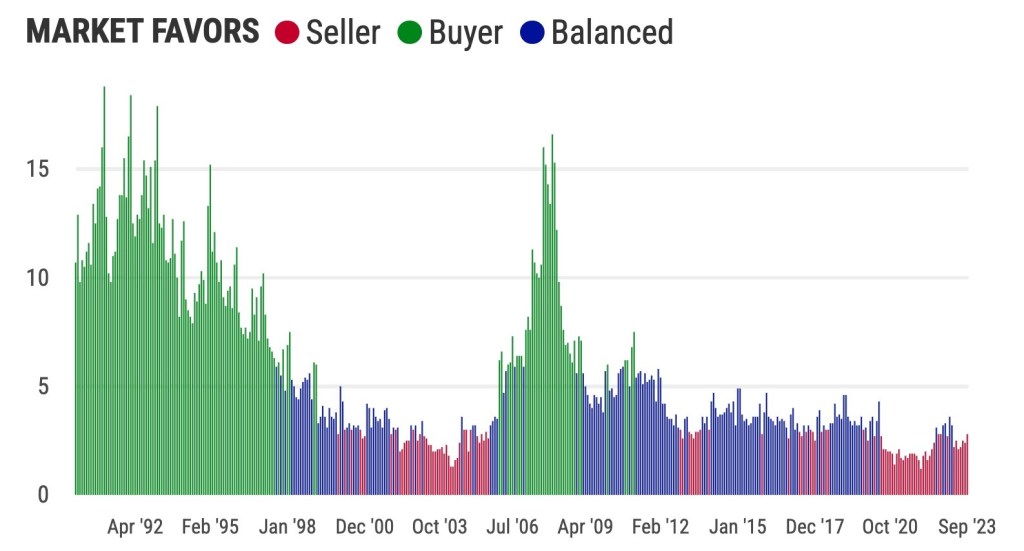

It’s been 12 years since California housing has been in a “buyer’s market.”

Industry folklore holds that when home seekers can choose from a list of six or more months worth of inventory on sale, buyers are presumed to be in control of the market. If the supply is less than his three months, home buying logic says it’s a “seller’s market.” In between, a so-called “balanced” market operates.

So, to find a buyer’s market, my trusty spreadsheet applies these interesting definitions to statistics from the California Association of Realtors, which tracks single-family home sales, and some related economic data dating back to 1990. Did.

First, note that California’s supply of homes for sale in September was 2.8 months. According to real estate mythology, it’s a seller’s market.

According to this definition, to find the last time California buyers dominated the market, we need to go back to February 2012, when supply was 7.5 months.

Over the past dozen years, California housing has been in a seller’s market 38% of the time and in a “balanced” market 62% of the time. During the same period, the median sales price of existing single-family homes by real estate agents rose at a rapid rate of 8% per year.

As California home hunters know, buyers are clearly not driving the market.

Abundant options

So what does history tell us about the typical California buyer’s market compared to the supposedly seller-friendly era?

There are plenty of homes for sale. The average length of supply over a 34-year buyer market period was 10.2 months, compared to 2.4 months when sellers were in control.

And there’s no need to rush. Since 1990, listed homes have sat for an average of 63 days in a buyer’s market, compared to 23 days in a seller’s market.

- real estate newsletter: Get your free “Home Stretch” by email. Subscribe here!

On the other hand, prices are falling. Buyers’ markets have declined an average of 3.7% over the past 12 months, while sellers’ markets have risen 15% annually.

When buyers dominate the market, mortgage rates also fall. Since 1990, interest rates on 30-year fixed loans have fallen by 0.3 percentage points in the previous year for buyers, but have increased by 0.1 percentage points when sellers are in control.

Buyer beware

However, these seemingly attractive buyer’s market conditions do not encourage home seekers to buy.

In California, sales rates in buyer’s and seller’s markets were, on average, 26% lower. Even builders are pulling out, with permit applications to build single-family homes down 27% in a buyer’s market.

- Rent trends: What is available and how much are landlords charging? click here!

So why does real estate cool in buyer’s market conditions? Well, that “time to buy” period usually coincides with an economic downturn that can scare home hunters and owners alike.

California’s unemployment rate averaged 7.7% in buyers’ markets, compared to 6.4% when sellers were in control. In a buyer’s market, job creation across the state has shrunk by 62%.

Also, consider the Conference Board’s national standards for interest in buying a home. His 3% of consumers surveyed had plans to buy a home in California’s buyer’s market, compared to 5% in a seller’s market.

conclusion

California has been in a buyer’s market one-third of the time since 1990, according to the spreadsheet. However, if you look at this calculation, the situation of finding a home is dying out in a matter of decades…

1990s: A decade marked by a painfully slow recovery from the housing crash from the highs of the late 1980s, it was a buyer’s market for 79% of the decade.

- Social job news: What industries are hiring? Who is holding back? click here!

2000s: A 27% buyer’s market with a surge in home purchases turned into a bubble, leading to the Great Financial Crisis at the end of the decade.

2010s: It’s a 3% buyer’s market as housing recovers from the carnage of the Great Recession.

2020s: Amid all the disruption caused by the pandemic, including a period of historically low mortgage rates, there will be no buyer’s market until September 2023.

History has shown us that the “buyer’s market” designation is a false label for a largely bad time for California wallets.

Therefore, a buyer’s market may need to come with a warning label, as a financial crisis may necessitate the creation of a new market for California home seekers.

Buyers, be careful what you wish for.

one suggestion

Long-term changes to the housing search include people moving less frequently, consumers having access to detailed market information, near-instant cash purchases, and stricter lending standards.

Perhaps the calculations of buyer’s and seller’s markets should change as well.

From 1990, just before the bubble burst, to 2006, using the traditional 6-month/3-month template and real estate agent data, California was in a “buyer’s market” 49% of the month and a “seller’s market” 17% of the time. “was. .

If you look at the last 12 years since the crash, assuming it matches that pattern, the supply period for a buyer’s market is more than 3.25 months and for a seller’s market less than 2.25 months.

At the very least, this evolving gap in homebuying supply is another measure of the tough challenges of finding a home today.

Jonathan Ranzner is a business columnist for Southern California News Group. Please contact us at jlansner@scng.com.