(Bloomberg) — With a looming economic slowdown, cost cutting combined with stabilizing advertising trends has made analysts more bullish as Facebook’s owner’s stock looks more durable.

Bloomberg’s most read articles

The stock surged 140% from its seven-year low in November as Meta began cutting thousands of jobs in light of falling sales. The company announced further job cuts last month and pledged to be more efficient, sparking rallies.

More than 20 brokerage firms have raised their stock price targets since the second round of job cuts were announced. Analysts have also boosted Meta’s 2023 earnings-per-share estimates by 15% in the past three months, according to data compiled by Bloomberg. Morgan Stanley’s Brian Nowak regained a buy-worthy rating in March after less than five months on the sidelines.

Ad business is slowing, but at least stable, bulls say. And in another positive sign for earnings, changes to Apple Inc.’s privacy policy that make it harder to target iPhone users with ads have been in place long enough to no longer impact Meta’s year-over-year growth. increase.

Mike Akins, Founding Partner of ETF Action, Amplify’s MVPS index provider, said: ETFs. “The recent surge in the meta has mostly just recovered from being oversold.”

Meta’s stock remains well below the tech giants and the Nasdaq 100 Index, as analyst earnings expectations have risen along with the stock. Meta is trading at 17 times its expected earnings, below its 26 times average over the past decade, according to Bloomberg data. In contrast, Amazon.com Inc. trades at 36x, Microsoft Corp. at 28x, Apple at 26x, and technology-focused gauges sell at 24x.

Morgan Stanley’s Nowak called Meta the most durable megacap should consumer spending weaken, as its cost cuts are bolder than peers such as Alphabet.

Fears of inflation and the possibility of a recession are putting pressure on corporate advertising budgets, squeezing key revenue streams for companies like Meta, Google parent company Alphabet, and Snap Inc. But some analysts, such as his Michael Morris at the Guggenheim, see overall ad demand as more stable. .

Still, some investors may be hesitant to pay Meta now because of the potential for a recession, especially offshore, after the torrid rally since November. Even if Meta’s advertising business is doing better than its rivals, all media stocks will suffer if the recession is deep enough.

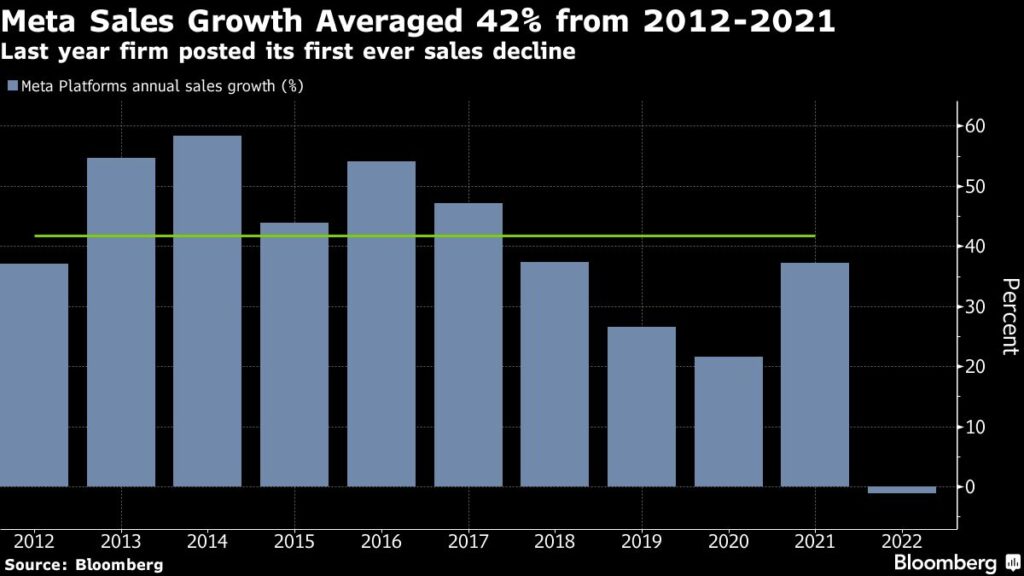

Until early last year, Meta had averaged 42% revenue growth over the decade since 2012, according to Bloomberg data. The company shocked investors last year when it reported its first-ever sales decline. The trend is now stable, with sales this year he will increase by 4.7%, and in 2024 he is expected to more than double to about 11%.

This is a much slower pace than investors are accustomed to, but Meta has managed to resume growth under CEO Mark Zuckerberg.

“In many ways, what Mark Zuckerberg has done in the last few months is to treat the company like a normal company, as opposed to a tech company with top-line growth that can cover a lot of the mistakes. Start looking at operating because they really own the stake, says Mark Stockl, chief executive of Adams Funds.

tech chart today

The Nasdaq 100 is up 20% this year, adding $2.6 trillion to its combined market value. As a result, the benchmark now has 28 companies with over $100 billion in capitalization, up for the second quarter in a row. This number is still down from 34 at the end of 2021. The gauge rose 0.2% on Tuesday.

top tech stories

-

US chip maker Micron Technology, which faces a cybersecurity review by the Chinese government, said the investigation had not affected its ability to deliver products.

-

Apple is cutting a few roles within the company’s retail team, according to people familiar with the matter.

-

Rogers Communications Inc. finally gains control of Shaw Communications Inc. after two years of legal battles, family intrigues and government lobbying to complete one of Canada’s largest corporate acquisitions . CEO Tony Staffieri doesn’t want to look back.

-

SenseTime Group Inc. has made its biggest gain in two months after speculation spread among investors that China’s most valuable specialist AI company is preparing to launch a challenger to the artificial intelligence phenomenon ChatGPT. showed an increase.

-

Walmart’s Indian payments business is set to expand into online shopping on the government-backed e-commerce network.

-

Japan is poised to significantly increase chipgear spending to boost its position in the global semiconductor market as it tightens exports amid U.S.-led pressure to limit China’s technological ambitions. increase.

–With help from Tom Contiliano.

(Update stock movement.)

Bloomberg Businessweek’s Most Read Articles

©2023 Bloomberg LP