BTC’s recent bullish move rests on expectations for spot approval of a Bitcoin exchange-traded fund (ETF). But now, as Bitcoin whales enter a redistribution regime, it faces a potential setback.

On-chain data suggests that there is a fair chance that Bitcoin price will flip towards $37,000.

Why Bitcoin Falls to $37,000

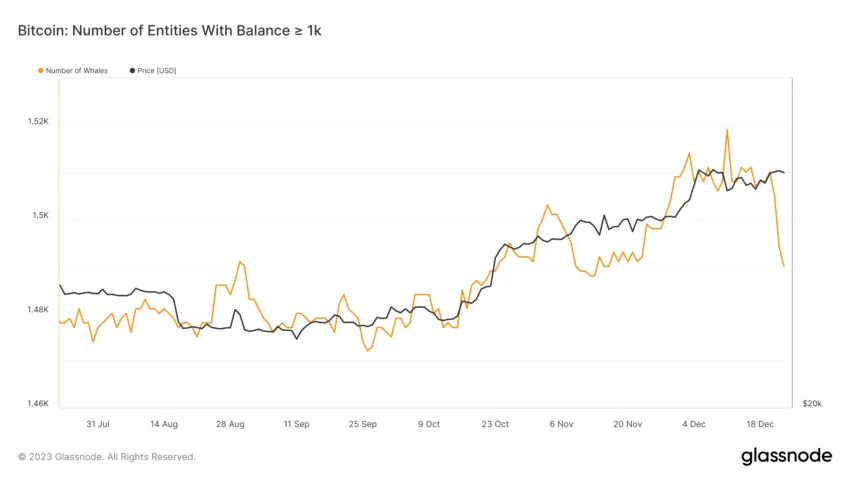

Ali Martinez, Global Head of News at BeInCrypto, said: I got it. The number of entities holding at least 1,000 BTC decreased by 1.10% in the past three days. This drop may not mean a sell-off. However, it does suggest a redistribution regime among the large Bitcoin whales.

Increased selling pressure could quickly impact Bitcoin price. Martinez believes that if the price loses support at $43,200, such an event could stall the recent bull run. In fact, he suggested that if that happens, the price of BTC could fall below $40,000.

“[If you are] Expect a correction in Bitcoin price… The first indicator is a sustained close below $43,200.If this happens, BTC could head towards $37,000,” Martinez said. Said.

Similarly, Santiment analysts cautioned: Focus on it The current surge in bullish market activity has led to widespread fear of missing out (FOMO) among investors. This is a trend they suggest requires a cautious approach. Nevertheless, Martinez added that “the odds appear to be in favor of the bulls” as long as Bitcoin continues to hold above the $43,200 support level.

BTC miners make money from fees

Investors aren’t the only ones benefiting, considering Bitcoin’s year-to-date price increase is an impressive 164%. In fact, as CasaHODL co-founder Jameson Ropp pointed out, Bitcoin miners have also been steadily growing this year, with total revenue exceeding $10 billion.

“Bitcoin miners will earn over $10 billion in 2023, a significant increase from the previous 15 years’ total of $57 billion. This figure assumes they can be immediately sold for fiat currency. , most definitely not. Miners are HODLers,” Ropp said. Said.

Read more: Top 7 platforms to earn Bitcoin sign-up bonuses in 2024

These high returns are likely due to the growth of Ordinal-like transactions on the Bitcoin network, which helped push average transaction fees to new highs.

According to analysts at Kaiko Research, Bitcoin “also outperformed all major traditional assets on a risk-adjusted basis.” This year, the company achieved one of the highest Sharpe ratios of any major asset.

In fact, Bitcoin ranks just behind semiconductor giant Nvidia, whose stock more than doubled between January and May due to growing excitement around artificial intelligence (AI).

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.