Bitcoin (BTC) trading volume on Binance has declined this month amid increased lawsuits and regulatory scrutiny of the world’s largest cryptocurrency exchange.

According to K33 Research, Binance’s seven-day average spot BTC volume has declined by 57% since early September, while most other exchanges’ readings have remained roughly flat. U.S.-based competitor Coinbase’s trading volume rose 9% over the period.

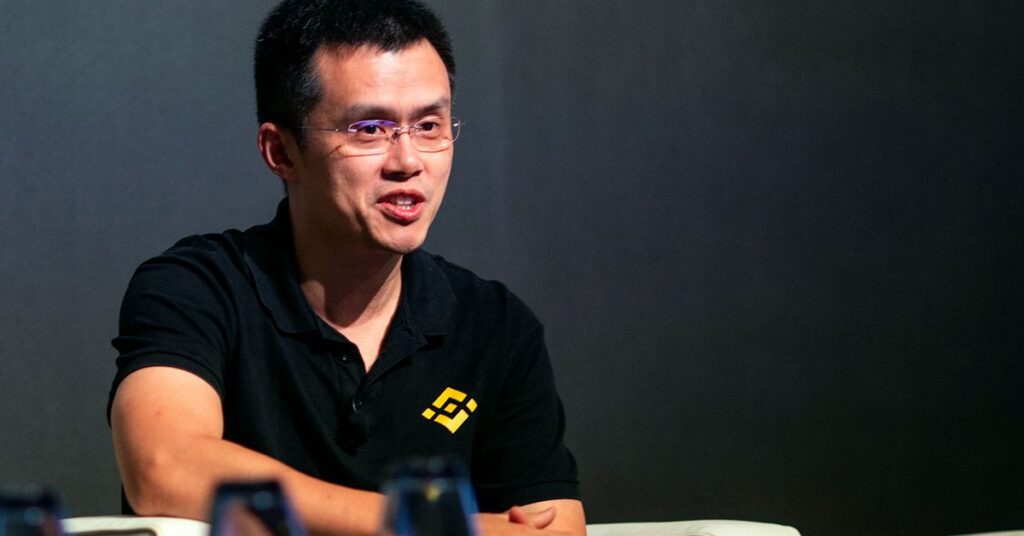

The dramatic drop comes as Binance is in the crosshairs of regulators around the world following a series of lawsuits, license denials and voluntary exits. Prosecutors at the U.S. Department of Justice (DOJ) are reportedly considering charges against the company, while the Securities and Exchange Commission (SEC) announced three months ago that Binance, the exchange’s U.S. subsidiary, Binance.US , indicted founder Changpeng “CZ” Chao on multiple charges. Federal securities laws.

“The ongoing DOJ and SEC lawsuits against Binance may have deterred market makers from trading on Binance, explaining some of the decline,” said Vettle Runde, senior analyst at K33 Research. ” he said. “While some of the market making has probably been leaked to other exchanges, it is almost certain that Binance’s woes are still having a negative impact on market volume,” he added.

Binance.US It also suffered from an outflow of trade activity. data The platform’s overall weekly trading volume has fallen by about 99%, to $40 million from nearly $5 billion earlier this year, according to a study by crypto analysis firm Kaiko.