USD/JPY, Federal Reserve Issues:

- Tomorrow brings the FOMC rate decision for May, but before we get there, we’ll also see the service PMI printout in the morning. And on Thursday, the European Central Bank will put the interest rate decision in the spotlight. This will be followed on Friday by the release of the Nonfarm Payrolls (NFP) and Canadian employment figures. All of these can keep the risk trend moving.

- USD/JPY made a strong push last week from a bullish flag formation after Kazuo Ueda’s first meeting of the Bank of Japan, with EUR/JPY closing at 14 as GBP/JPY tested a new seven-year high. It also helped jump to all year highs. .

- We explore these topics in more detail in our webinars every Tuesday at 1:00 PM ET. Registration is free. Click here to register.

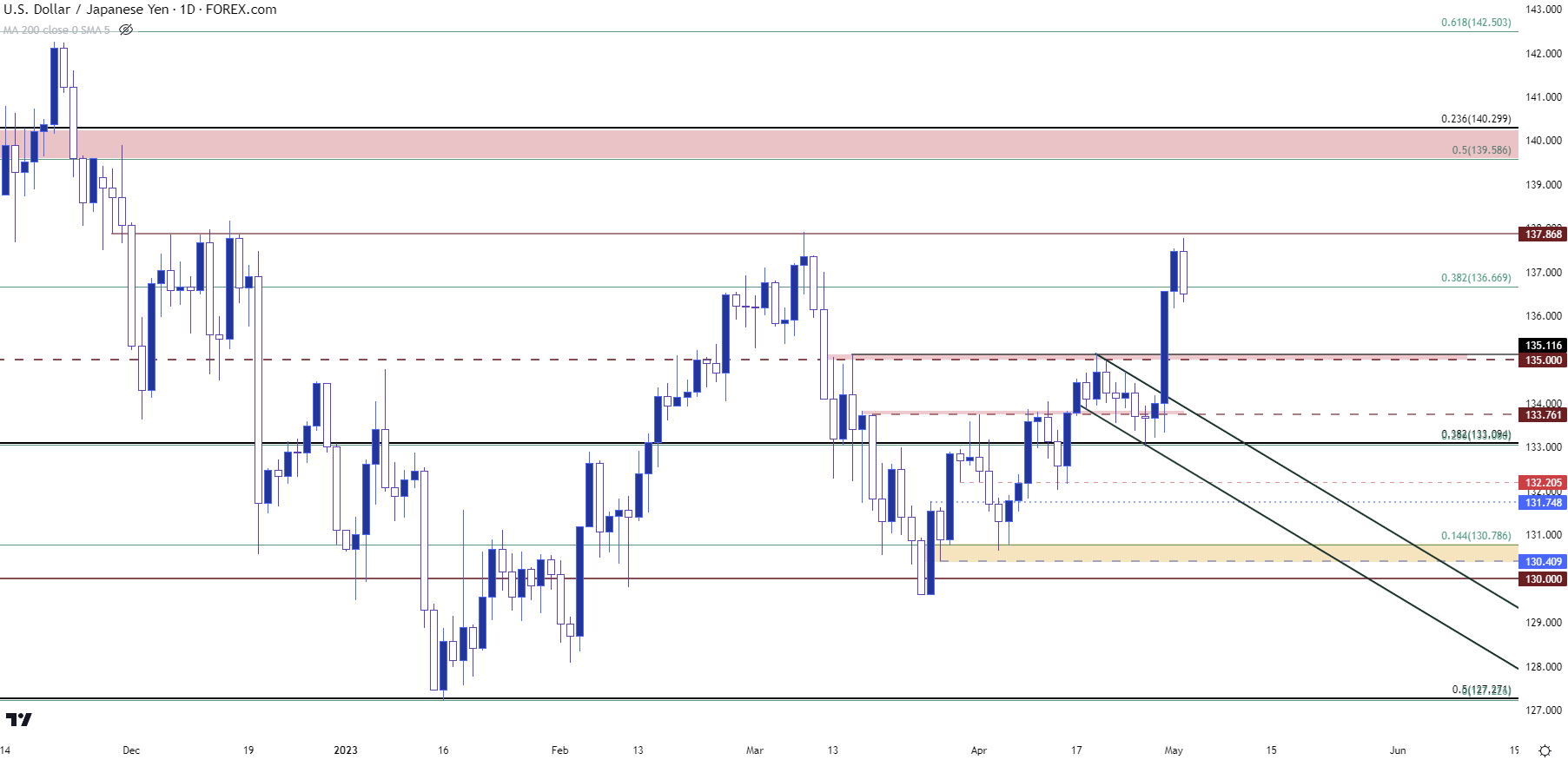

USD/JPY is retreating from today’s new breakout. The pair saw a strong topside move last week after the Bank of Japan’s rate decision on Thursday night/Friday morning, which led to a breakout from USD/JPY’s bullish flag formation. As we saw in setting up USD price action this week, there was no significant change from the Bank of Japan’s statement. Maybe that’s what caused it, as the market started gearing up for some element of change. as the bank introduced new leadership as core CPI remained above his 3%. But in Kazuo Ueda’s first meeting with bank chiefs, he allayed fears by ordering a review of the bank’s current spending while keeping policies very loose. As such, the resulting depreciation of the yen seems to be an expectation that the BOJ will move cautiously during this review period.

Another theme is starting to resurface ahead of tomorrow’s FOMC interest rate decision. US banking stress. This initially appeared in early March, and the resulting market impact was lower US interest rates, a weaker US dollar, and heightened expectations that his Fed would cut rates later in the year. After several days of pressure, these low interest rates helped stocks find support and the S&P 500 quickly pushed back to the resistance that was in effect until yesterday. And while fears seemed to have abated a bit, the regional banks continued to come under pressure and returned to equilibrium again this morning as PacWest recorded another event leading the decline of the group of regional banks.

In USD/JPY, the breakout continued this week with the bulls just slightly approaching the key resistance spot at 137.87. The Daily Bar is no outside bar at this point, but there are still hours left before the candles are done. I’m here.

USD/JPY daily chart

Chart created by James Stanley, USD/JPY on Tradingview

Chart created by James Stanley, USD/JPY on Tradingview

euro/yen

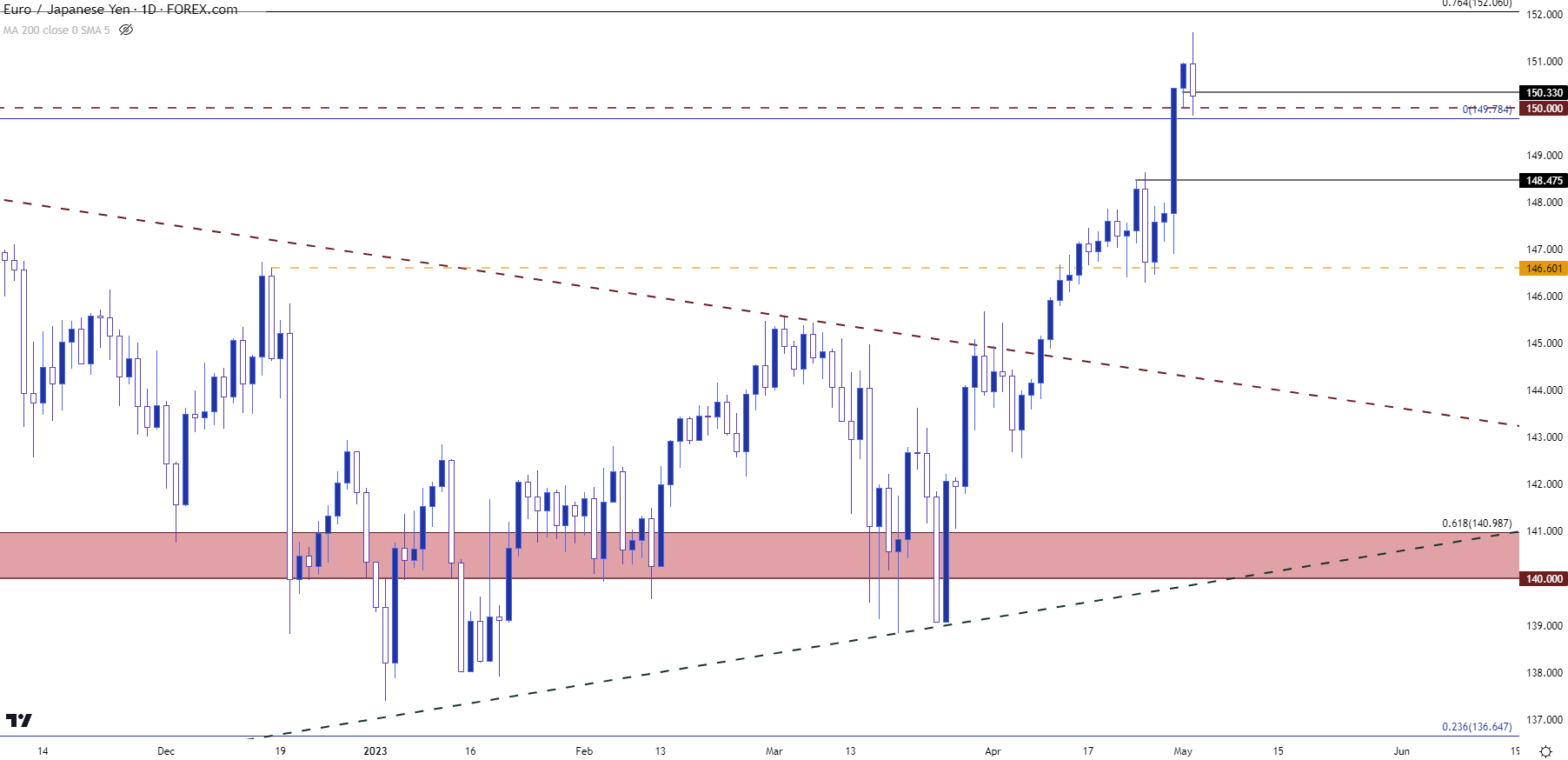

EUR/JPY climbed to a 14-year high after last week’s Bank of Japan interest rate decision. This is the first time the pair has traded above the 150 level since the 2008 financial crash, and recent trends prove just how strong the euro is.

But within 24 hours from the Fed, there is an ECB interest rate decision on Thursday. EUR/JPY is already posting outer bars today. This isn’t totally swallowed up, but you can have a similar drive. The 150 level has held support since then, but if the Yen continues to appreciate today and allows sellers to break below his 149.78 level, the door to a deeper rebound could soon open. there is. There is a possibility of deeper support at 148.48 and 146.40, turning the previous spot of resistance into support.

EUR/JPY daily chart

Chart created by James Stanley, EUR/JPY on Tradingview

Chart created by James Stanley, EUR/JPY on Tradingview

GBP/JPY

GBP/JPY showed a similar breakout, but with a little less historical reference. EUR/JPY jumped to his 14-year high, but GBP/JPY tested his 7-year high before pulling back up to the 170 handle. Psychological levels have helped hold lows since then, but similar to EUR/JPY above, there is potential for low-high resistance around the 171-171.11 area of the chart. Below, we have a Fibonacci level at 168.10, which highlights a possible follow-through support.

GBP/JPY 8-hour chart

Chart created by James Stanley, GBP/JPY on Tradingview

Chart created by James Stanley, GBP/JPY on Tradingview

— Written by James Stanley, Senior Strategist