As stock market volatility continues to weigh on investor decisions, some mega-cap stocks (market capitalization) with established business models and strong fundamentals are among the leading stocks. It would be wise to consider stocks with a value of more than $200 billion. players in their respective industries. Use TipRanks’ stock comparison tool to compare Apple (NASDAQ:AAPL),Amazon(NASDAQ:AMZN), and Nvidia (NASDAQ:NVDA) to find the most attractive mega-cap tech stocks, according to Wall Street analysts.

Apple stock (NASDAQ:AAPL)

iPhone maker Apple’s sales have fallen for the fourth straight quarter, as macro challenges impact customer spending on big-ticket items. Apple beat analysts’ fiscal fourth-quarter forecasts as its iPhone and services sales considerably cushioned sluggish sales of its Mac and iPad, but investors doubted the company’s December quarter I was disappointed in the outlook.

Management expects fiscal first quarter sales to be in line with year-ago revenues. However, Wall Street expected the company to return to 5% revenue growth in the crucial holiday quarter. Management’s comments clearly demonstrated the impact of macro pressures on Apple products.

Is Apple a buy, hold, or sell?

Keybanc analyst Brandon Nispel said Tuesday that demand for some iPhone models has slowed. His October research for Keybanc revealed a significant slowdown in demand for Apple’s iPhone 15 and Plus models, partially offset by strong demand for the iPhone 15 Pro and Pro Max. it was done.

Additionally, Nispel noted that store inventory has increased well above last year’s iPhone 14 inventory levels. Keybanc’s “first look data” also reflects weaker iPhone sales compared to historical trends.

Overall, Nispel expects Apple’s fiscal first quarter revenue growth to be similar to last year. He emphasized that sales could also be affected by the lack of product releases in October and the fact that the iPhone was released later than usual in September. He also expects lower upgrade rates and slower customer demand to weigh on hardware revenue.

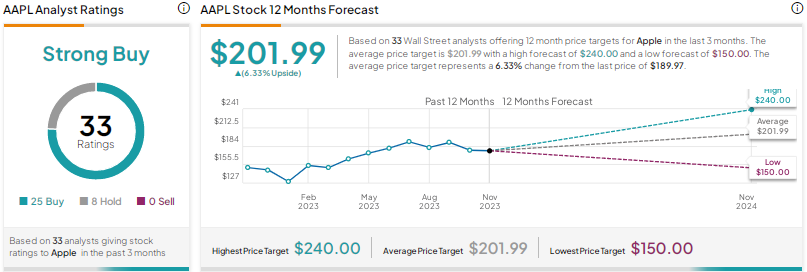

On Wall Street, the consensus rating for Apple stock is “Strong Buy,” with 25 buys and 8 holds. The average price target of $201.99 implies an upside of 6.3%. The stock price is up more than 46% so far in 2023.

Amazon stock (NASDAQ:AMZN)

E-commerce and cloud computing giant Amazon impressed investors by reporting better-than-expected profits for the first three quarters of 2023 despite a challenging macro environment. The company reported strong growth in its retail division, cloud computing division Amazon Web Services (AWS), and advertising business in the third quarter of 2023.

Amazon’s aggressive cost-cutting and streamlining measures have helped boost the company’s profitability. The company’s operating margin in the third quarter of 2023 expanded to 7.8% from 2.0% in the same period last year. Management is optimistic about future growth prospects due to artificial intelligence (AI) tailwinds in the AWS business, a strong e-commerce business, and increasing advertising revenue.

Is Amazon stock good to buy now?

Earlier this month, UBS analyst Lloyd Walmsley raised his price target on Amazon stock to $180 from $178 and reaffirmed his “buy” rating. The analyst pointed to Amazon’s strong third-quarter results, driven by strong margin improvements in North American Retail, International Retail, and AWS. The analyst also highlighted accelerating advertising revenue and a positive outlook for the fourth quarter.

He added that management’s tone on the conference call was positive about continued expansion in retail margins, but disappointed in AWS’ reacceleration of growth in the near term. Overall, Walmsley maintained Amazon as his top idea in the Internet market.

Like Walmsley, other analysts who cover Amazon are also bullish on the tech giant, giving the stock a consensus rating of Strong Buy. The average price target of $175.51 means there is approximately 20% upside potential. The stock has increased 75% since the beginning of the year.

NVIDIA Stock (NASDAQ:NVDA)

Semiconductor giant Nvidia has been enjoying a phenomenal performance this year, thanks to a surge in demand for graphics processing units (GPUs) due to a wave of generative AI. Nvidia recently announced its third-quarter financial results, which beat Wall Street expectations but fell short of shareholders’ high expectations.

Investors are also concerned about the impact of the Biden administration’s restrictions on exports of advanced chips to China. Nevertheless, the company is very optimistic about the future as it believes that “generative AI is his biggest TAM”. [total addressable market] It’s an expansion of software and hardware that we’ve seen for decades. ”

What is the target price for Nvidia stock?

JPMorgan analyst Harlan Sarr on Wednesday raised his price target on Nvidia to $650 from $600 and reiterated his rating on the stock as a “buy.” Sur emphasized that the company’s third quarter performance was on a higher revenue base.

Sur added that Nvidia’s guidance of 10% revenue growth going forward reflects continued strong spending by customers to support AI initiatives. Sur said NVIDIA was able to report third-quarter results that beat the market due to “massive demand pull” for its data center products. The analyst raised his forecast in response to this report.

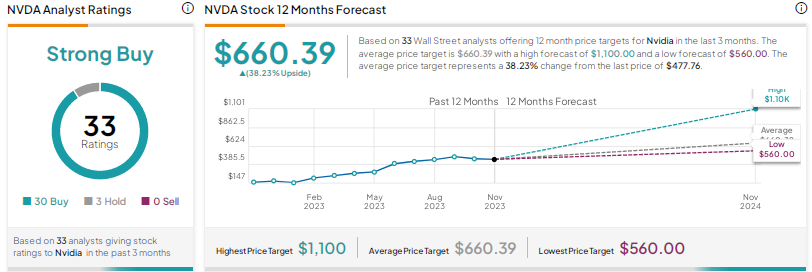

Nvidia received a Wall Street consensus rating of “Strong Buy” based on 30 Buys and 3 Holds. The average price target of $660.39 implies an upside of 38.2%, even after an impressive 227% year-to-date gain.

conclusion

Wall Street is very optimistic about the three mega-cap tech stocks featured here. Still, analysts believe Nvidia stock has the most upside potential among the big three tech companies, even after this year’s impressive year-to-date rally driven by generative AI. According to TipRanks’ Smart Score system, Nvdia has a “Perfect 10” score. This means the stock has the ability to outperform the overall market over the long term.

disclosure