Rawf8/iStock via Getty Images

Abstract of the paper

Bitcoin (BTC-USD) has moved more than 12% over the past five days. The world’s best cryptocurrency has exceeded $30,000.

It could also be argued that much of this recent volatility is due to SEC News, BlackRock (BLK) and now this new “Wall Street Exchange”. On the other hand, we have rallied precisely at key support levels and reversed in a very predictable way from a TA perspective.

BTC continues to dominate the cryptocurrency space, and we wonder if this performance will continue.

And while BTC is up 12%, Grayscale Bitcoin Trust (OTC:GBTC) is up more than 30% over the past five days. what happened to that? Should I buy?

emotional roller coaster

Bitcoin has been on a news and price roller coaster while I’ve been at it. I got emotional. On June 6th, SEC sues Coinbase (coin) to manage unregistered securities. The day before, the SEC provided services to Binance (BNB-USD) 13 charges.

This caused a drop in Bitcoin, especially the altcoins that were specifically named in the SEC lawsuit. The SEC’s interpretation of securities surrounding cryptocurrencies has not always been transparent, but its actions sent a very clear message.

And now, with perfect timing, BlackRock has submitted an application to launch the service. Proprietary Crypto ETF. This happened last Thursday, June 16th.

BlackRock has a good record of 575-1 in ETF approvals. But the SEC also has a great track record of rejecting his BTC ETF with him 33-0. A true battle of the Titans.

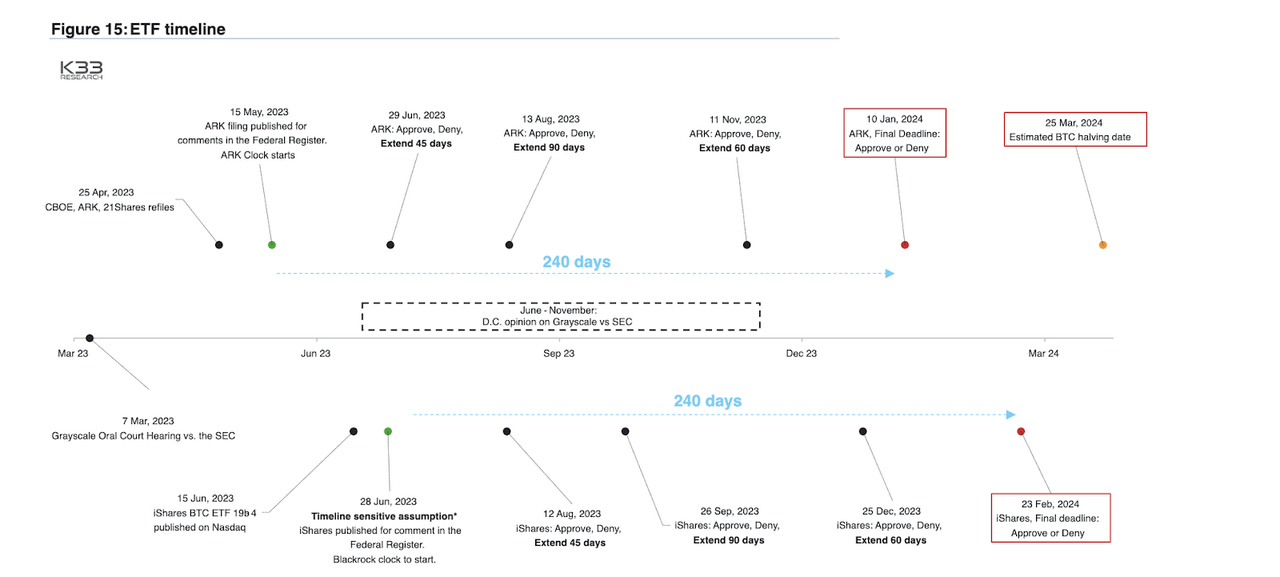

Regarding the ETF schedule, K33 research I am drawing a timeline for when this will be approved.

BlackRock ETF Timeline (K33)

Both ARK and BlackRock may launch ETFs ahead of the Bitcoin halving. It’s really good timing.

The BlackRock ETF application appears to have given the go-ahead to institutional investors, especially with the help of Wall Street “insiders” such as Charles Schwab (SCHW) and Citadel Securities. Institutional cryptocurrency exchange It’s called EDX Market.

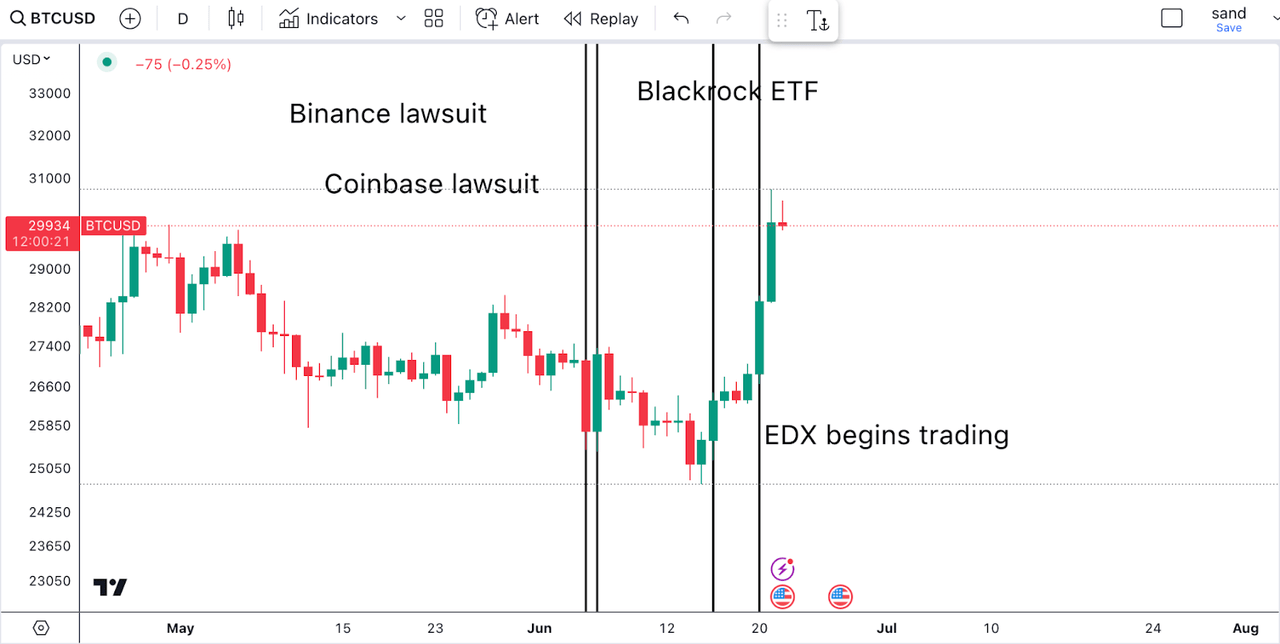

In summary, let’s see what these events look like against the BTC price chart.

BTC Timeline (author’s work)

Bitcoin Outlook

Looking at the chart above, we can say that the sentiment has changed. In fact, the BlackRock ETF seems to have turned the tide for Bitcoin, and the fact that this happened just 10 days after the SEC went after the world’s two largest cryptocurrency exchanges is very interesting.

In just a week or so, my feelings went from utter despair to hope and happiness. This may seem strange, but it is very consistent with the dynamics of Elliott Wave theory. The second wave often reflects the greatest fear and despair, while the third wave tends upwards and is the result of euphoria and high expectations.

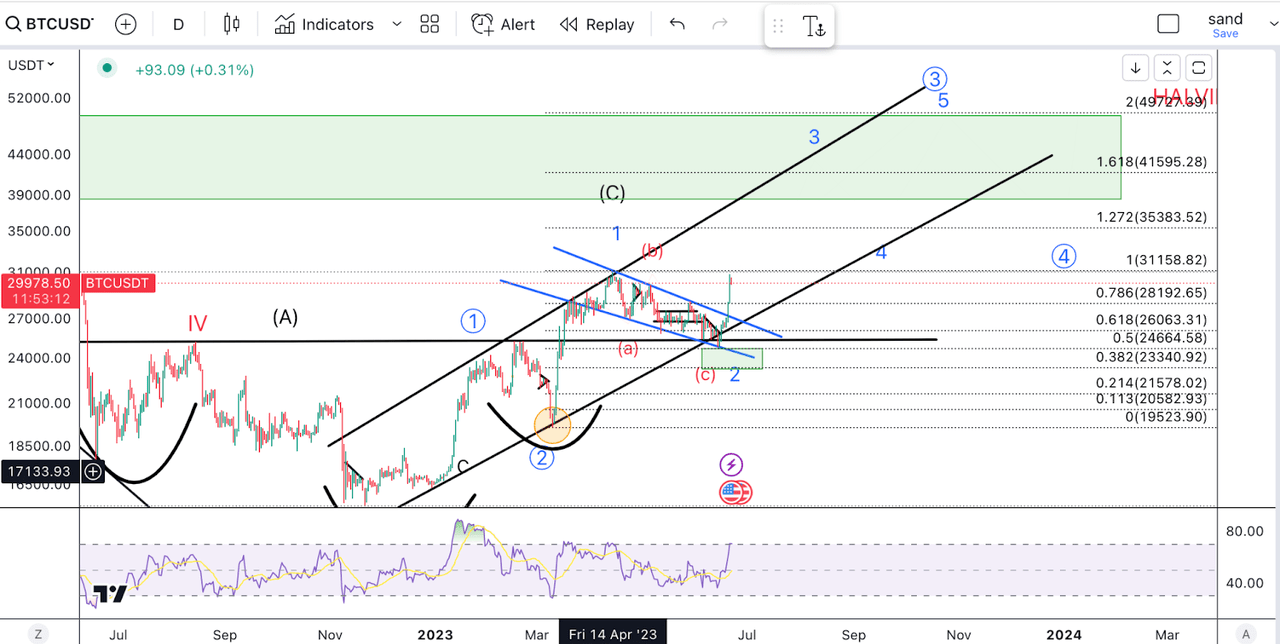

Take a look at the Bitcoin charts I’ve shared with my readers and subscribers over the past month.

BTC TA (author’s work)

According to my Elliott wave calculations, the recent drop was wave 2 inside the larger circle wave 3. So far this is unfolding as expected from a TA perspective.

BTC has just found a trough on the 50% retracement of the first wave, rising from $19.5,000 to $31,000. This level is also the larger reversed head and shoulders neckline we have been shaping. We talked about this in our last Bitcoin article. And this is also the bottom of the descending channel we have been forming with Bitcoin (blue line).

Unsurprisingly, once it broke out of the channel, BTC fell, and only now, nearing its previous highs, did the red come into view.

So what can we expect now? The chart above shows the expected trajectory as we approach the next halving (around March 2024). This time around, we believe Bitcoin could have completed most of its rally and even hit all-time highs before the halving. Treble.

Bitcoin Advantage

With Bitcoin’s recent rise and changes in institutional psychology, there are a few more issues to address.

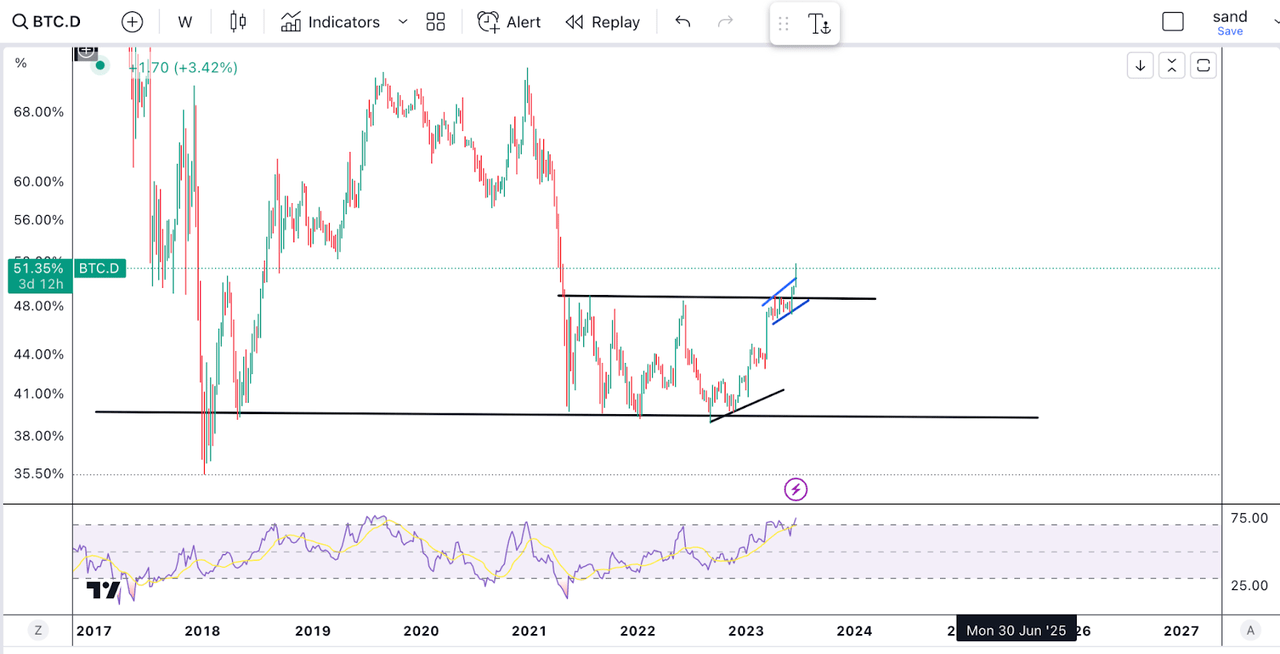

First, Bitcoin Dominance:

BTC Dominance (TradingView)

The graph above shows the percentage of Bitcoin in the cryptocurrency market. As you can see, the recent rally broke the 2-year range and also the rising channel shown in blue. From a TA perspective, it looks like it wants to climb further and return to the 60% range.

From a basic point of view, this might make sense. New institutional interest appears to be limited to Bitcoin and a few other major coins for now. BlackRock has launched a Bitcoin ETF. Rather than a crypto ETF, Wall Street’s new EDX exchange appears to be limited to Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and Bitcoin Cash (BCH).

Altcoins have been the hardest hit in the recent plunge. Is it possible that this slump will continue?

Although we are no longer in the free-money corona era of every coin flying around, I still believe there is room for one, two, even three or more cryptocurrencies to thrive. Blockchain technology has many uses and there are many altcoins that utilize this technology. My own crypto portfolio includes BTC, ETH and over 10 other high-confidence coins.

Is GBTC a good buy?

Finally, I would like to talk about GBTC. BTC has risen nearly 15% since its lows, while GBTC has more than doubled. what happened?

In short, we are closing the gap.

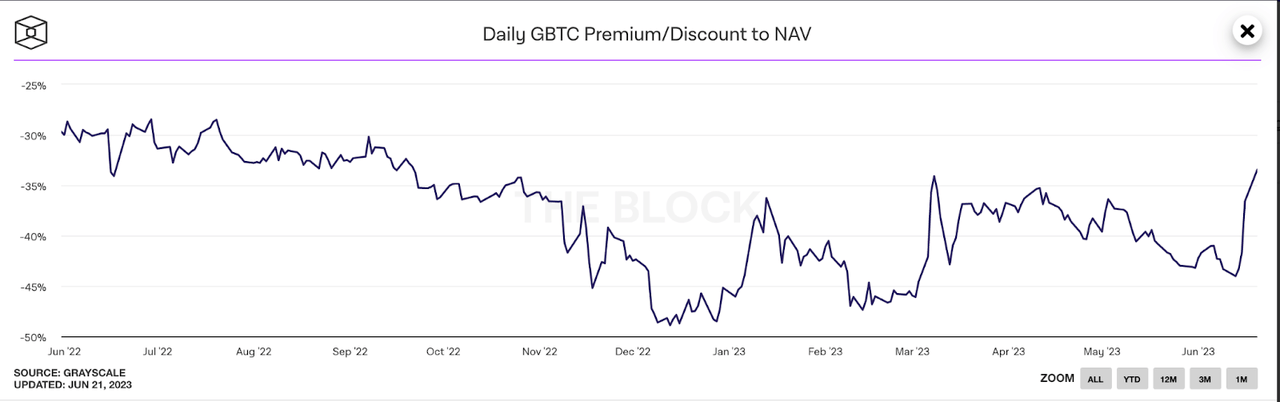

GBTC Discount/Premium (The Block)

Although GBTC owns physical Bitcoin, it is not an ETF and cannot arbitrage its own share price, so it does not trade at fair value. The value of GBTC is below the value of BTC held by GBTC. In other words, it is traded at a discounted price.

What we saw last week was a reduction in this discount rate, from nearly 45% to just under 35%. The BlackRock ETF filing raises new hopes that GBTC can be converted into an ETF. This will ensure that the discount ends and you will earn even more than what BTC has to offer.

But even if the BlackRock ETF didn’t go through GBTC, there would still be a significant discount, and we’ve seen this discount turn into a premium during the height of the Bitcoin bull market.

Ultimately, I think GBTC is a good way to own Bitcoin.

final thoughts

Bitcoin’s recent rally has caught many off guard, but it may not matter much to those with a good grasp of sentiment and technical analysis. Going forward, I expect BTC to reach all-time highs next year. However, how you get there depends on many factors. At the moment, we are looking at the $36,000 area as our next target.

Editor’s Note: This article describes one or more securities that are not traded on any major US exchange. Please be aware of the risks associated with these stocks.