red photographer

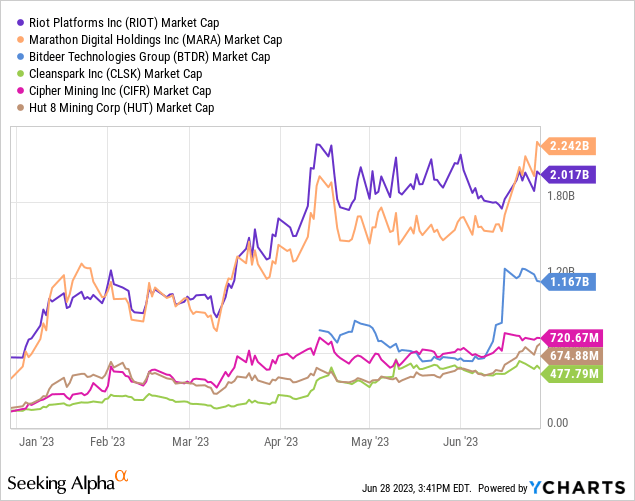

One of the newest Bitcoin (BTC-USD) miners available to US stock market investors is Bitdeer Technologies Group (NASDAQ: BTDR). The company has a blended approach to earning revenue from three main sources. Self-mining, hosting, hashrate sharing.ever since my Initial coverage Along with the stock price rally in April, the announcement of Q1-23 earnings results and share buybacks doubled the stock price from less than $7 at the time of the announcement to just under $13 per share in early June.

This share price surge pushed Bitdeer’s market capitalization well past $1 billion. BTDR is currently the third largest public miner by market capitalization. In this update, we take a look at one of the company’s core revenue segments and what might be driving this price action.

First Quarter Earnings Breakdown

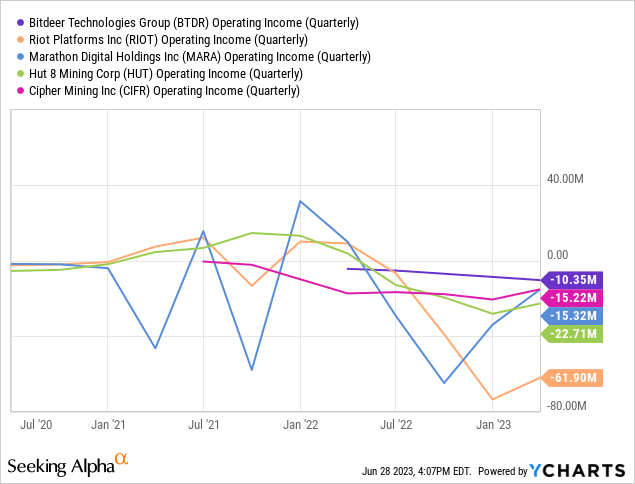

at Bitdiaz Q1 earnings report, the company reported revenue of $72.6 million for the quarter. This is the second highest division revenue after Riot Platforms recorded $73.2 million (Riot) in the quarter.However, Bitdeer’s operating loss for the quarter was just $10.4 million is significantly better than Riot’s $66.4 million loss, and better than smaller peers like Cipher (CIFR) and hut 8 (hut) likewise:

Gross profit of $13.5 million was offset by SG&A expenses of $18.4 million, of which $12.3 million was stock-based compensation. However, given the company’s operating loss against peers with similar revenue figures, Bitdeer’s performance is clearly better by comparison. The company appears to benefit from a more diversified business model that can draw well from each of Bitdeer’s revenue segments.

- $13.2 million from self mining

- $18 million from cloud hash mining

- $22.1M from Generic Hosting

- $16.5M from Membership Hosting

Compared to Q1-22, total revenue decreased by 19.7% year-on-year. The company attributed this loss to the falling Bitcoin price and a drop in cloud hash mining orders. The cloud hash mining segment saw the largest individual segment decline. That’s down 55% from $40 million a year ago. I suspect that the business segment is declining more than other segments due to unprofitable contracts with some of the company’s cloud hash customers.

An interesting takeaway from the Q1 report is how the company’s ownership hash numbers are calculated. Of the 18.3 operational EH/s as of March 31, 5.7 are unique or unhosted. Of the 5.7 unique EH/s, 3.9 is used for self-hosting and 1.8 is used for cloud hash rate business. So 1.8 EH/s of cloudhash brought in $18 million in revenue for Bitdeer, but his 3.9 EH/s in self-mining only made him $13.2 million.

While reading some reviews of the service online, I came across many examples of experiences that articulated something similar to a quote from a YouTube review from last year.

The first plan I purchased was the 30 day plan. In total I think it cost me $180-185, but I got about $150 back.

That is not the secret to success for cloud hash buyers, and those with small cloud hash plans may be better off simply buying BTC directly rather than betting on mining earnings. It seems somewhat clear that selling the company’s hashrate is a more profitable business than actually mining it with machines. With that in mind, it makes sense for Bitdeer to maintain more of its own mining capabilities if it were to aggressively expand the size of his BTC treasury. But that doesn’t seem to be the case.

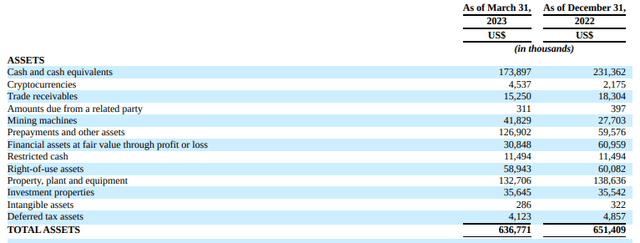

Balance sheet

Bitdeer has a real cryptocurrency trove to speak of, despite its cloud hash business appearing to be more profitable, and even though it keeps a lot of its own capacity for self-mining. is not. Since the end of 2022, the firm’s crypto holdings have more than doubled, but that doubling comes from a low starting point.

assets (Bitdia)

The balance sheet has a huge cash reserve of $173.9 million. The company has just $4.5 million in crypto assets, but to my knowledge, the breakdown of those holdings was not included in the Q1 report. The company’s prospectus previously had a hefty allocation to Filecoin (FIL-USD), which was recently designated an unregistered security in the SEC lawsuit against Binance.

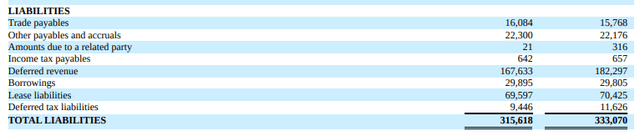

liabilities (Bitdia)

Meanwhile, the company has total debt of $315 million. Most of that is deferred revenue.

Share buyback plan

June 16th, bitdia announced The $1 million share repurchase program is in effect through September 15, 2019. The reaction to the announcement was strong, with the company’s stock price rising from $7.56 on June 15 to $11.41 the following day. Given the company’s market capitalization of $841 million as of Wednesday, this is a fairly positive response to such a small share buyback deal, perhaps making BTDR the smallest in the sector. It is thought that this is due to holding one of the free float stocks.

| BTDRMore | Riot | Mara | hut | CIFR | CLSK | |

|---|---|---|---|---|---|---|

| Number of issued shares | 111.29M | 178.16M | 169.97 million | 221.28 million | 248.94 million | 112.69M |

| Floating % | 24.38% | 95.32% | 99.42% | 99.34% | 16.58% | 95.69% |

| insider stock | 84.16 million | 8.33 million | 989.05K | 1.47 million | 5.74 million | 4.85 million |

| insider% | 75.62% | 4.68% | 0.58% | 0.66% | 2.31% | 4.30% |

Source: Seeking Alpha

With only 24.4% free float, BTDR stocks can be more volatile than many other BTC mining stocks. For example, consider his 50% intraday price movement on June 16 after the buyback plan announcement. The move was made at a trading volume of just 712,000 shares, or 2.6% of float and 0.6% of shares outstanding. By comparison, RIOT typically trades between 10-15% of outstanding shares in a regular session.

Additionally, the idea of the company buying back its own shares at this time is somewhat disconcerting. If BTDR stock were trading well below book value, or had a meaningful level of positive earnings that the market didn’t respect, I think I would understand it more. Neither seems to apply here.

Points for investors

Bitdeer is a fairly unique mining business in the public equity market, as it splits fairly well-balanced revenue from several different streams. The company holds a large amount of insider stock, and management is believed to be encouraging the stock to go higher. However, it is questionable how sustainable the cloud hash rate business will be in the long term. Cloud hashing appears to be more profitable by leveraging the company’s own hash rate, but at the expense of Bitdeer’s customers. I think this segment shows he’s down more than 50% since last year.

The churn in this category is not unexpected given the vastly different Bitcoin sentiment from early 2022 to early 2023. If the price of Bitcoin rises further and retail bitcoiners try to get back into mining activity, Crowdhash’s earnings could rebound. . There is some debate about selling shovels in Gold Rush. Given the potential volatility with this low float stock name, I’m not sure he’ll follow BTDR stocks as an investment.