Flashpop/DigitalVision (via Getty Images)

Abstract of the paper

Bitcoin (BTC-USD) has fallen 20% since reaching local highs in April, following a 100% price gain. Still, the current sentiment would suggest that we are poised to make new lows.

a lot of this Negative factors can also be attributed to the SEC’s recent actions against large exchanges.

Still, the technical landscape remains bullish and what we have now is a good opportunity to buy BTC on support. This could be broken and the lows may continue, but the risk/reward here is good for long-term trades.

If BTC holds up and the rally continues, we expect altcoins to start outperforming. Are you in a position to handle this?

fear is in the air

As I recently wrote in this article, cryptocurrencies are under attack again. SEC filed lawsuit against Binance (BNB-USD)) and coinbase (coin); Binance and its CEO, Chao, said, “Net of Deception”Meanwhile, Coinbase is under investigation for listing 13 crypto assets that should have been registered.

The reality is that the SEC is very unclear about cryptocurrency regulations, and at least Coinbase has done everything in its power to comply with them. The company’s CEO sums it up nicely on Twitter:

1. SEC reviewed our business and allowed us to go public in 2021.

2. There is no way to ‘come and register’ – we have tried many times – so we do not list our securities. We reject most of the assets we review.

3. The SEC and CFTC have made conflicting statements and have not even agreed on what is a security and what is a commodity….

sauce: Brian Armstrong

In any case, the effects of this debacle are felt across the cryptocurrency industry, with cryptocurrencies being sold across the board.

That said, in the bigger picture, BTC has only given up a fraction of its gains in 2023, and from a technical standpoint, this fall was expected and continues the uptrend. still well on track to do so.

Technical outlook remains bullish

First, let’s zoom in on the 4-hour chart.

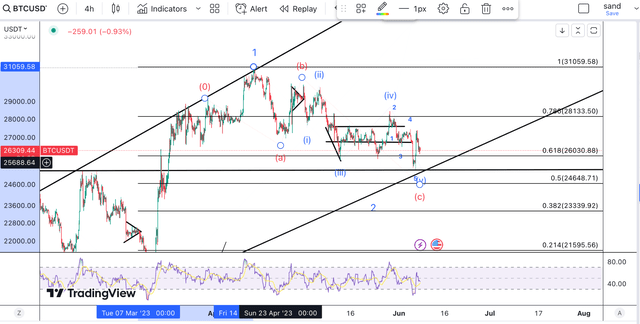

BTC 4 hour chart (Trading View)

From an EWT perspective, you can’t see it here, but wave 1 inside the larger (3) we topped out in March. Since then we have formed a modified structure which is now expected to be completed. We have a complete ABC and can also clearly see the five waves in C.

At the moment, it has rebounded slightly above $25,300, which is just above the 50% retracement of the first wave. It is also just above the trendline of the lower channel and just at the apex of the inverted head and shoulders neckline. This becomes even clearer when you zoom out to the daily chart.

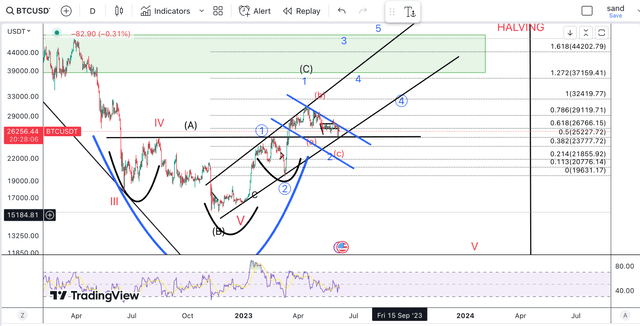

BTC 1D Chart (Trading View)

It can be argued that it forms an inverted head and shoulders indicated by the black curve. The black line is the neckline, which is exactly where it was reversed. Above this the momentum is maintained.

From a chart perspective, the cup and handle can also be evaluated, which also suggests a breakout to the upside.

And finally, it’s worth mentioning that we’re still in the big channel that we’ve been forming from the bottom.

In summary, why are we bearish here? The structure remains very bullish. We are testing the support and this is what happens even in a bull market. This is a good opportunity to accumulate or enter the trade with tight stops.

That said, the 61.8% retracement at $23,300 is the next big support when it comes to brake support. Presumably, this will push the RSI on the daily chart back to the oversold levels that led to a strong reversal in the recent selloff. Even if you fall below support and quickly return to the channel, this could still count as a fakeout. Of course, a break below $25,000 for an extended period of time would require me to reconsider this immediate bullish outlook.

Not just Bitcoin

As an aside, there are many reasons to be fundamentally bullish on Bitcoin, which we have already detailed. So I expect global liquidity to start increasing soon.

I would like to conclude this article by saying that we expect the next crypto bull market to be led by altcoins. Bitcoin has outperformed so far this year, and I believe the rotation to altcoins has begun.

The consensus is that altcoins typically start outperforming the largest altcoin, Ethereum (ETH-USD). And what do we see on the ETHBTC chart?

ETHBTC (Trading View)

After forming a big wedge over the past few months, it finally made its breakout on the ETHBTC chart. In other words, ETH is starting to outperform, followed by smaller cryptocurrencies.

The right altcoins can have very high returns for investors and I cover these extensively for my subscribers.

remove

In conclusion, now is the time to take risks as Bitcoin breaks above support. Falling below this may require re-evaluation, but this is not my primary expectation. Bitcoin’s next step is the $44,000 area, a 1.618 extension of the big wave 1 that can be seen on the daily chart. However, it is recommended to be very careful with alt. These carry higher risk, but also offer higher rewards.