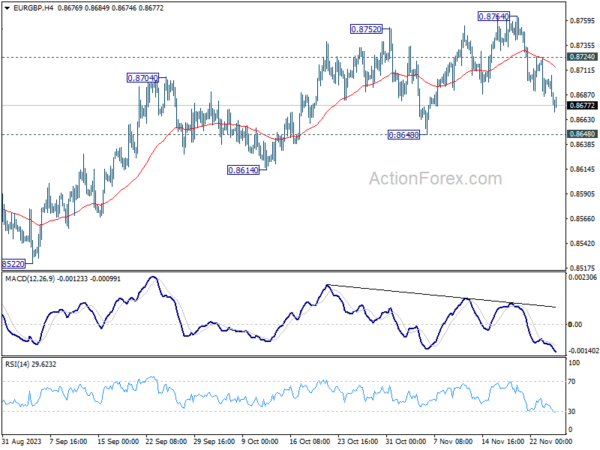

Last week’s significant decline in EUR/GBP indicates a short-term ceiling at 0.8764 under the 4th hour MACD bearish divergence conditions. Initial bias for this week is currently to the downside with support at 0.8648. A decisive break here would assert that the entire rally from 0.8491 is complete, making the near-term outlook bearish. Nevertheless, a break above the minor resistance at 0.8724 will maintain the bullish trend in the short term and bring about a retest at 0.8764.

Looking at the bigger picture, the downtrend from 0.9267 (2022 high) should be completed with a 3-drop to 0.8491. The rise from 0.8491 is seen as another bar within the pattern from 0.9499 (2020 high). We should see further upside above the resistance level at 0.8977. However, a solid break below the 0.8648 support would weaken this view and increase the possibility of a medium-term decline to 0.8941.

Looking at the long-term situation, the long-term range pattern is expanding. However, the rally from 0.6935 (2015 low) is expected to resume to 0.9799 (2009 high) at a later stage.