Featured: Jackson Hole Symposium and PMI Report

- Jackson Hole Symposium Begins Thursday

- Central bank officials convened when investors show signs of losing risk appetite

- Range of PMI reports likely to cause price volatility

of Jackson Hole Symposium It can be expected to shed light on the thinking of the world’s central bankers. Investors are watching to see if there is any indication how long rate hikes are expected to apply.

Foreign exchange

pound dollar

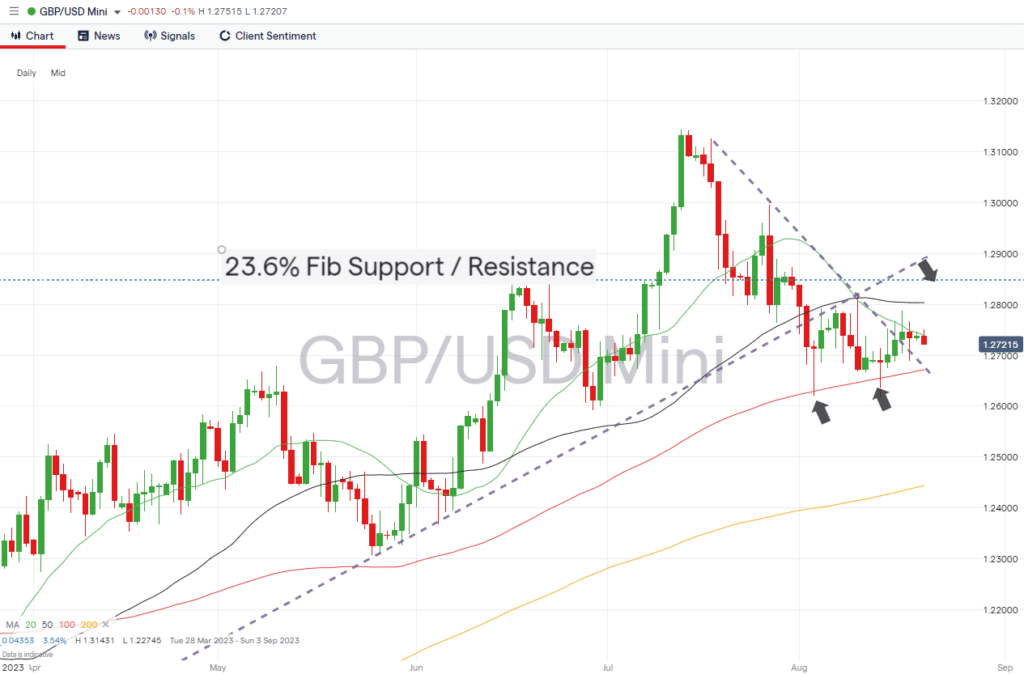

The pound continues to outperform the euro bank of england Lowering the inflation rate is given priority over economic growth. Purchasing Managers Index data released on Tuesday will provide insight into the health of the UK economy and indicate whether the World Bank needs to reconsider its approach.

Daily Price Chart – GBPUSD Chart – Daily Price Chart

Source: IG

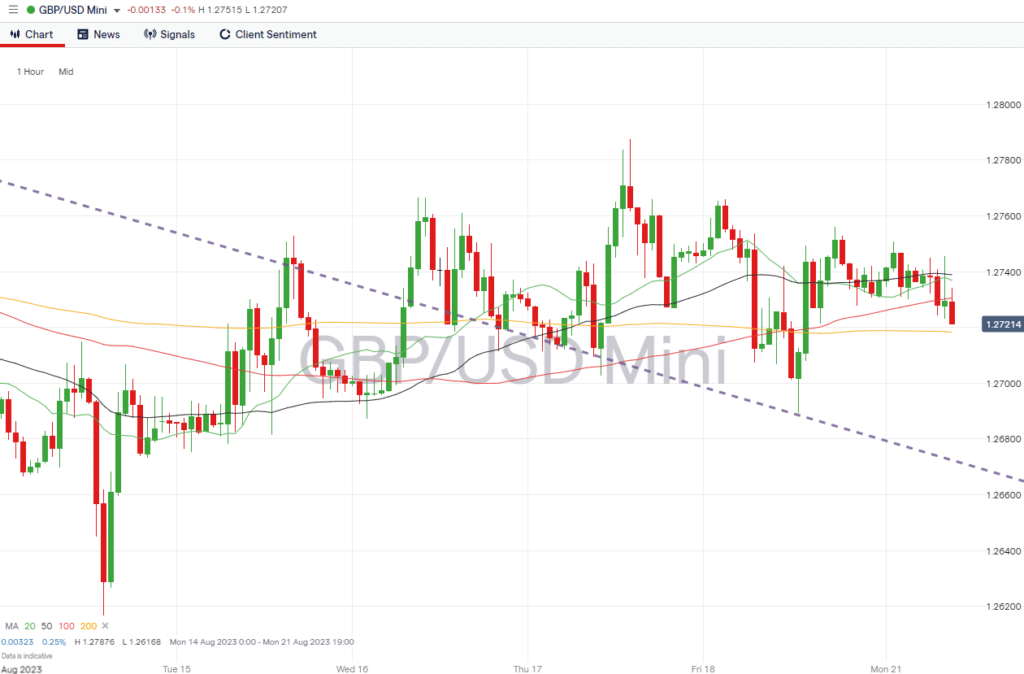

GBPUSD chart – hourly price chart

Source: IG

Economic data reports likely to affect the value of the British Pound currency pair (always BST):

- Wednesday, August 23 – 9:30am – UK PMI (July, breaking news). The manufacturing PMI index is expected to rise to 46.2 and the services index to fall to 51.2.

- Thursday 24th August – The Jackson Hole Symposium begins. Central bank officials from around the world will meet in Wyoming to discuss structural changes in the global economy.

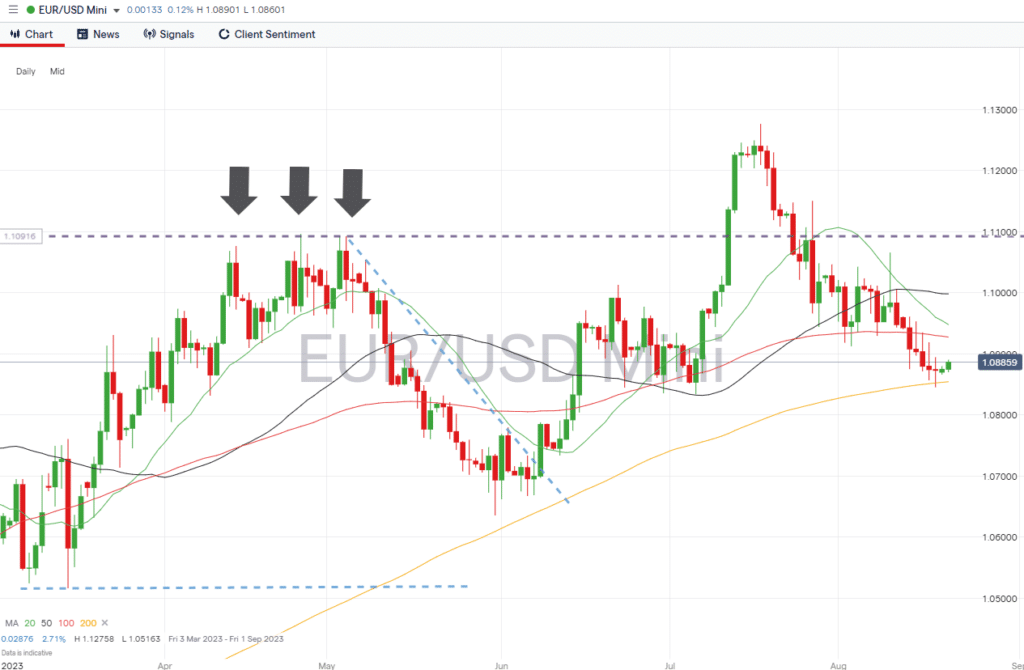

euro dollar

Eurozone and German PMI data to be released on Tuesday are expected to trigger Eurodollar price volatility. His IFO index for Germany on Friday allows analysts to establish a mood among industry leaders.

EURUSD chart – daily price chart

Source: IG

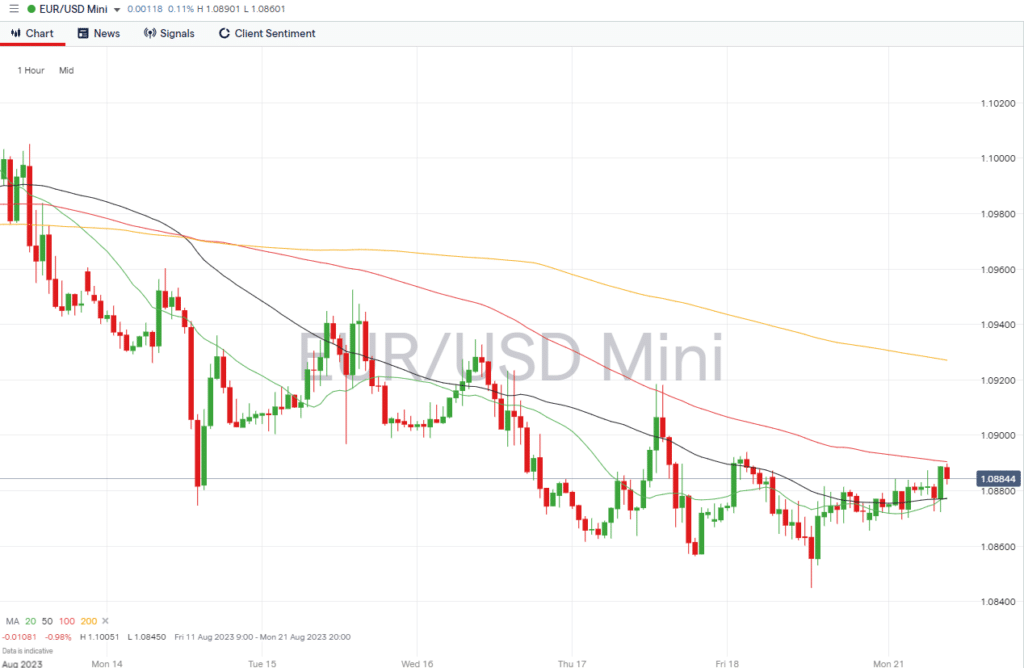

EURUSD chart – hourly price chart

Source: IG

Economic data reports that may affect the value of the Euro currency pair:

- Wednesday, August 23 – 8:30am – German PMI (July, breaking news). Manufacturing rose to 41 from 38.8. Also, 9am – Eurozone PMI (July, breaking news).

- Thursday 24th August – The Jackson Hole Symposium begins. Central bank officials from around the world will meet in Wyoming to discuss structural changes in the global economy.

- Friday, August 25 – 9:00 am – German IFO index (August). Analysts expect the business sentiment index to drop to 86.9.

index

S&P500

Earnings season is drawing to a close, but NVIDIA’s investor update due on Wednesday could spark a broader move in the market. The company’s exposure to the AI sector is seen as something of a leader across the board.

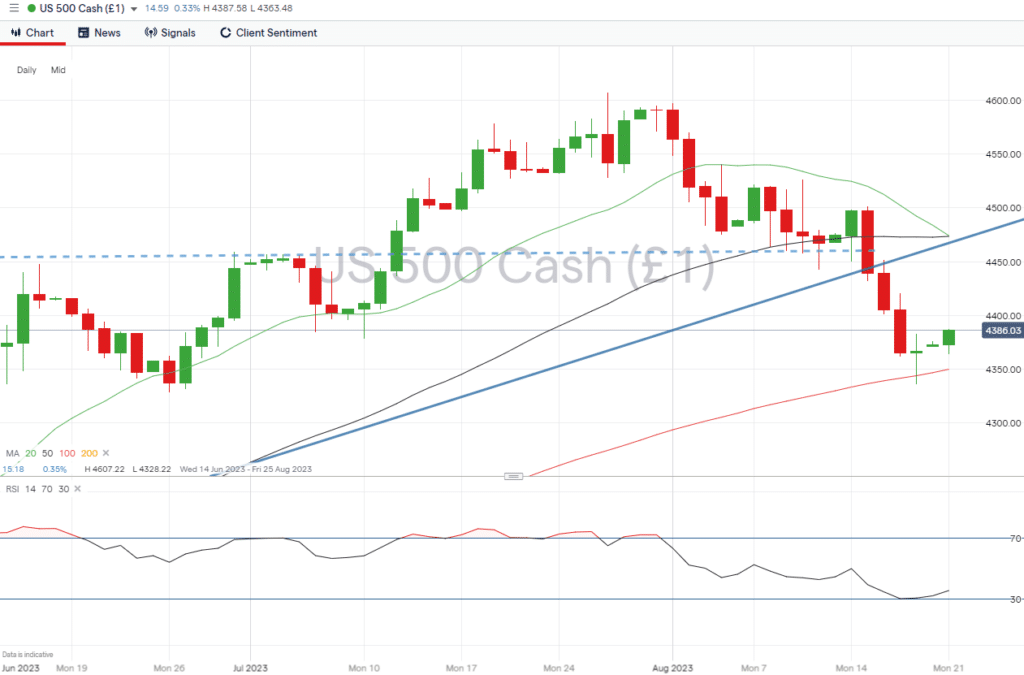

S&P 500 Chart – Daily Price Chart – 100 SMA

Source: IG

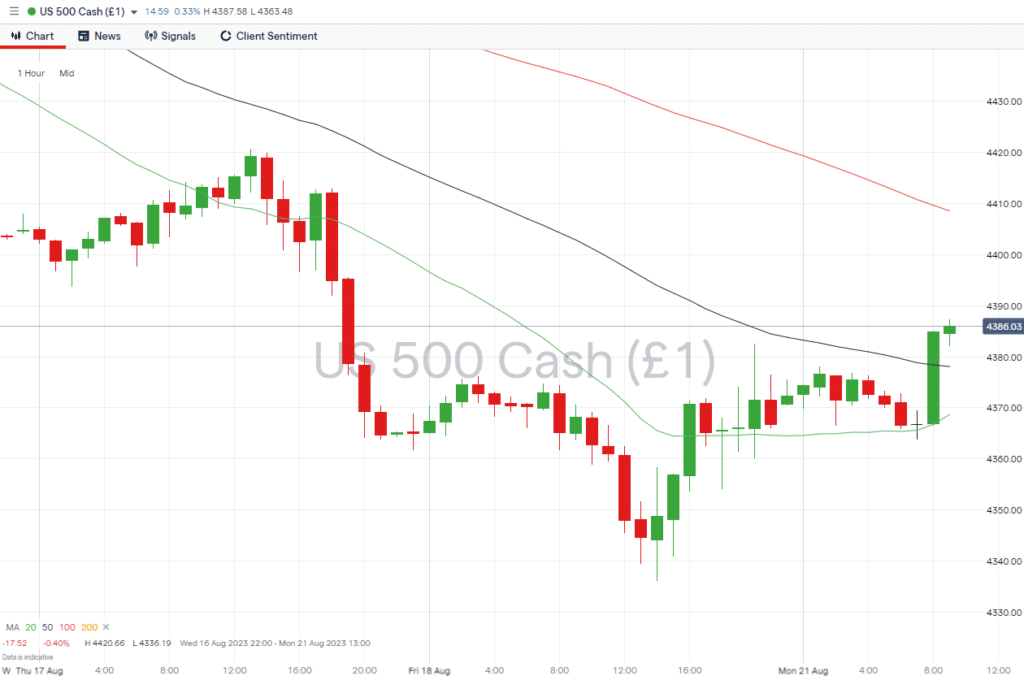

S&P 500 – Hourly Price Chart

Source: IG

Reports of economic indicators likely to affect the value of US stocks:

- Wednesday, August 23 – 2:45 PM – US PMI (July, Flash). The manufacturing PMI is expected to rise to 49.5 and the services sector to fall to 52.

- Thursday 24th August – The Jackson Hole Symposium begins. Central bank officials from around the world will meet in Wyoming to discuss structural changes in the global economy.

Companies reporting earnings this week:

- Monday, August 21 – zoom

- Tuesday, August 22 – Macy’s, Urban Outfitters.

- Wednesday, August 23 – NVIDIA, Peloton

- Friday, August 25 – gap

Others also read:

Risk statement: Trading financial instruments, especially leveraged products such as CFDs, involves a high degree of risk to your capital. May not be suitable for everyone. Please use after fully understanding the risks. You should consider whether you can afford to risk losing money.