Diego Garrido Reca, Volcan’s interim chief executive officer, wrote in an email that the company has hired Bank of America and Apoyo as advisors to address liquidity concerns. bloomberg. Other options include selling assets.

But the company is currently facing pressure from friction with Glencore and this month’s debt downgrade. Late Monday, Volcan announced the appointment of a new chief executive officer and a new chairman. Outgoing executives said these changes were made by directors affiliated with Glencore and may have been enacted illegally. The miner said the board’s decision was taken legally and in accordance with company rules.

Glencore last year began considering selling its 23% stake, representing 55% of its Class A voting shares, as the Swiss company seeks to simplify its operations. Potential changes in primary ownership add uncertainty to Volcan’s debt outlook.

Garidrekka declined to comment on the process by which Glencore would sell its stake in Volcan, and a representative for the Swiss company also declined to comment.

zinc falls

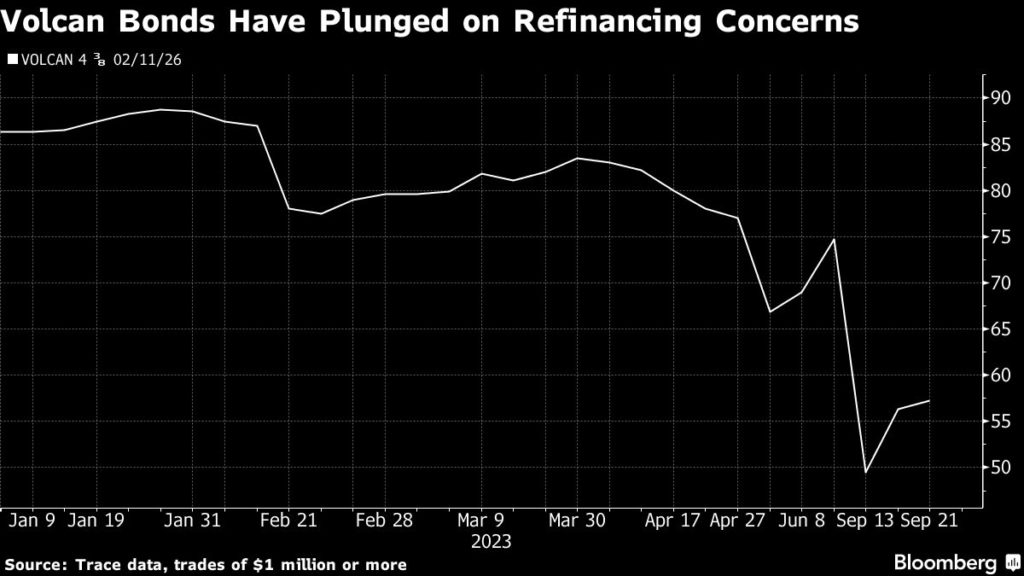

On September 8, Moody’s Investors Service downgraded Volcan’s rating by two notches to Caa1, one of its lowest rating levels, citing Volcan’s refinancing risks. According to Moody’s, Volcan has approximately $105 million in debt due by the end of 2024, and after making necessary capital expenditures, the company’s business will have approximately $203 million in debt over the same period. We estimate that we will run out of it.

The Lima-based mining company ended the second quarter with about $50 million in cash and has a $50 million revolving credit facility available through November. Its liquidity has been squeezed by falling prices for zinc, which is commonly used to galvanize steel for car manufacturing and construction.

While futures prices have risen over the past few weeks, they are still down about 30% from their January peak due to China’s uneven recovery and the prospect of more supply. Volcan announced in July that it had temporarily suspended its Islay mine in central Peru, joining a string of producers to cut production in response to falling prices.

Some analysts see opportunity in the company’s debt. Volcan bonds pared losses after hitting record lows.

Earlier this week, Lucrow Analytics upgraded its recommendation on the bond from “hold” to “speculative buy” due to the weak valuation. Analyst Jocelyn Jensen said in a note that while bonds are “at historic lows, they have become more attractive in our view given the company’s proven ability to refinance its debt.” .

liquidity options

Interim CEO Garidrekka said Volcan’s management and board are capable of addressing the current financial situation, with options such as renewing the revolving credit facility and selling hydropower and cement assets. said in a written response to questions.

But Omar Zeora, a research analyst at Oppenheimer & Company, said it’s unclear how much money could be raised from selling these assets. In addition to the loan due in 2026, the company has approximately $360 million in dollar-denominated debt due in February 2026.

“Volcan is seeing its cash dry up and a liquidity crisis,” said Bevan Rosenbloom, senior credit analyst at Seaport Global Holdings.

(Written by Vinicius Andrade and James Atwood, with assistance from Marcelo Rochabrune)