- The Australian dollar continues to fall as concerns grow over the Israel-Gaza conflict.

- Australia’s unemployment rate was higher than expected, at 3.6%.

- The People’s Bank of China kept the loan prime rate (LPR) unchanged at 3.45% for one-year terms and 4.20% for five-year terms.

- The number of U.S. unemployment insurance claims fell to 198,000, the lowest level since January.

- Fed Chairman Jerome Powell has indicated that the Fed has no plans to raise rates in the near term.

The Australian dollar (AUD) is facing a third straight day of declines, with risk-off sentiment likely widespread. However, the AUD/USD pair gained some strength due to a weaker US dollar (USD) following comments from Federal Reserve Chairman Jerome Powell on Thursday. Supporting prices has come from Chairman Jerome Powell’s indications that the central bank has no plans to raise interest rates in the near term.

Australia’s employment landscape is undergoing some interesting developments. Employment changes fell more than expected in September, creating an unexpected twist in the equation. On the bright side, the unemployment rate fell more than expected and turned positive, deviating from the expected trend.

The US Dollar Index (DXY) has recovered from its recent decline, which can be attributed to rising US Treasury yields, coupled with strong economic indicators in the United States (US).

US employment data showed that the economy remained strong. Weekly new jobless claims fell to their lowest level since January, indicating a strong and resilient job market. Meanwhile, existing home sales have fallen to their lowest level since 2010, suggesting challenges in the housing market.

The decline in existing home sales is particularly noteworthy, pointing out that rising mortgage costs are having a negative impact on confidence in the housing market.

Daily Digest Market Trends: Australian Dollar Expands Losses Due to Strong US Employment Statistics

- Australia’s unemployment rate showed a surprising positive in September, at 3.6%. This was higher than the expected 3.7% and in line with the previous 3.7%.

- Australia’s employment change for the month was 67,000, lower than the consensus estimate of 20,000. This is a notable decrease compared to the 64,900 jobs added in August.

- The Central Bank of Australia has expressed strong concerns about the impact on inflation from the supply shock. Reserve Bank of Australia Governor Michelle Bullock said the RBA would take immediate policy action if inflation were higher than expected. There is a visible slowdown in demand, and per capita consumption is on the decline.

- The People’s Bank of China (PBoC) kept the loan prime rate (LPR) unchanged at 3.45% for one year and 4.20% for five years. Furthermore, China’s retail sales (year-on-year) showed an increase of 5.5%, exceeding both the previous estimate of 4.6% and the expected 4.9%.

- The situation in Israel with the possibility of a ground invasion into Gaza is likely to add further uncertainty to traders of the AUD/USD pair. The fact that US President Joe Biden is scheduled to address the nation on Thursday suggests the issue is important on the world stage.

- Federal Reserve Chairman Jerome Powell said further monetary tightening could be justified if there is substantial evidence that growth is above baseline or if the labor market stops improving. He clearly stated that he has sex.

- Chairman Powell emphasized that the main concern remains inflation risk. However, the policymaker indicated the central bank had no plans to raise rates in the short term to support the AUD/USD exchange rate.

- Weekly new U.S. jobless claims fell to 198,000, lower than market expectations of 212,000 for the week ending October 14 and the lowest level since January.

- The change in existing home sales in September decreased by 2.0% from the previous month, with existing home sales improving to 3.96 million.

- The U.S. unemployment rate improved to 3.6%, but was expected to stabilize at 3.7% in September.

- The number of building permits in September was 1.475 million, exceeding the expected 1.45 million. Meanwhile, housing starts recovered to 1.35 million, falling slightly short of the market consensus of 1.38 million.

- The U.S. Bureau of Economic Analysis (BEA) said retail sales rose to 0.7% in September, beating expectations of 0.3% month over month. Meanwhile, the Retail Sales Management Group rose 0.6% compared to his previous increase of 0.2%.

- This strong performance highlights consumer resilience. The Fed then reported that industrial production improved by 0.3%, although it was expected to remain at 0.0%.

- The U.S. bond market continues to be volatile, with the 10-year Treasury yield stabilizing at around 4.99%, its highest level since 2007. Meanwhile, the yield on two-year government bonds has fallen to 5.16%.

- No major reports are planned in the United States. Federal Reserve officials Logan, Mester and Harker are scheduled to address the nation, but their speeches are unlikely to cause any surprises.

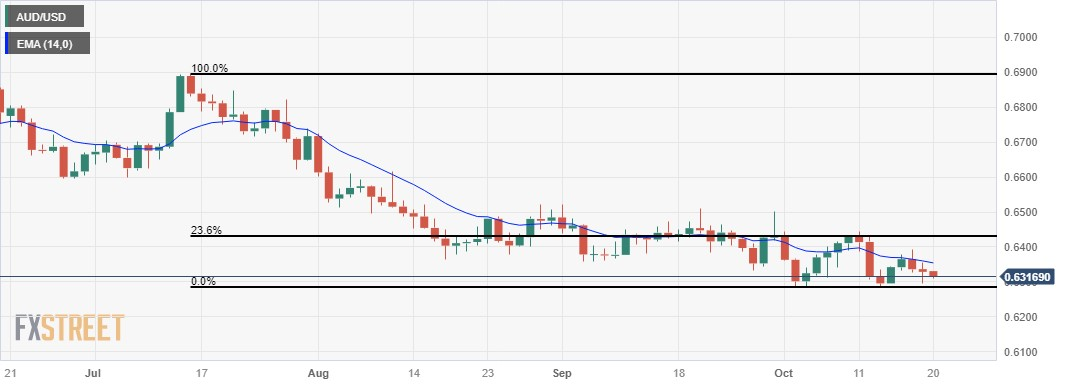

Technical analysis: Australian dollar remains above key level 0.6300 after Fed Chairman Powell’s remarks

The Australian dollar is currently trading lower around 0.6320 on Friday with major support at the 0.6300 level. Immediate support is marked by the monthly low at 0.6285. On the upside, key resistance is identified near the 14-day exponential moving average (EMA) at 0.6354, followed by the major level at 0.6400. A breakout of this level could reach the 23.6% Fibonacci retracement level near 0.6429.

AUD/USD: daily chart

Australian dollar price today

The table below shows today’s percentage change in the Australian Dollar (AUD) against major listed currencies. The Australian dollar was the weakest against the US dollar.

| USD | EUR | GBP | CAD | australian dollar | JPY | new zealand dollar | Swiss franc | |

| USD | 0.14% | 0.23% | 0.05% | 0.22% | 0.03% | 0.28% | 0.09% | |

| EUR | -0.14% | 0.09% | -0.10% | 0.08% | -0.11% | 0.14% | -0.05% | |

| GBP | -0.21% | -0.07% | -0.17% | 0.01% | -0.17% | 0.07% | -0.11% | |

| CAD | -0.04% | 0.13% | 0.18% | 0.21% | 0.00% | 0.25% | 0.06% | |

| australian dollar | -0.24% | -0.06% | 0.02% | -0.17% | -0.18% | 0.07% | -0.10% | |

| JPY | -0.03% | 0.10% | 0.16% | -0.01% | 0.16% | 0.22% | 0.06% | |

| new zealand dollar | -0.31% | -0.15% | -0.08% | -0.24% | -0.07% | -0.24% | -0.20% | |

| Swiss franc | -0.10% | 0.04% | 0.12% | -0.06% | 0.12% | -0.06% | 0.19% |

The heat map shows the percentage change between major currencies. The base currency is selected from the left column and the quote currency is selected from the top row. For example, if you select Euro from the left column and move along the horizontal line to Japanese Yen, the percentage change displayed in the box represents EUR (base)/JPY (estimate).

Frequently asked questions about risk sentiment

In the world of financial terminology, two terms are widely used: “risk-on” and “risk-off” to refer to the level of risk that an investor is willing to accept during a given period of time. In a “risk-on” market, investors are optimistic about the future and are more willing to buy risky assets. In a “risk-off” market, investors begin to “play it safe” out of fear for the future, so they buy low-risk assets that are guaranteed to yield a return, even if it is a relatively small amount.

Typically, during “risk-on” periods, the stock market rises, and so do the values of most commodities, except gold. This is to benefit from positive growth prospects. The currency of a country that is a large exporter of primary products will appreciate due to increased demand, and the virtual currency will appreciate. In a “risk-off” market, bonds, especially major government bonds, rise, gold shines, and safe-haven currencies such as the Japanese yen, Swiss franc, and US dollar all profit.

Minor currencies such as the Australian dollar (AUD), Canadian dollar (CAD), New Zealand dollar (NZD), ruble (RUB) and South African rand (ZAR) all tend to rise in “riskier” markets. This is because the economies of these currencies rely heavily on commodity exports for growth, and commodity prices tend to rise during risk-on periods. High economic activity This is because investors are anticipating an increase in demand for raw materials in the future.

The major currencies that tend to appreciate during “risk-off” periods are the US dollar (USD), the Japanese yen (JPY), and the Swiss franc (CHF). The U.S. dollar is the world’s reserve currency, because investors buy U.S. government bonds in times of crisis, and is considered safe because the world’s largest economy is unlikely to default. The yen is due to increased demand for Japanese government bonds, and since a high percentage of the value is held by domestic investors, there is little chance of a fire sale of government bonds even in times of crisis. The Swiss Franc is a popular choice because Switzerland’s strict banking laws provide investors with greater capital protection.