The co-founders of cryptocurrency analysis firm Glassnode believe that a trough in Bitcoin (BTC) could form after one of two events following a market downturn.

Glassnode co-founders Jan Happel and Yann Allemann share a Negentropic handle. tell me Their 56,000 X followers say they are considering two scenarios where Bitcoin could carve out the bottom of the region.

According to Happel and Allemann, bitcoin could slowly drop to the $25,000 level or experience a serious liquidation before hitting the bottom.

“Bitcoin risk signal is 100.

There are two possible short-term scenarios.

1. Gentle bleed from $24,800 to $25,000.

2. A fast and aggressive core that will quickly buy you up. Either way, you’re likely to hit rock bottom as soon as the game is over. We have in the past seen these two scenarios unfold whenever the BTC risk signal hits 100. ”

Looking at analyst charts, BTC tends to make corrections when the risk signal hits 100.

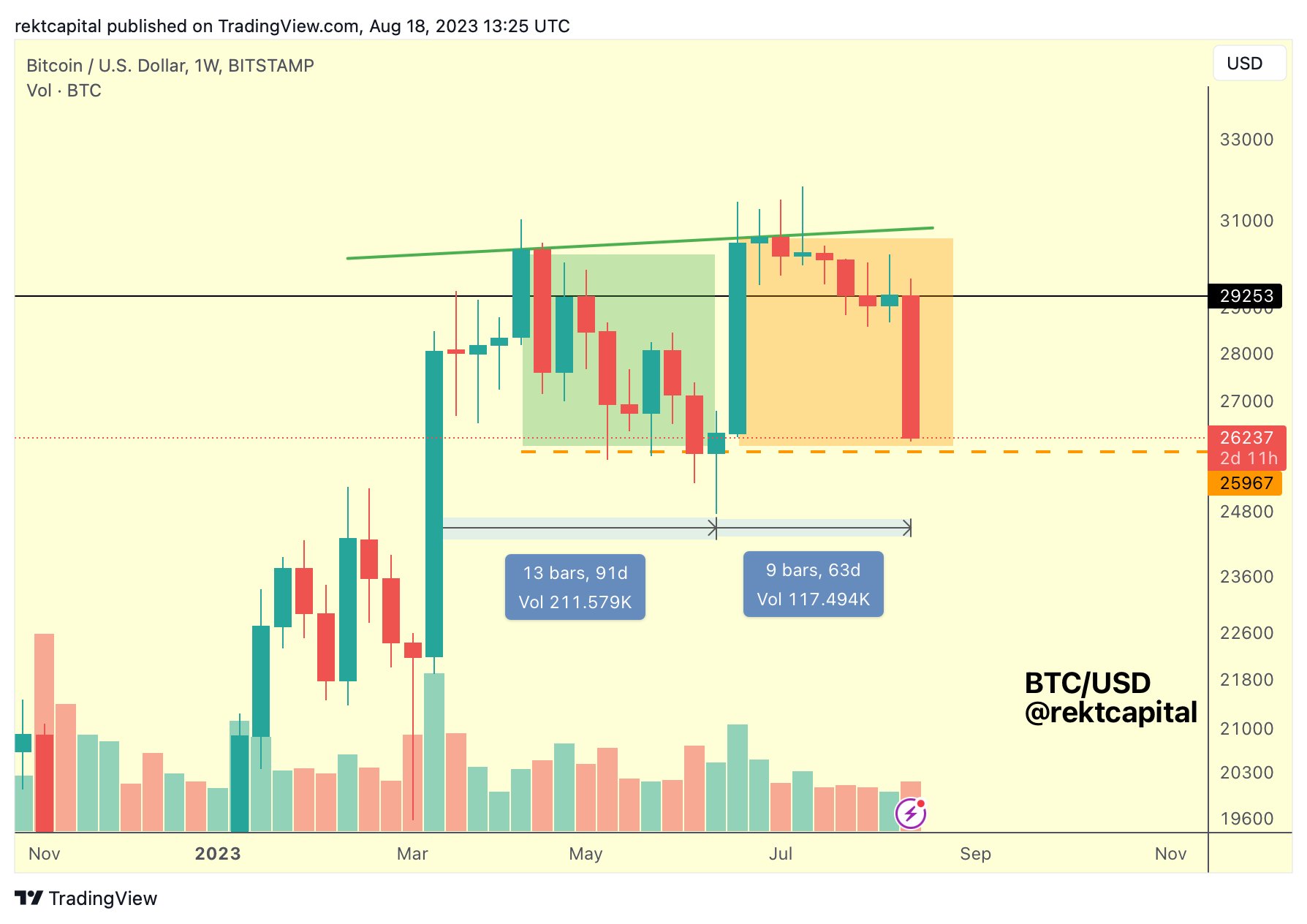

The pseudonymous cryptocurrency strategist Recto Capital is also eyeing BTC.Bitcoin Seen Weaker Afterwards, Analysts Say printing A bearish double top pattern.

“It took BTC 91 days to form the first half of the double top.

And 63 days left until the formation of the second half of the double top.

What do you get?

The price gradually fell in the first half, respecting the support but eventually breaking it (green box).

Mid-down support was not considered in this recent crash (orange box).

there was no reaction

It shows how weak the buy side pressure is around the area circled in orange.

Buys are not prepared or strong enough to intervene appropriately and change the direction of price action.

And current volume levels suggest that seller pressure hasn’t even peaked yet. ”

Bitcoin is trading at $26,028 at the time of writing, down 2.3% over the past 24 hours.

Never Miss a Beat – Subscribe to get email alerts delivered straight to your inbox

Check price action

follow me twitter, Facebook and telegram

surf the daily hoddle mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should conduct due diligence before making risky investments in Bitcoin, cryptocurrencies or digital assets. Please note that transfers and transactions are made at your own risk and any losses you may incur are your responsibility. The Daily Hodl does not endorse the buying or selling of any cryptocurrencies or digital assets. The Daily Hodl is also not an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: Midjourney