Bitcoin Group SE (ETR:ADE) Shareholders should be pleased to see the share price is up 11% in the last month. But the fact remains that the returns over the past three years have been less than satisfactory. In fact, the stock price is down 21% over the past three years, well below the market return.

Next, let’s look at the company’s fundamentals to see if long-term shareholder returns are in line with the performance of the underlying business.

Check out our latest analysis for Bitcoin Group.

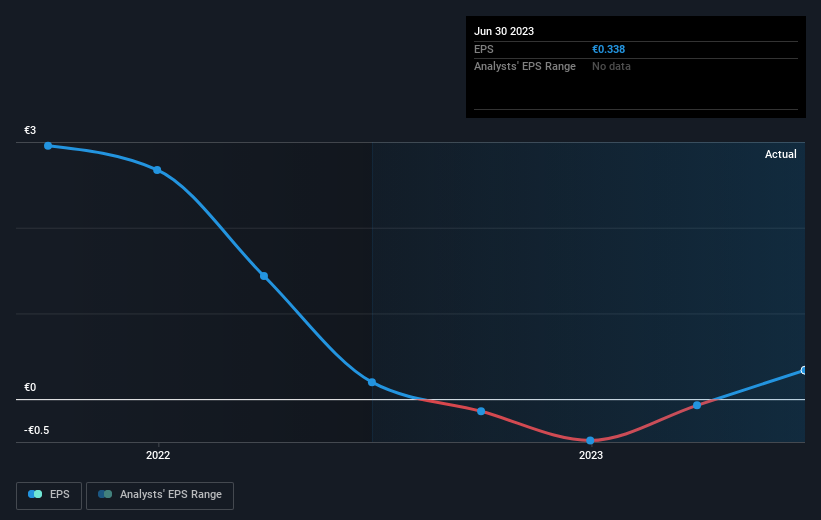

While there is no denying that markets are sometimes efficient, prices do not always reflect underlying company performance. By comparing earnings per share (EPS) and share price changes over time, we can learn how investor attitudes to a company have changed over time.

Bitcoin Group has seen its EPS decline at an average rate of 16% per year over the past three years. By comparison, the compound annual share price decline of 8% is less severe than the decline in his EPS. So the market may not be too worried about the EPS numbers at the moment. Alternatively, it is possible that the stock had already factored in some decline. With a P/E ratio of 65.60, it’s safe to say that the market sees a brighter future for him in terms of EPS. business.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Bitcoin Group has been improving its earnings lately, but will its earnings grow? Why not check this out? free Report showing analyst revenue forecasts.

different perspective

It’s good to see that Bitcoin Group shareholders received a total shareholder return of 9.1% over the last year. And this includes dividends. This is certainly higher than the annual loss of about 3% over the past five years. While we typically value long-term performance over short-term performance, recent improvements may signal a (positive) inflection point within the business. I think it’s very interesting to look at stock price over the long term as an indicator of business performance. But to really gain insight, you need to consider other information as well.For example, taking risks – Bitcoin Group two warning signs I think you should know.

of course, You may find a great investment if you look elsewhere. So take a look at this free A list of companies with expected revenue growth.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.