Palantir Technologies

Palantir Technologies

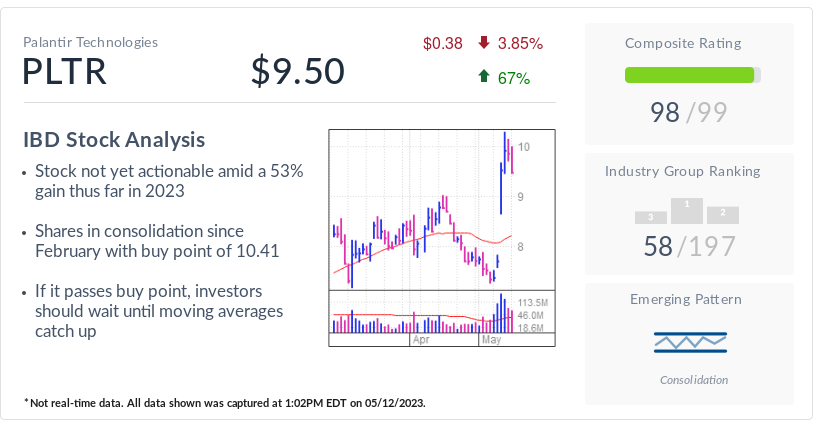

PLTR

$0.38

3.85%

67%

IBD Stock Analysis

- Stock not yet viable as it rises 53% by 2023

- Share consolidation after February, buy point is 10.41

- If the buy point is crossed, investors should wait for the moving averages to catch up.

![]()

Industry group ranking

![]()

new pattern

![]()

integration

*This is not real-time data. All data shown was captured on May 12, 2023 at 1:02 PM EDT.

Palantir Technologies (PLTR) is the IBD stock of the day as enterprise software makers are trading near the buy point. With PLTR shares up 53% in 2023, it’s still not viable.

X

In the stock market on the day, Palantir fell 3.8% to 9.50. The stock is well below the software maker’s intraday high of $45 set in late January 2021. Moreover, investors who bought PLTR shares listed directly on Sept. 30, 2020 at 7.25 could point to only a small gain.

PLTR shares rose on May 8’s first-quarter earnings report. Meanwhile, Palantir shares have been consolidating at the entry point of 10.41 since February. But investors should keep an eye on Friday’s performance, including volume.

On a bullish note, Palantir shares will form a handle and the moving averages will catch up with the stock’s trading levels.

If the stock somehow reverses on Friday and crosses the buy point, investors should delay taking positions. The stock price strays too far from the moving averages. If we can get behind the wheel, there is a high possibility that the movement lines on the 21st and 50th will catch up somewhat.

PLTR Stocks: Improving Profitability

Improving profitability boosted PLTR shares. In the fourth quarter of 2022, Palantir reported net income of $31 million under generally accepted accounting principles (GAAP). This shows Palantir’s GAAP net income for the first quarter was positive. Net income for the March quarter was $17 million.

However, the slowdown in sales growth remains an issue. Revenue growth in 2022 slowed to 24% from 40% in 2021 and 47% in 2020.

Palantir also derives nearly 60% of its revenue from government agencies. They use his Palantir software for intelligence gathering, counter-terrorism and military purposes. Additionally, the software maker has expanded into the healthcare, energy and manufacturing sectors.

The Denver-based company offers three platforms. One is Palantir Gotham, used primarily by government agencies. There is also Palantir Metropolis for banks, financial services companies and hedge funds. In addition, Palantir Foundry is also used by corporate customers. Palantir often customizes software for its customers.

New artificial intelligence platform

Incorporating artificial intelligence into software platforms, on the other hand, has been a strategy for many years. Amid the sudden buzz around “generative” AI, the question is whether Palantir will seize the opportunity.

Generative AI could disrupt many industries by uniquely creating text, images, videos, and computer programming code. Generative AI technology is also already applied to marketing, advertising, drug development, legal contracts, video games, customer support, and digital art.

In announcing its first quarter earnings, Palantir unveiled its latest offering. “Artificial Intelligence Platform” will begin rolling out to select customers this month.

“AIP’s goal is to blend existing PLTR technology’s machine learning technology with large-scale language models to co-exist in the current PLTR platform, enabling businesses and governments to make more data-driven decisions and optimize processes. The Bank of America report states:

high overall rating

PLTR stocks scored 98 out of 99 on the IBD Overall Rating, the highest possible score, according to the IBD. IBD inventory diagnosis.

The IBD Comprehensive Rating combines five separate, unique ratings into one easy-to-use rating. Also, the best growth stocks have an overall rating of 90 or higher.

Additionally, PLTR stock has a cumulative/distributive rating of A-. This evaluation analyzes changes in a stock’s price and volume over the last 13 weeks of trading. Current ratings show more funds buying than selling.

This rating measures the buying and selling of institutional stocks on a scale of A+ to E. A+ represents a large purchase by an institutional investor. E means bulk sale. Think of a C grade as neutral.

Follow Reinhard Klaus on Twitter @reinhardtk_tech See the latest in 5G wireless, artificial intelligence, cybersecurity and cloud computing.

You’ll probably also like:

IBD Digital: IBD’s Premium Stock Listings, Tools and Analysis Now Available

Learn how to time the market with IBD’s ETF Market Strategy

How to use the 10-week moving average for trading

Get Your Free IBD Newsletter: Market Readiness | Tech Reports | How To Invest