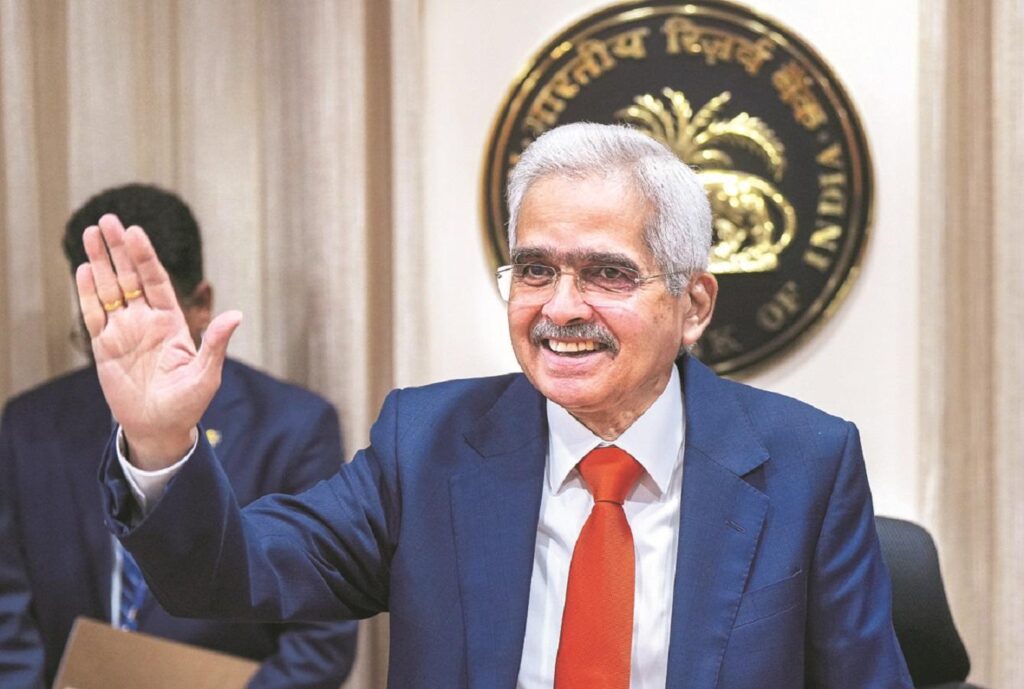

Issuance of Master Directions for Foreign Exchange Market Participants is part of comprehensive efforts to help market participants manage risk in an ever-changing market, RBI Governor Shaktikanta Das said on Friday. stated in its monetary policy statement.

The rules for managing currency risk through hedging were thoroughly reviewed in 2020, with the aim of establishing a system based on principles. The regulatory framework has been strengthened by drawing insights from market participant feedback and experience gained, and by consolidating guidelines for all trade types, both over-the-counter (OTC) and exchange-traded, into a unified master direction. I did. Additionally, improvements have been made to increase operational efficiency and ease access to foreign exchange derivatives, especially for users with limited exposure. This improvement ensures a more flexible approach for a wide range of customers with risk management expertise to efficiently address their exposures.

Click here to follow our WhatsApp channel

Meanwhile, India’s foreign exchange reserves rose by $6 billion in the week to December 1 to $604 billion, according to the latest data from the Reserve Bank of India. This was the highest percentage increase since July 14 of this year.

Since August 11, reserves have exceeded $600 billion.

Foreign exchange reserves increased by $5 billion this week due to an increase in foreign currency assets.

Total reserves for the week ending November 24 were $598 billion.