Bitcoin BTC, Ethereum and other major cryptocurrencies have recently lost momentum, even as traders focus on a $6 trillion earthquake in 2024.

Subscribe from now Forbes Crypto and Blockchain Advisor Navigating the Bitcoin and Cryptocurrency Market Roller Coaster

Bitcoin price has doubled since the beginning of the year, but uncertainty dominates the market, putting pressure on top 10 cryptocurrencies Ethereum, BNBBNB, XRP, Dogecoin, Cardano, Solana, Tron and Polygon. So it fell last month.

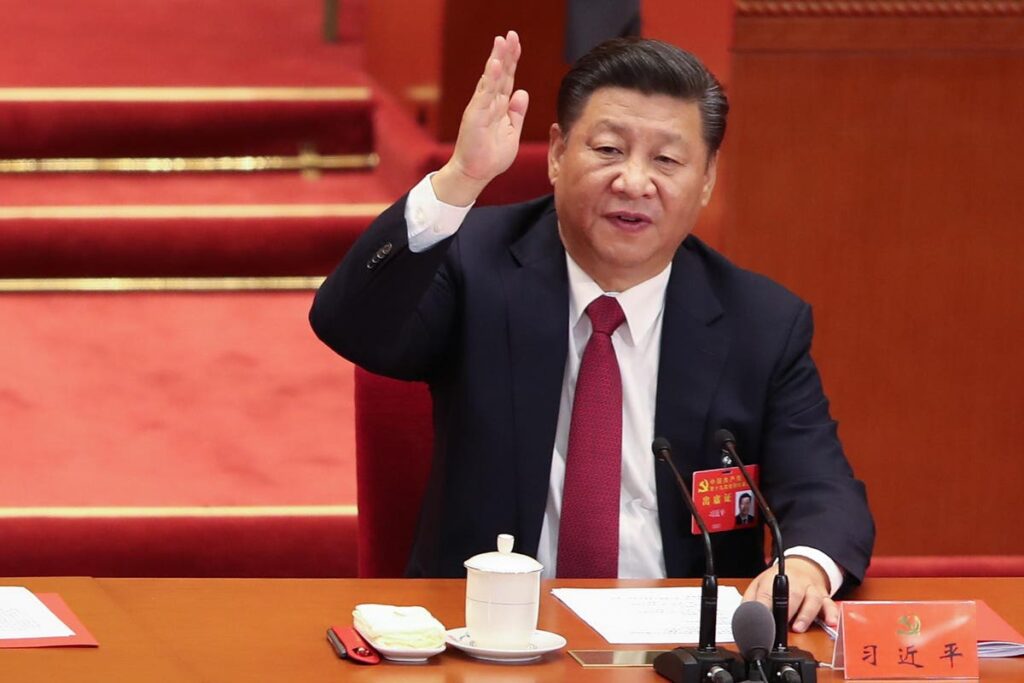

Hong Kong, China under new crypto regime after Tesla billionaire Elon Musk denies reports that X (Twitter) may be trying to blow up bitcoin and cryptocurrency markets issued its first license, opening cryptocurrency trading to the mass market.

Updates are most needed at the start of a bull market. Sign up for free now crypto codex—Stay ahead of the market with our daily newsletter for traders, investors and anyone interested in cryptocurrencies.

Bitcoin and cryptocurrency exchanges HashKey and OSL were granted their first licenses this week, allowing them to serve retail customers in the so-called Special Administrative Region of China, Hong Kong.

A HashKey spokesperson said the exchange has “expanded its reach from servicing professional investors to serving individual users, expanding its business scope to provide users with a safer and easier purchasing process. To meet demand, we have successfully completed a streamlined process to obtain license upgrades.” and store cryptocurrencies. “

“This is a significant first-mover advantage,” OSL CEO Hugh Madden said in a statement, adding that traders can now trade Bitcoin and Ethereum on the platform.

Earlier this year, Hong Kong announced a new cryptocurrency licensing regime. It aims to help Hong Kong become a global bitcoin cryptocurrency hub amid a global crypto crackdown, with some of the largest US bitcoin and cryptocurrency companies operating globally. I’m on a quest to find a new base.

China’s crackdown on Bitcoin, Ethereum and cryptocurrencies in 2021, which will expel the cryptocurrency companies and so-called miners that maintain blockchain networks, has caused a sudden price crash and caused dozens of cryptocurrencies to disappear from the entire cryptocurrency market. Billions of dollars were blown away, causing panic among traders.

Some speculate that China’s return to bitcoin and cryptocurrencies could trigger the next price boom. Jeremy Allaire, chief executive of stablecoin issuer Circle, which oversees the $28 billion USDCUSDC stablecoin, said in June that there was “huge demand” for digital assets in emerging markets “focused” on China and Asia. “I see there is,” he said.

“Hong Kong is clearly trying to establish itself as a very important center for digital asset markets and stablecoins, and we are paying close attention to that,” Allaire said in Tianjin, China. told Bloomberg at the World Economic Forum.

SIGN UP NOW crypto codex— Free daily newsletter for anyone interested in cryptocurrencies

For now, Bitcoin and cryptocurrencies (including major coins Ethereum, BNB, XRP, Dogecoin, Cardano, Solana, Tron and Polygon) are stuck in holding patterns, with volatility declining and Bitcoin becoming gold. may emerge as a substitute for

“Bitcoin continues to show resilience around the $29,000 support level,” Rachel Lynn, chief executive of crypto derivatives platform SynFutures, said in an emailed comment.

“The recent dip in volatility is nothing out of the ordinary. We are observing one of the quietest periods in the history of Bitcoin and the broader cryptocurrency market. Over the past six months. “Bitcoin’s volatility has fallen as the market calm has been so pronounced.” “Bitcoin could be a viable option for risk-averse investors seeking exposure to the crypto space.”

follow me twitter.