Industry experts say up to £30bn could be wiped out from the liabilities of UK corporate pension schemes as life expectancy drops to the highest level in a decade.

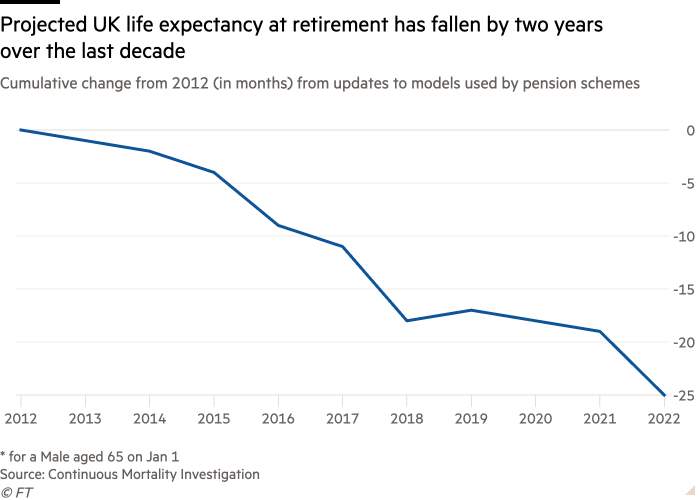

The latest modeling by actuaries found that the life expectancy assumption at retirement age is 1.9% lower, or six months, compared to the previous year’s model.

Industry analysts believe the forecast could save billions of dollars from total private sector defined benefit pension plan liabilities, which stood at £1.28 trillion at the end of September 2022. I’m here.

“We expect the typical impact of a scheme changing its lifetime assumptions [from the 2021 model to 2022 model] It will reduce debt by about 2%.” — up to £30bn, said Tim Gordon, partner at actuarial consultancy Aon.

About 10 million people in the UK are on private sector defined benefit or final salary schemes. These pay guaranteed annuities for as long as the member and surviving spouse are alive, and use life expectancy models to calculate the cost of meeting liabilities that may extend decades into the future. To do.

Chris Tavenner, partner at LCP, an actuarial consultant, said, “For a typical defined benefit pension plan, this is one of the biggest year-over-year declines in life expectancy at retirement age assumptions in the past decade. likely to become,” he said.

“Looking at the four previous versions of the model, the average change in life expectancy at age 65 for each version was a few weeks, but one might have already expected some of this decline.” he added.

“The extent to which individual schemes are affected will be influenced by many scheme-specific factors, from when and how funding assumptions are determined to the amount of longevity risk already hedged.” and Stephen Kane, Director retirement at Willis Towers Watson, one of the UK’s largest pension consultancies.

The Continuing Mortality Research (CMI), sponsored by the Institute of Actuaries and Faculty of Actuarial Studies, revise the tables annually to take into account the latest mortality trends. They are based on demographic trends across the country and are widely used by pension plans and insurance companies to price products such as annuities, annuities and life insurance.

In 2017-18, CMI lowered its life expectancy projections by approximately seven months. This is the biggest drop since the table was created in 2009.

The latest decline is due to higher death rates in England and Wales in late 2022, according to research.

“Deaths in 2020 and 2021 were clearly unusually high due to the significant number of deaths seen during the first two Covid-19 waves, but the number of deaths in 2022 was consistently higher than pre-pandemic expectations for most of the year,” said Jonathan Hughes, chairman of the CMI.

“In CMI’s view, higher-than-expected mortality rates may persist as underlying factors are likely to persist soon.”