policies were found to have been grossly misunderwritten.

Kingsway Financial Services Kingsway Financial Services

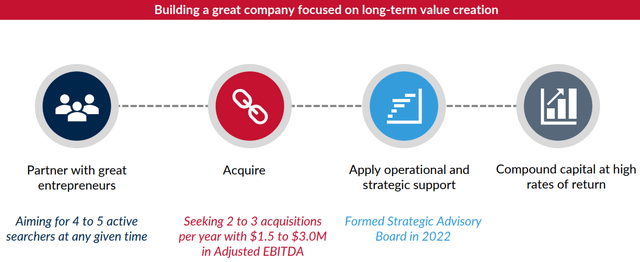

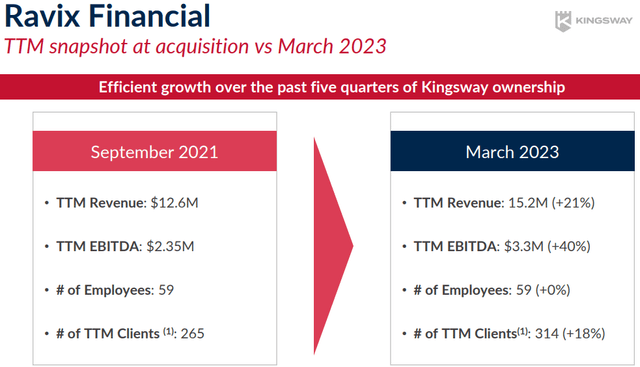

Kingsway then embarked on a turnaround plan, acquiring IWS in 2012, Trinity Warranty Solutions in 2013, Professional Warranty Services in 2017, and Penn Warranty and Prime Autocare in 2019, giving priority to We shifted our focus to the warranty service sector (mainly automotive). I also had a real estate portfolio. In 2021, Kingsway will launch his CEO Accelerator program. This program was later renamed Kingsway Search Xcelerator (KSx). We are focused on investing in low-capital-intensive growth businesses with recurring revenues and high margins, run by young CEOs. Since then, Kingsway has acquired three companies under the KSx program. The companies will invest Ravix Financial, an outsourced accounting and human resources services provider, for $11 million in 2021, CSuite, a financial executive services company, for $8.5 million in November 2022, and Secure Nursing Service, a medical assistant staffing firm. Acquired for $10.9 million. The three companies have been acquired at 4x his EV/EBITDA to 4.5x his, and I think it’s encouraging that Ravix’s earnings and his EBITDA improved significantly under Kingsway’s ownership.

Kingsway Financial Services Kingsway Financial Services

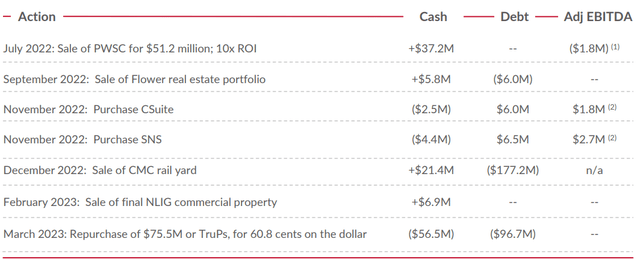

Kingsway now appears to be focusing on its KSx program as it sold most of its PWSC and real estate business between July 2022 and February 2023. Kingsway used most of the proceeds from the sale to repurchase Trust Preferred Notes (TruPs). A little over 1 dollar and 60 cents.

Kingsway Financial Services

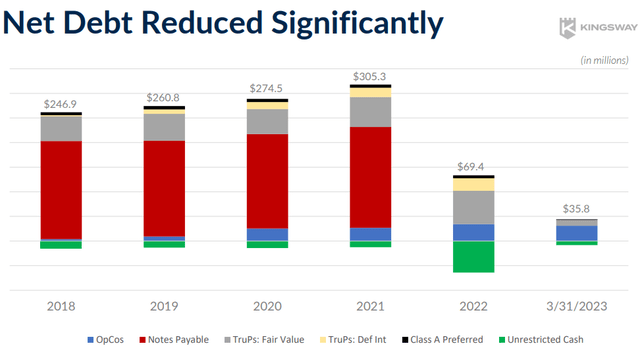

This has allowed Kingsway to significantly strengthen its balance sheet, reducing net debt from $305.3 million in 2021 to just $35.8 million in March 2023. The company’s book value is $11.8 million related to the remaining TruPs debt products. In my view, Kingsway will likely buy back the last tranche of TruPs by the end of 2023.

Kingsway Financial Services

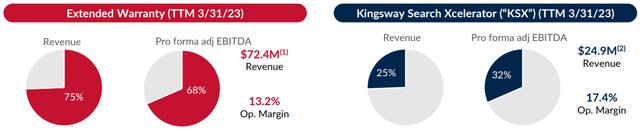

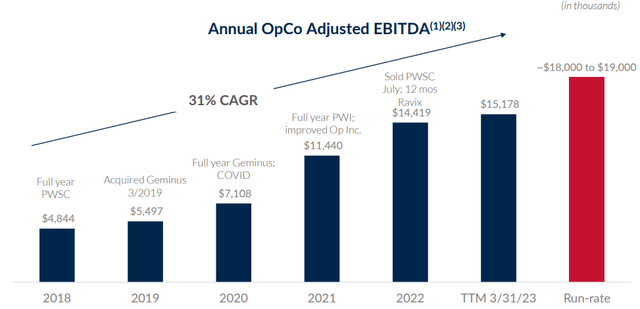

Financial results for the first quarter of 2023 show revenue of $26.4 million, up 17% year over year, and adjusted EBITDA of $2.4 million, up 134.7%. The improvement in profitability was primarily due to improved performance at Ravix, adjusted EBITDA of the CSx division increased 93.3% to $1.7 million, and the addition of CSuite and Secure Nursing Service. This brings TTM revenue and EBITDA for this segment to $24.9 million and $4.6 million, respectively, which means it now accounts for a quarter of total revenue and nearly a third of EBITDA. . Overall, Kingsway’s TTM EBITDA is currently at $15.2 million, with a run rate of about $18 million to $19 million, the company said.

Kingsway Financial Services Kingsway Financial Services

Looking at the valuation, Kingsway is valued at $266.3 million at the time of this writing, trading at a LTM EV/Adjusted EBITDA ratio of 17.5x. While that number seems high, it’s worth noting that Kingsway has a net operating loss carryforward (NOL) of $610 million (see slide 8). here) and Adjusted EBITDA increasing at a compound annual growth rate [CAGR] Businesses in the KSx segment have been acquired for less than 5x EBITDA, and that ratio should decline significantly over the next few years. The company targets two to three new acquisitions per year, each with annualized adjusted EBITDA in the range of $1.5 million to $3 million. That means EBITDA could grow by up to $9 million annually over the next few years. Also, Kingsway $10 million A share buyback is scheduled for March 2023, which could boost the stock price in the coming months.

That said, it remains to be seen if CSuite and Secure Nursing Service’s performance will improve as quickly as Ravix’s, but Kingsway will find more business for the KSx platform given the lack of new companies. I am concerned that I may be struggling with It’s been over 7 months since he was added. Additionally, I believe debt continues to be an issue as rising interest rates pushed interest expense up 117.9% to $3 million in Q1 2023. This means Kingsway won’t benefit much from NOL at this point.

Points for investors

Kingsway has significantly reduced net debt over the past year and financial results for the KSx division are positive with TTM EBITDA in excess of $15 million. But what worries me is that the company hasn’t added any new companies to his KSx platform in over 7 months, and that the interest rate hike is pushing the quarterly interest expense to $3 million. is. Overall, I think Kingsway is on the right track in its pivot to KSx, with new businesses being acquired at less than 5x EV/EBITDA. The company is on my watchlist, but I would not open positions at valuations greater than 12x EV/EBITDA due to the significant risks involved.

Editor’s Note: This article describes one or more securities that are not traded on any major US exchange. Please be aware of the risks associated with these stocks.