With Halloween just around the corner, the housing market this past year has been scary for some home hunters.

While it’s a spooky holiday that celebrates haunted houses and other spooky things, this holiday may evoke frightening thoughts about the difficulty of achieving the American Dream. But what aspects of homeownership are homebuyers most afraid of, and which cities are they most afraid of?

a New research from Point2Homes Home prices are on the rise and are expected to continue rising into 2024, with 30-year fixed-rate mortgages reaching their highest level in decades, the company said. Current inventory for sale is less than one year’s supply. In other words, this year has been a difficult year for many homebuyers.

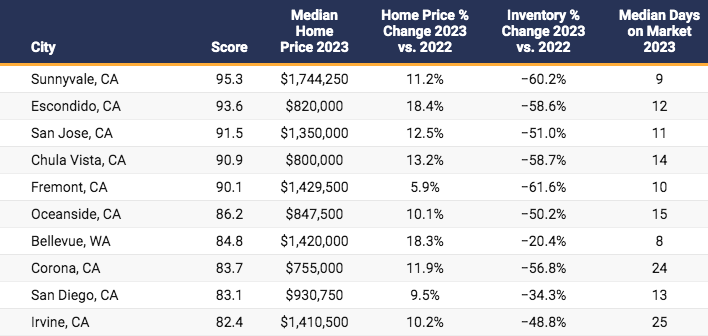

Point2 analyzes the nation’s 200 largest markets using four metrics: median price, year-over-year (YoY) difference in home prices, year-over-year change in inventory for sale, and shortest number of days to determine the scariest housing market. I set out to do that. market.

Top 10 Scariest Markets for Home Buyers in 2023

- Sunnyvale, California

- Escondido, California

- San Jose, California

- chula vista, california

- Fremont, California

- oceanside california

- Bellevue, Washington

- Corona, California

- san diego

- Irvine, California

From soaring house prices and scarce inventory to regrets about not buying a house yet and houses slipping through the cracks, people are trying to buy their dream home amid fears of a housing market crash. Here are the main points about the bone-chilling horror that awaits people.

- Buying a home is difficult everywhere, but data shows some cities have accumulated the bulk of buyer anxiety over the past year. Nine of the 10 scariest markets are in California, led by Sunnyvale and Escondido, not LA or San Francisco.

- Prices rose the most in markets known to be among the more affordable of the 200 largest markets. Compared to 2022, homebuyers in Louisville, Kentucky, Tallahassee, Florida, and Kansas City, Kansas are now dealing with home prices that are 20% more expensive. taller than.

- Monster prices will be available in established ultra-high-net-worth markets such as Manhattan and San Jose, Calif., as well as Sunnyvale ($1.7 million), Bellevue, Wash. ($1.4 million), and Glendale, Calif. ($1.3 million). It is also a reality in the emerging West Coast heartland. ($1 million), Torrance, California ($1.1 million).

- Inventory for sale is near historic lows, with 28 of the 200 largest U.S. markets seeing housing inventory cut in half from 2022 onwards, and California’s Fremont and Sunnyvale currently have lower housing inventory compared to last year. The number of home sales has decreased by approximately 60%.

- Extremely high demand keeps homebuyers on high alert. In 19 major cities, homes go off the market in just 10 days. In Grand Rapids, Michigan and Lakewood, Colorado, active listings last less than a week.

Move beyond LA and San Francisco. Now it’s Sunnyvale and Escondido’s turn. It’s no secret that California is expensive. Nine out of the 10 scariest cities to buy a home are all in the Golden State.

Meanwhile, prospective owners in Sunnyvale find themselves in the middle of the residential Bermuda Triangle due to high home prices, low inventory, and a rapidly declining number of properties. For some time now, Sunnyvale has emerged as an upscale market on par with its Silicon Valley sister city, San Jose.

Escondido, one of the most popular spots in San Diego County, comes close when it comes to keeping potential buyers up at night. Apart from higher prices, homebuyers can now choose from about half as much housing stock as last year, and only these homes in three cities sell within 12 days.

Meanwhile, Southeastern cities like Jackson, Mississippi, Birmingham, Alabama, and New Orleans keep homebuyers’ dark thoughts at bay. What makes home hunting easier in these housing markets and several others in the Sunbelt is that home prices are below the national average of $420,000, prices are declining year-over-year; Often, there are a lot of homes for sale. It is on an increasing trend from 2022 onwards.

Petrifying prices: over $1.1 million in Bellevue, Washington, Manhattan, and much of California.Prices in Louisville, Kentucky rise 25% year over year

Fluctuations in home prices are the main factor keeping home seekers up at night on the path to homeownership. With prices well over $1.1 million, eight of the top 10 most expensive markets for homebuyers are in California.

Home prices in Sunnyvale, one of the most competitive housing markets in the country, have increased by 11% since 2022 to more than $1.74 million. The situation is similar in neighboring Fremont, where despite a more optimistic 6% decline year over year, the median price is closer to $1,430,000. California home seekers are forced to deal with a combination of rapidly rising prices, homes being taken off the market and shrinking inventory, making homeownership increasingly difficult.

To read the full report with more data, graphs, and methodology, go to click here.