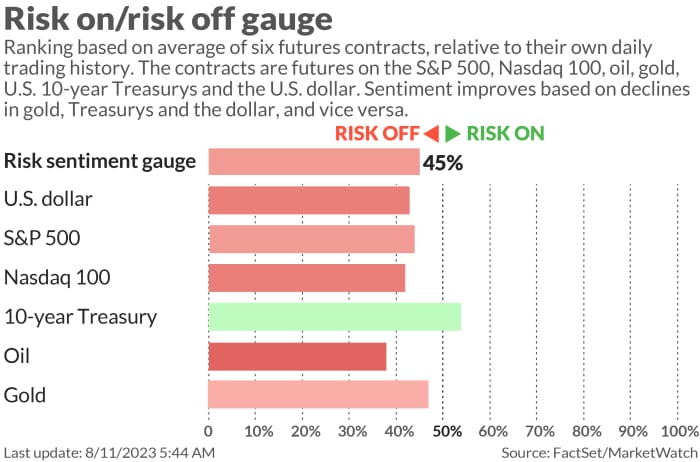

Early trading in futures said Wall Street was undecided on whether it would target further gains on Friday. This is consistent with the recent struggles of the S&P 500.

Six of the last eight sessions have fallen during the August bearish trend.

Several technical factors raise concerns. NASDAQ 100

is in danger of decisively falling below the support trend of the 50-day moving average. Apple AAPL

That happened a week ago, but now the relative strength index, a measure of momentum, has fallen sharply to 30, suggesting the stock could soon enter oversold territory in the near term. It suggests.

Over the same short period of time, the 10-year Treasury yield is

Stocks have traded in a range of about 4% to 4.2% as investors try to keep track of fluctuations in inflation and economic growth indicators.

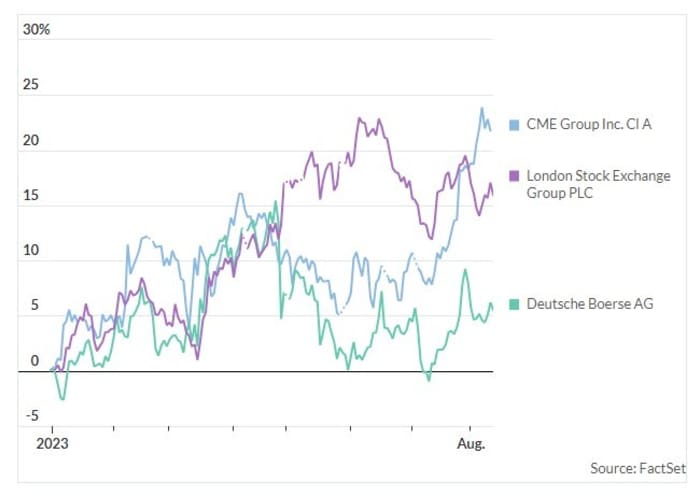

So what should investors do in the midst of all this uncertainty? Australia-based fund manager VGI Partners believes that all you have to do is buy companies that help traders trade. In its semi-annual investor letter covering performance to the end of June, VGI highlights the top 10 long-term global investment fund investments, three of which are more or less financially viable. It offers what is called market plumbing.

London Stock Exchange UK:LSEG holds a 7% weight.,

VGI is enthusiastic about its transformation from a traditional exchange to a data and analytics group. After acquiring Datagroup’s Refinitiv in 2021, LSE now makes just 3% of its revenue from traditional cash stock exchanges.

Deutsche Börse represents approximately 8% of the portfolio, with trading, clearing, pre- and post-trade services, and data and analytics services in four main business segments: Trading & Clearing, Fund Services, Security Services and Data & Services. VGI says it is attractive because it offers analysis.

DB is “a diversified exchange group whose activities touch most aspects of the European capital markets, providing both trading and non-trading revenue,” VGI added.

However, the top holding is CME Group CME,

with a weighting of 9%. CME operates futures and derivatives exchanges such as the Chicago Mercantile Exchange, New York Mercantile Exchange, Chicago Board of Trade, and Dow Jones Index Services.

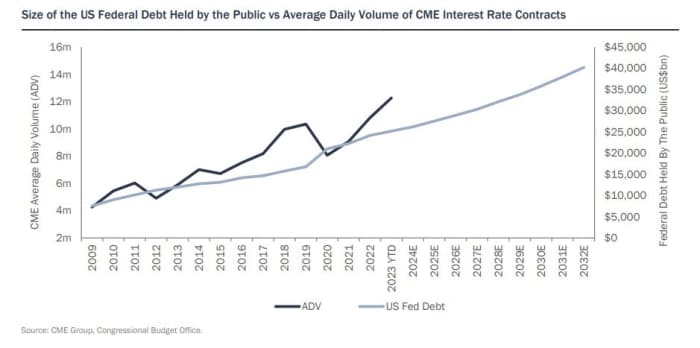

VGI is particularly fond of CME’s “virtual monopoly” in interest rate derivatives trading. “Demand for interest rate derivatives is driven by interest rate market volatility, the impact of which is exacerbated by the number of bonds held by those wishing to manage interest rate risk, and thus market liquidity,” the fund manager notes. And the graph below shows this strong relationship.

Source: VGI Partners

VGI expects that as the Fed continues to ease its balance sheet, the size of the Treasury market, particularly related to private Treasuries, will grow, providing significant support for CME’s interest rate derivatives business. CME, like other exchanges, should benefit from increased net interest income from the collateral balances it holds.

“CME’s assets are an important part of the market infrastructure and we believe they will be recognized as such in the future,” concludes VGI.

market

US Stock Index Futures ES00,

YM00,

NQ00

Barely Different from Benchmark Treasury Yields

immersion.dollar

Crude oil price CL is falling

Slip & Gold GC00

you get a profit.

Try Barron’s Crossword Puzzles and Sudoku Games. It now runs daily along with a weekly digital jigsaw based on that week’s cover story. To see all puzzles, click here.

Buzz

Economic data on Friday will include the July Producer Price Index report at 8:30am and the August Consumer Confidence Index at 10am. Both are eastern.

UBS Group UBS

has a 9 billion Swiss franc ($10.27 billion) loss protection contract introduced when it bought troubled rival Credit Suisse, and a 100 billion Swiss franc public liquidity buck guaranteed by the Swiss government. Finished the top.

Pound GBPUSD

It climbed above $1.27 again after Britain’s economy grew 0.5% in June, more than double the expected 0.2%.

Country Garden Shares Hong Kong: 2007

Shares plunged nearly 6%, falling below HK$1 for the first time, as China’s largest homebuilder warned of losses and received further downgrades on its debt.

Shares of Kano Health Co., Ltd. CANO

The company’s shares fell more than 50% in premarket Friday after primary care providers and healthcare platforms said there were “serious doubts” about their ability to continue operations.

best of the web

Countries must come together to prevent the threat of deep sea resource grabbing.

diamonds for sale. they are not forever.

In San Francisco, regulators are opening the floodgates for driverless taxis, wanted or not.

chart

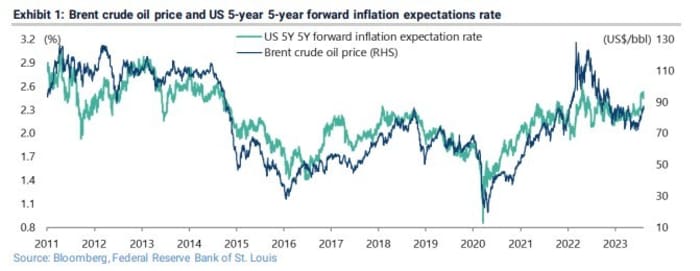

Christopher Wood, Global Head of Equity Strategy at Jefferies, explains why some investors are nervous about the recent surge in oil prices, with a welcome tale that major central banks will soon be able to stop rate hikes. It was a reminder that you can mess things up.

Source: Jeffries

“The correlation between Brent oil prices and five-year future inflation expectations has been 0.88 since 2011,” says Wood. “In the context of the popular view that both the Federal Reserve and the ECB are all but done with this tightening cycle, this is potentially the case, even if the official tenet remains ‘data dependent’ in both cases. It could be a nasty development.”

top ticker

As of 6am ET, the most active stock market tickers on MarketWatch are:

random read

It’s a nice new home for Jeff.

Eight legs, nasty biting and a big embarrassment.

Theoretical physicists try again: Something might exist.

Need to Know starts early and updates until the opening bell, sign up here Delivered once to your mailbox. The email version will be sent at approximately 7:30 am Eastern Time.

listen to The best new money ideas podcast With MarketWatch financial columnist James Rogers and economist Stephanie Kelton