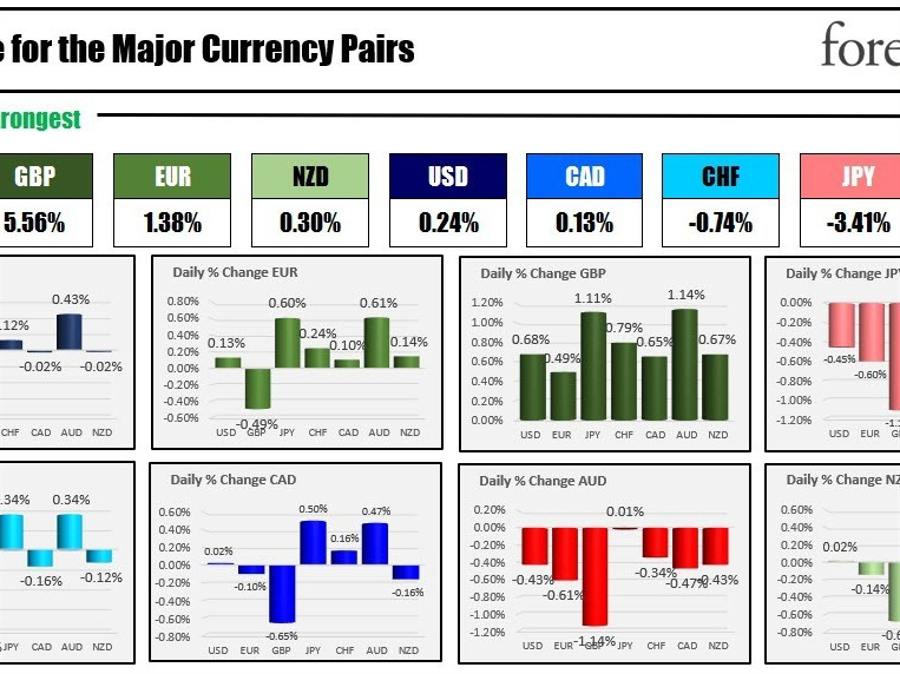

GBP is the strongest, AUD is the weakest

When the NA session begins, GBP is the strongest and AUD is the weakest. The RBA kept rates on hold at 3.6% as expected, but the central bank left open the possibility of resuming rate hikes in the future if financial market volatility were blown away. The AUD is battling the JPY as the weakest currency at the start of the North American session. GBP was torn higher in the European session after consolidating in the Asian session. GBPUSD moved above his key swing area between 1.24225 and 1.2445, opening the door for buyers to step in (see chart below).

GBPUSD Moves Above Swing Area

USD is mixed in early US trading ahead of JOLT and factory orders scheduled to be released at 10am ET. Adam has argued that the JOLT data is misleading to companies using job ads as a way to manipulate current and potential employers (which simply lacks necessity). exaggerated, see this post). durable goods Orders – part of factory orders – were -1.0% (+0.6% expected) on Mar 24 (see post here).

Stocks are higher in the US. Yields are higher. Crude oil continues to rise and is currently above $81. JP Morgan CEO Jamie Dimon said overnight Federal Reserve Board You may have to raise interest rates more than you expected. He also said the likelihood of an economic recession has increased.

Here’s a snapshot of the market:

- Physical gold is trading at $1.55 or -0.08% at $1982.50.

- Spot Silver remains $23.94

- WTI crude is trading at $81.14. The price closed yesterday at $80.42.

- Bitcoin is trading at $28,330. Yesterday’s low saw him drop to $27,236 before turning upwards.

Premarket for your stocks, the major indices are trading slightly higher. Yesterday the S&P fell and the NASDAQ fell, but well off the lows of the day.

- Dow Jones Industrial Average hits 52.85 after yesterday’s 327-point gain

- S&P index gains 14.24 points after gaining 15.18 points yesterday

- The Nasdaq Index is up 65 points from yesterday’s drop of -32.45 points

In European stock markets, major indices are higher.

- German DAX, +0.90%

- Francis CAC +0.60%

- UK FTSE 100 +0.02%

- Spanish ibex +0.86%

Asia Pacific market:

- Japan’s Nikkei +0.35%

- Hong Kong’s Hang Seng Index -0.66%

- China Shanghai Composite +0.49%

- Australia’s S&P/ASX Index rose 0.18%

In the US bond market:

- 2Y Yield 4.013% +3.3bps

- 5Y Yield 3.552% +2.3bps

- 10-year yield 3.463% +3.2 basis points

- 30 year yield 3.669% +2.3 basis points

European bond markets have high 10-year yields.

European Benchmark 10 Year Yield