- The risk of Australia slipping into recession has increased significantly.

- The Commonwealth Bank of Australia puts the probability of Australia in recession this year at 50%.

- Markets are suggesting that the RBA could raise interest rates two more times to reach 4.6%.

The outlook for AUD/USD today is slightly bearish. The risk of Australia slipping into recession has increased significantly after the central bank surprised markets with a rate hike this week.

–Want to learn more about copy trading platforms? Check out our detailed guide –

He also expressed his willingness to tighten further to curb high inflation. Even if it means sacrificing job retention.

Over the past year, Reserve Bank of Australia Governor Philip Lowe has debated the challenges of balancing lower inflation and maintaining unemployment. But this week, the governor’s stance changed.

Low stressed that the road ahead will be difficult. He also said he would prioritize curbing high inflation over keeping jobs.

This change in approach has led economists to price in at least one more rate hike and a full-blown risk of recession. It will be the country’s first recession in more than 30 years, not counting the recession caused by the 2020 COVID-19 pandemic.

The Commonwealth Bank of Australia currently puts the probability of a recession this year at 50%. Moreover, it expects growth to slow to 0.7% annualized in the previous quarter and the unemployment rate to rise to 4.7% by mid-2024.

The economy is already experiencing a below-average slowdown. Recent data showed growth of just 0.2% in the March quarter. Following unexpected rate hikes in May and June, the market now suggests two more rate hikes could reach 4.6%.

AUD/USD major events today

The pair is likely to hold firm in the absence of important economic data from the US or Australia.

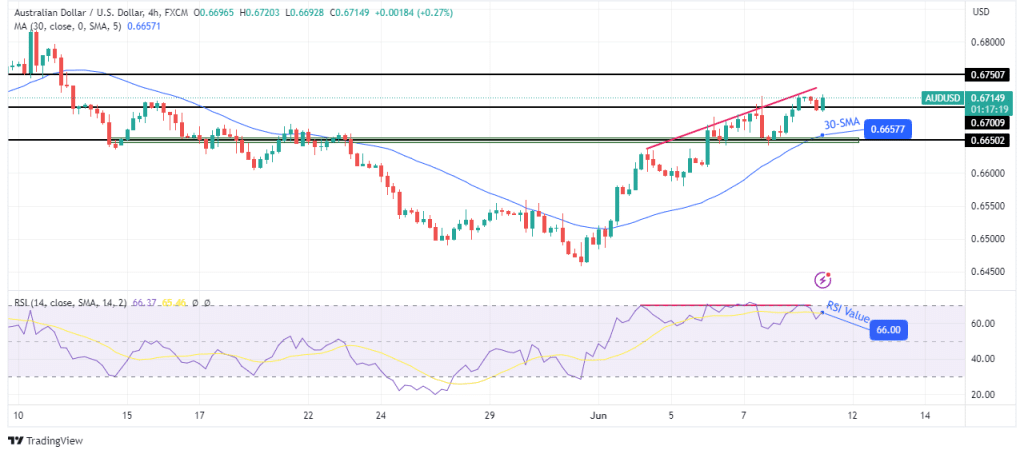

AUD/USD technical outlook: RSI consolidation points to bullish weakness.

The AUD/USD bias is bullish on the 4-hour chart. The price is constantly making new highs while trading above the 30-SMA. This shows that the buyer is in control. Additionally, the RSI is trading above 50, indicating strong bullish momentum.

–Want to learn more about scalping forex brokers? Check out our detailed guide –

However, while the price is making new highs, the RSI is pausing and moving sideways below the overbought territory. This shows that bullish momentum is waning and could lead to a pullback to the 30-SMA and 0.6650 support.

Considering Forex Trading Now? Invest in eToro!

68% of retail investor accounts suffer losses when trading CFDs with this provider.You should consider whether you can afford to take the high risk of losing money