On-chain data shows that the largest Bitcoin whale has returned to circulation, a sign that the asset price could be bearish.

Bitcoin investors with over 10,000 BTC are starting to sell again

As analyst James V. Straten explains in a new article, post In X, the BTC whale, which was previously in the accumulation phase, has now switched to distribution behavior.

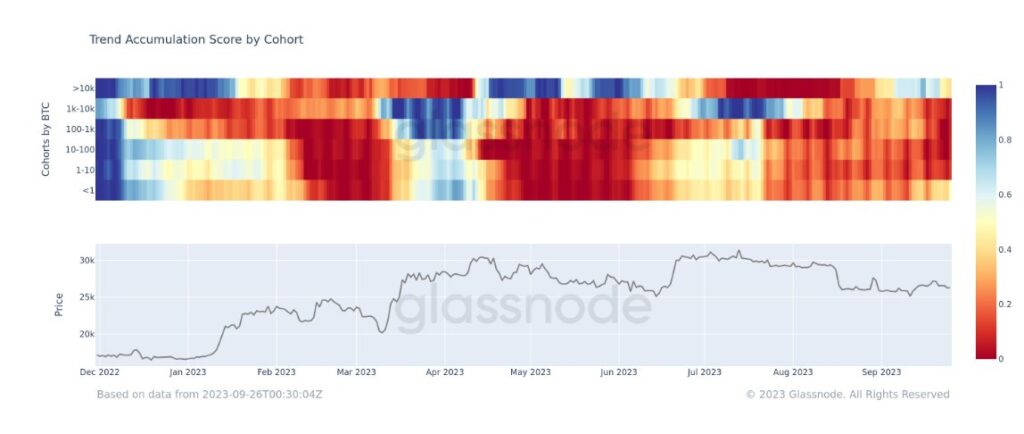

The relevant metric here is Glassnode’s ‘Trend Cumulative Score’. This tracks whether Bitcoin investors have bought or sold over the past month. This metric finds this value by looking at the change in the balance of the owner’s address.

The score also places higher weight on larger entities. This means that the accumulation of a few large holders is more important for the indicator than the movement of small hands.

A trend accumulation score value close to 1 means that there is currently a net accumulation trend in the market. On the other hand, a value close to zero means that dispersion is currently the dominant behavior.

Well, here’s how this score has changed for different Bitcoin investor cohorts since the beginning of the year.

The data for the Trend Accumulation Score for various groups | Source: @jimmyvs24 on X

As seen above, the overall Bitcoin market was exhibiting a net distributive behavior during August, as the cumulative propensity score was a shade of red across all cohorts (the darker the shade, the closer it is naturally to the zero mark). Masu). During this period of decline, BTC experienced a significant drawdown.

As of early September, most of the investor groups were still selling, but interestingly, the sector’s largest group held over 10,000 BTC ($262.7 million at current exchange rates). Owners were starting to save on their behalf.

This group is sometimes called the “mega whales” because they are outstanding investors among whales. The data shows that these giant whales were making purchases earlier this month, but have recently shown a change in behavior again.

The propensity cumulative scores of these large entities have decreased and are now tilted toward the distribution. This suggests that these investors thought the previous lows were an ideal entry opportunity, but the fact that the coin has continued to stagnate recently may have changed their minds. may be.

However, at this point, the big whales are not releasing Bitcoin on a large scale. However, the same is not true for the rest of the cohort, which has recently had a fairly intense sell-off, with its Trend Cumulative Score in the red.

This market-wide sell-off could be a troubling sign for cryptocurrencies and could portend a drawdown in the near future.

BTC price

Bitcoin has shown an overall trend of consolidation since its crash in August, with the cryptocurrency continuing to hover around $26,200.

BTC has been stuck in sideways movement for a while now | Source: BTCUSD on TradingView

Featured image from Rod Long on Unsplash.com, charts from TradingView.com, Glassnode.com