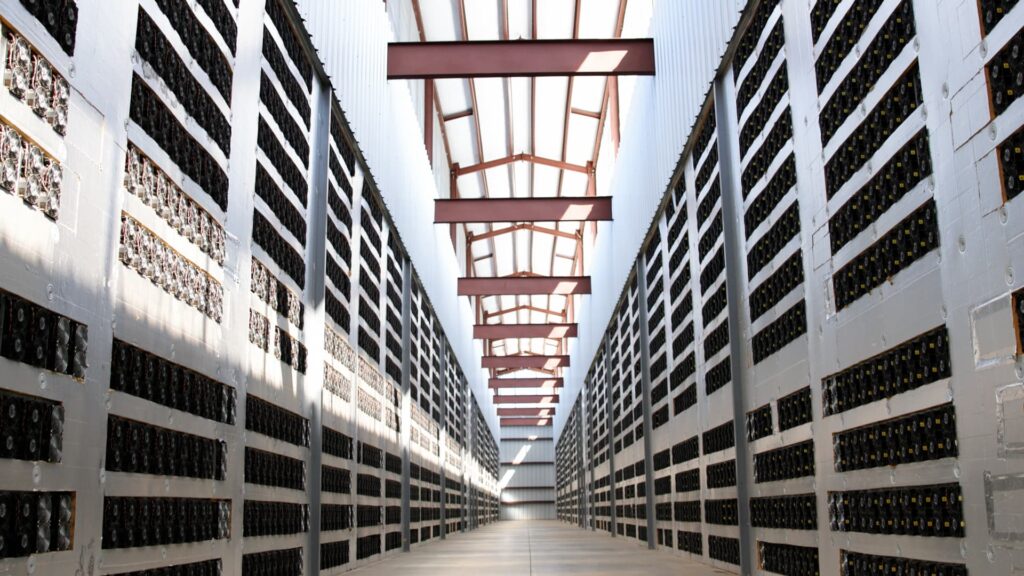

Mining stocks are under pressure now that Bitcoin has broken through this year’s key resistance, and some will suffer if the cryptocurrency doesn’t reach $50,000 by Q2 2024 there is a possibility. Earlier this week, Bitcoin started to rise. After staying below $30,000 for several months, it rose to $35,000 at one point. However, Bitcoin’s halving is scheduled for spring, and corporate profits are likely to decline. That means the cryptocurrency may need to rise another 60% by then to alleviate the pain of some high-cost miners. “Bitcoin price stability at ($28,000 to $32,000) is intolerable for many crypto companies, especially for high-cost It’s intolerable for the miners.” “If Bitcoin prices rise above $45,000 to $50,000 by the expected halving date of April 15, 2024, we expect Coinbase and low-cost miners’ stock prices to rise significantly, even after the halving. “If we are unable to sustain above $45,000, we expect stock prices, especially for high-cost miners, to be significantly weaker,” the miner said. “After the halving, low-cost miners will take market share, while high-cost miners will have to reduce the hashing power provided to the network until Bitcoin prices rise,” he added. . Bitcoin’s price currently sits just below $34,000, but chart analysts expect the lows as well as the highs to rise further in the coming months, reaching $40,000 by the end of 2023. Some people predict that it will reach . The Bitcoin halving event is a highly anticipated event for cryptocurrency investors. Historically, it has set the stage for new bull markets. This happens every four years and cuts the reward for mining Bitcoin in half, which makes up a significant portion of a mining company’s revenue. This reduction is mandated by the Bitcoin code to reduce the supply of the cryptocurrency over time. J.P. Morgan said, “The Bitcoin mining industry is struggling with the prospect of a Bitcoin ETF that could trigger an upswing, as well as a record hash rate rise that threatens the industry’s revenue and profitability.” “We are at a crucible moment as we weigh this against the impending halving of block rewards.” Analyst Reginald Smith said in an Oct. 11 note. “With that backdrop, we believe discipline and timing are paramount, and we believe that we are seeking the best relative value given existing hashrate, operational efficiency, power contracts, funded growth plans and liquidity. Marathon Digital and Riot Platforms are the largest mining stocks by market capitalization. Marathon is notorious for having the highest energy costs and lowest profit margins, while Riot has relatively low electricity costs but a high stock price. CLSK YTD Mountain Clean Spark Year-to-date Stock Price Clean Spark is the only mining stock in JPMorgan’s coverage universe with an Overweight rating, but its price target is for a 12% decline from current levels. It suggests. Needham highlighted Riot and Cipher as favorites, noting that their diversified revenue exposure could further limit the impact of the halving. Decreasing Revenues, Increasing Costs In general, mining stocks benefit as rising Bitcoin prices lead to increased mining revenues for companies. Over the past week, Riot stock is up more than 10%, CleanSpark is up 12%, Marathon is up 17%, and Cipher is up 40%. But their performance is more complex than that. In addition to revenue from block rewards about to be cut in half, miners are also facing a steady increase in network hashing rates. Hash rate measures how much computing power the Bitcoin network uses to process transactions and is a key indicator of network health. . Bitcoin’s hash rate has been consistently at all-time highs throughout the year, which is good for the health and safety of Bitcoin, but tends to hurt miners’ profits. “Now that more hardware-equipped miners are coming onto the market, there are more people than ever competing for these coins, which is making economic conditions difficult for the industry as a whole,” Smith said. Ta. When it comes to costs, the main cost for miners is electricity. Some companies have contracts with power generation companies to purchase a certain amount of electricity per year at a fixed price. Miners who purchase power at spot prices may incur losses when power prices spike in summer or winter. Another big cost he has is the hardware. Some miners are using old and inefficient mining equipment and may not be able to invest in new equipment as they juggle other costs and variables. It could be difficult for companies as the halving approaches, but a large enough rally could help. “Even if Bitcoin goes up or doubles between now and the halving, these machines that I think are currently uneconomic could still become economic. It depends on what happens to the price of Bitcoin,” Smith said. “About 20% of the network is running on machines that will no longer be economical in the next half-life, so those machines need to be taken offline. “Depending on whether you have a high-speed machine in a location, the machine could be shut down. It would be forced out of the market.” —CNBC’s Michael Bloom contributed reporting.