There was no unusually strong countertrend price action in the forex market last week, so I don’t expect it this week

Recommended forex brokers in your area

this week Start with monthly and weekly Forex forecasts for notable currency pairs. The first part of my forecast is based on a study of Forex prices over the last 20 years and shows that the following methodologies all produce profitable results.

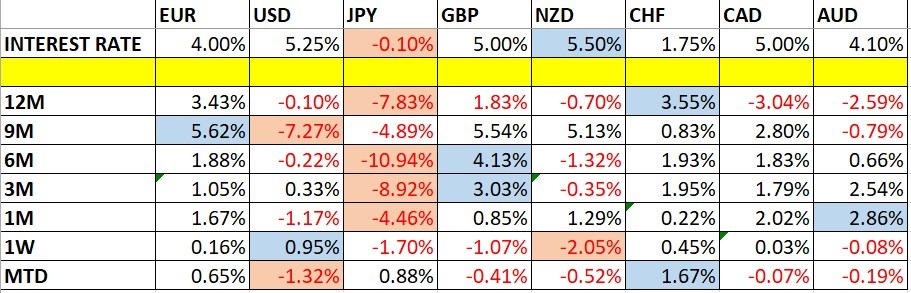

Let’s take a look at historical data related to currency price changes and interest rates, compiled using trade-weighted indices for the world’s major currencies.

For July, we predicted the value of the USD/JPY currency pair to rise.

The performance of this forecast to date is as follows:

Last week I predicted that the following currency crosses are likely to rise in value: GBP/SEK, EUR/SEK and EUR/NOK.

Pound/Swedish krona fell 0.39%.

The euro/Swedish krona gained 0.52%.

Euro/Norwegian krone fell 0.65%.

This resulted in an overall loss of 0.52%.

There were no unusually strong counter-trend movements in the forex market last week, so I wouldn’t expect it this week.

Forex market directional volatility dropped very slightly last week 48% of the most important currency pairs and crosses fluctuate by more than 1% over the course of a week. Volatility will likely drop next weekBecause the weekly data schedule is much lighter.

The US dollar was relatively strong last week, while the New Zealand dollar was relatively weak.

My predictions can be traded on a real or demo forex brokerage account.

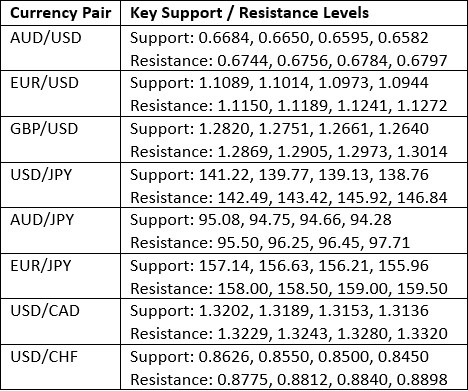

I teach that trades should be entered and exited at or very close to that point in time. Key support and resistance levels. This week, the more popular currency pairs have some important support and resistance levels that you can monitor.

Let’s see what happened last week when trading two of these major pairs from major support and resistance.

expected a level of $1.1272 may act as resistance in EUR/USD currency pair last week, as it previously acted as both support and resistance. Notice how these “role reversal” levels work so well. The price chart for the first half of the year below is Prices rejected this level just after the London trading opened last Tuesday (this could be the perfect time to start forex trading on a major currency pair like this). holding a big candelabra, Marked by a red down arrow on the price chart below, it shows the timing of this bearish rejection. This transaction is very Highly profitable, with reward-to-risk ratios of up to over 4:1. Based on the size of the entry candlestick.

expected a level of $1.3243 may act as resistance in USD/CAD currency pair last week, as it previously acted as both support and resistance. Notice how these “role reversal” levels work so well. The price chart for the first half of the year below is Shortly after the opening of the New York session last Tuesday, the price rejected this level (which could be the perfect time to start forex trading on major currency pairs, including the US dollar). with pin bar, Marked by a red down arrow on the price chart below, it shows the timing of this bearish rejection. This transaction is very It is highly profitable and offers a reward-to-risk ratio of up to about 3:1. Based on the size of the entry candlestick.

Ready to trade forex weekly analysis? We’ve put together a final list of the best forex trading brokers in the industry for you.