What is a quilt chart?

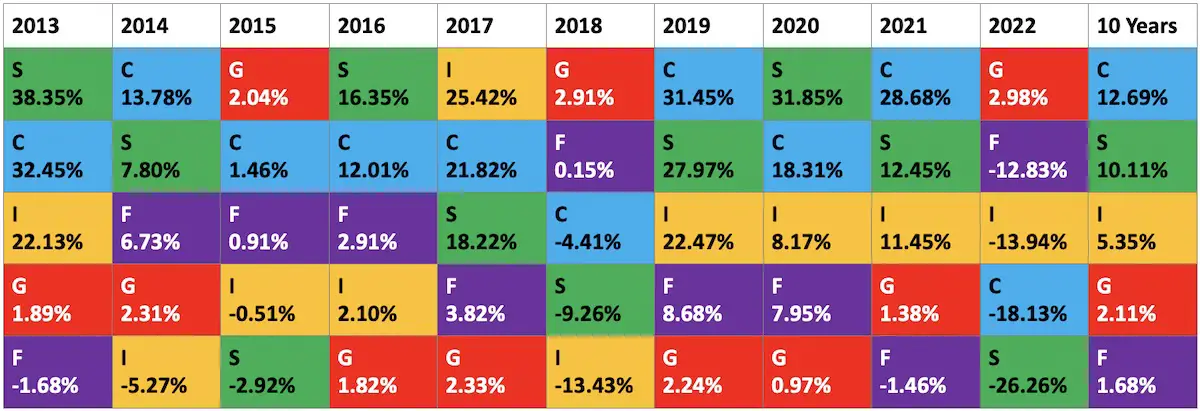

quilt investment chart A visual representation of financial asset categories showing the importance of diversification to an investment portfolio. Time periods, such as 10 years, are used to represent how the performance of each asset category changes from year to year relative to other asset categories.

Each asset class is depicted in a unique color each year on the chart. Each asset class has a unique color and often performs differently each year, so the resulting depiction is like a quilt using different patches of fabric. If an investor holds these square baskets consistently for a long period of time, positive returns can be plentiful as a result.

A quilt chart of financial assets can help you understand the value of diversification, but it cannot be used to predict the future. However, the actual quilts consist of layers of fabric and filler material and have contributed to an interesting part of our nation’s history. Helped provide details.

Kilts were used by African Americans in the 1800s to navigate the subway system. Certain patterns drawn on the quilts helped guide other slaves to freedom. “It was a way to give directions without saying ‘go northwest,'” said Professor Raymond Dobbard of Howard University. National Geographic’s article, Did the quilt keep the code on the Underground Railroad?.

Ben Carlson is a Chartered Financial Analyst and Director of Institutional Wealth Management at Ritholtz Wealth Management. He also writes a highly readable financial online column. wealth of common sense.

One of the traditions he shares each year is sharing his views on the quilt chart of financial asset categories. You can take a look at his 10-year financial chart and read about it. Update My Favorite Performance Chart for 2022.

Core TSP Fund Quilt Chart

I was unable to find an online quilt chart for the 5 core funds of the Thrift Savings Plan. So I took the time and created one as shown below.

What is the value of a quilt chart?

Again, the financial quilt chart is not a tool for predicting where the best allocation will be for the year. Using a quilt chart to understand your current or future asset allocation is like using your rearview mirror or a map of where you’ve been to guide your financial future.

The value of the quilt chart is a reminder that you need to embrace diversification as the key to long-term success in your retirement portfolio. Think of diversification as a strategy for spreading your money across different types of investments. This allows you to reduce risk while growing your investment. It is one of the most basic principles of investing.

G Funds and Risk Management

The 10-year TSP quilt chart produced in this article shows that even an asset class like the G Fund could be the frontrunner among the TSP family of funds in a year like 2015 and then drop. It emphasizes the emotional roller coaster-like movement. Bottom after 12 months.

Indeed, the G Fund I never have It went negative, unlike the other four funds. A man who had invested exclusively in the G-Fund for the past decade would have had his TSP portfolio very safe. But how would you feel if you invested in it and invested only in the last 10 years?

Are you satisfied with average annual returns of just over 2%? Remember the reality of inflation. Risk is part of preparing for retirement. Too much security will not protect you from market volatility, but it will also prevent the portfolio growth you need for your future retirement.

Mark Zuckerberg took a big risk, dropped out of Harvard and founded Facebook. Here’s his advice on risk: In a fast-changing world, the only strategy that is guaranteed to fail is not taking risks. ”

TSP Lifecycle Fund

The TSP quilt chart also highlights that investing in the long-term contribution of TSP and matching life cycle fundThe advantage of these options is that you accept expected risks and returns that are appropriate for the time range that suits you.

Every three months, an allocation of 10 Target Date Lifecycle Funds will automatically adjust an allocation of 5 TSP Funds. This will gradually shift the allocation to a lower risk-reward profile. Eventually, all lifecycle funds will be phased out. The final state of the Lifecycle Fund is the L Income Fund. According to TSP, “The investment objective of the L Income Fund is to achieve low levels of growth with a focus on asset protection.”

The L Income Fund is designed for “if you are currently withdrawing money from your TSP account in monthly payments”. Some financial consultants think the L Income Fund is too conservative. Some consider it not as safe as the G Fund. The L Income Fund went negative in 2008 and 2022. Since its inception in 2005, it has averaged just over 4% per year.

© 2023 Francis Xavier (FX) Bergmeister. All rights reserved. This article may not be reproduced without the express written consent of Francis Xavier (FX) Bergmeister.