After all, the Australian dollar’s recent performance suggests that upward momentum continues.

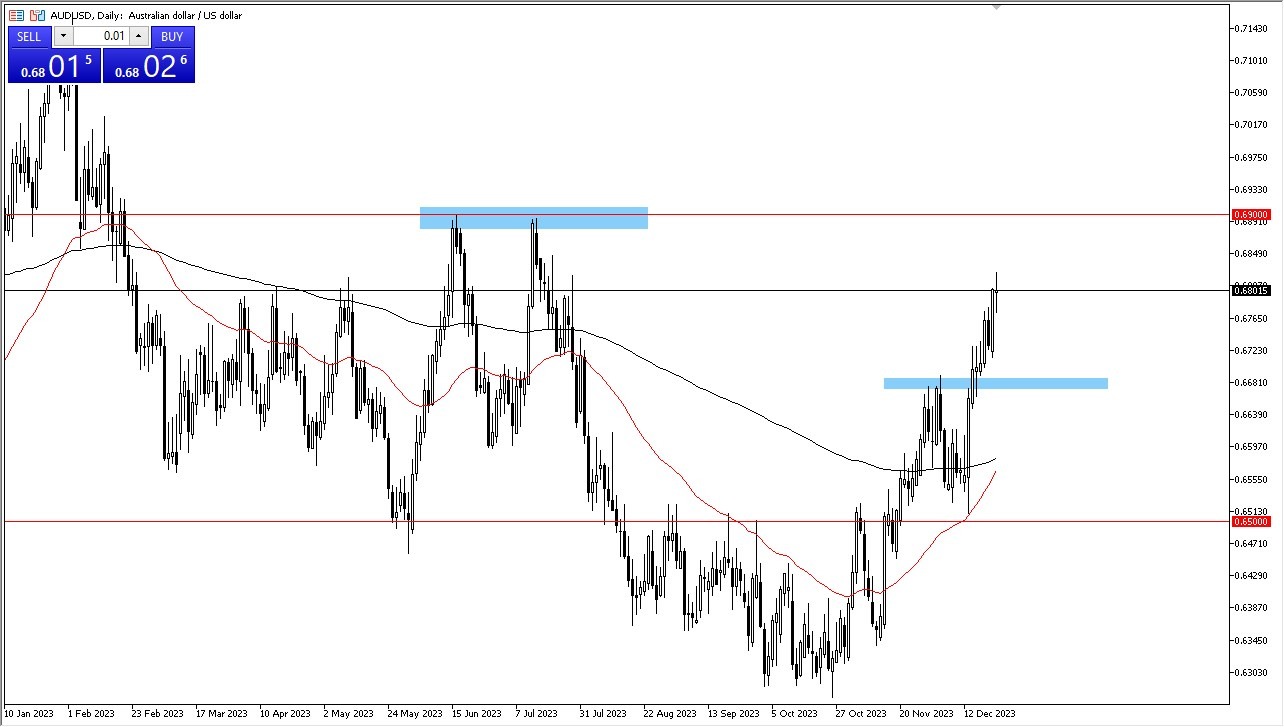

AUD/USD initially fell back during trading on Friday, but then quickly reversed and showed signs of vitality. Simply put, this suggests that the market is likely to continue its upward trajectory. Traders are pricing in the expectation that the U.S. Federal Reserve will cut interest rates through 2024, contributing to the positive sentiment. Analyzing the technical aspects is consistent with this perspective. It has risen significantly in the past, but it seems to be gaining even more momentum. However, it is important to note that liquidity tends to dry up during the holiday season, but we expect buyers to step in whenever there is a push.

Recommended Forex Brokers in Your Area

- As I write this, the market is testing the 0.68 level and I believe it will eventually reach the 0.69 level.

- While this level previously acted as a significant barrier, the recent uptrend indicates an increasing presence of value-seeking traders.

- It remains to be seen whether it can break through the 0.69 level, but if it does, the next logical target would be the 0.70 level. This has very important psychological meaning because of its approximate nature.

Under the current price trend, the 0.67 level appears as a potential support zone. The 200-day exponential moving average could provide a safety net in the event of a decline below this level, but such a scenario seems unlikely. An impending “golden cross” where the 50-day EMA is about to break above the 200-day EMA is a bullish signal that long-term traders love. While that is not necessarily guaranteed, it adds another incentive for traders to take long positions.

After all, the Australian dollar’s recent performance suggests that upward momentum continues. Expectations for Fed rate cuts are a prominent driver of this trend. Technical analysis further supports this outlook, saying that while the holiday season could cause some disruption and instability due to lower liquidity, it is unlikely to disrupt the overall bullish trend. That said, it’s probably only a matter of time before it moves higher, especially as traders return from vacation and factor in Federal Reserve action in 2024.

Ready to trade daily forex predictions? Here is a list of some of the best Australian forex brokers you should check out.

Ready to trade daily forex predictions? Here is a list of some of the best Australian forex brokers you should check out.