Bitcoin

BTC

subscribe from now Forbes Crypto and Blockchain Advisor Navigating the Bitcoin and Cryptocurrency Market Roller Coaster

Bitcoin Price Volatile, Trailing Other Major Cryptocurrencies Including Ethereum and XRP

XRP

BNB

Now, according to local media reports, the Supreme Court of China, which recently moved to open Bitcoin and cryptocurrency trading to the Hong Kong mass market, ruled that cryptocurrencies are “legal property and protected by law.” It is said that it created a report declaring that there is

Updates are most needed at the start of a bull market. Sign up for free now crypto codex—Stay ahead of the market with our daily newsletter for traders, investors and anyone interested in cryptocurrencies.

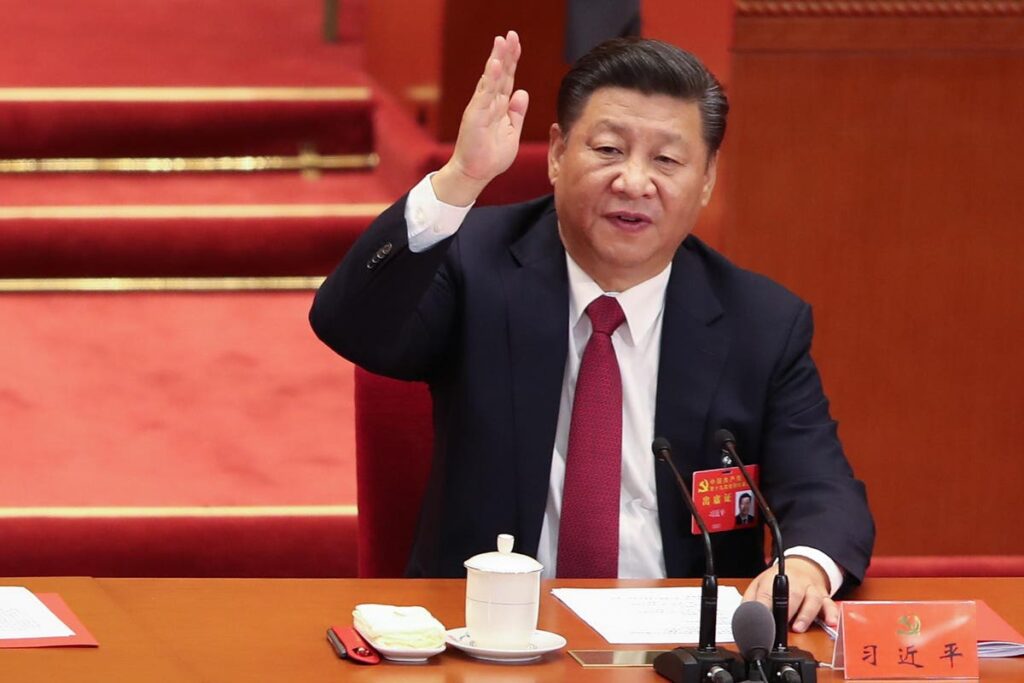

Chinese President Xi Jinping has overseen the country’s crackdown on cryptocurrencies for several years. … [+]

“Virtual currencies are not classified as illegal goods. Therefore, under the current legal policy framework, virtual currencies held by related parties in our country are still legal property and are protected by law. said the People’s Court of China in its “Report on Identification and Disposal of Property Attributes of Virtual Currencies.”According to a local news site, property related to the case Every day.

“At some point, China’s strategic adoption of cryptography [People’s Republic of China] It will attract the attention of U.S. policymakers,” said Faryal Sirzad, chief policy officer at Bitcoin and cryptocurrency exchange Coinbase. Posted Go to X (Twitter). “Chinese courts do not create any legal framework without the permission of the central authority.”

The court report comes after bitcoin and cryptocurrency companies in Hong Kong, a special administrative region of China, have been issued licenses to offer cryptocurrency trading to the public under a new regulatory regime. Last month, the first licenses were granted to cryptocurrency exchanges HashKey and OSL.

China has cracked down on Bitcoin, Ethereum, and cryptocurrencies in 2021, expelling cryptocurrency companies and so-called miners that maintain blockchain networks, and causing the Bitcoin price to plummet, despite Hong Kong becoming the global leader. Some predict that it is poised to become a major cryptocurrency hub.

Jeremy Alea, chief executive of stablecoin issuer Circle, which oversees the $28 billion USDC stablecoin, said in June that there was a “massive demand” for digital assets in emerging markets “focused” on China and Asia. Said he sees there is.

“Hong Kong is clearly trying to establish itself as a very important center for digital asset markets and stablecoins, and we are paying close attention to that,” Allaire said. bloomberg At the World Economic Forum in Tianjin, China.

SIGN UP NOW crypto codex— Free daily newsletter for anyone interested in cryptocurrencies

Bitcoin price gains have collapsed this year amid mounting economic and regulatory pressures. but, … [+]

Meanwhile, China’s economy, along with its property market, is sending out red flags, forcing the People’s Bank of China to step up its stimulus package.

“As we noted two weeks ago, the most significant economic risk is China, where the USD/RMB continues to rise,” said head of research and strategy at crypto market maker Matrixport. author Markus Thielen wrote in an email.

“China’s apocalypse must be extremely close, and the authorities seem to be aware of the problem and trying to help the economy. Or a local fund manager ‘encouraged me not to sell the stock’.

The People’s Bank of China this week cut the amount of foreign currency financial institutions must hold in reserves for the first time this year, and China’s big banks have also cut interest rates on various yuan deposits.