Lakshmiprasad S

Written by Fawad Razazada

The initial excitement around the possibility of central banks taking a more dovish stance has faded; stock return calendar Results from some companies fell short of expectations.

Burberry Group (OTCPK:BURBY), For example, a decline in demand for high-end products could cause the company’s stock price to fall by up to 9%, preventing it from achieving its sales forecasts.

HelloFresh ( OTCPK:HLFFF ) also faced a setback, with its stock plummeting nearly 20% following a downward revision to its sales forecast. Additionally, Cisco Systems (CSCO) reported a 10% decline in pre-market trading after reporting a slowdown in new product orders.

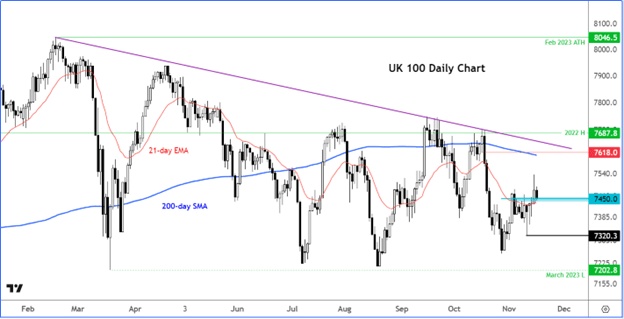

FTSE: Time to catch up with global indexes?

FTSE has struggled to find sustainable support after hitting a record high in February, hit by concerns about weak economies and high standards in China and the UK. interest rates around the world.

But some positive data from China, the UK and the US this week may mean the worst days are behind us. Indeed, the fact that UK inflation has fallen sharply to an annual pace of 4.6% from 6.7% previously brought some relief on Wednesday.

Most of those gains have since been eroded, but there are some technical signs that suggest FTSE could start rising again as macro concerns recede.

Frustratingly for bulls, FTSE has not enjoyed the same bullish momentum seen in other European and US stock markets over the past three weeks.

FTSE has a lot of catching up to do in this regard. However, in recent days, the FTSE has managed to rally above its 21-day exponential moving average and resistance near 7450.

So there are some signs of bullish momentum returning to the UK market. As of this writing, this 7450 level is being tested from above, meaning the bulls could show up here to push the index higher towards the end of the day.

Although the UK index has been making a series of new highs throughout this year, it is not strictly sold off and has mostly remained within a broad consolidation range.

The index managed to rise above the low of 7202 formed in March after several bearish attempts to break below it, twice in the summer and again in October.

The resilience of the bulls in the face of all macro risks is very impressive. If we can weather the storm with only minor damage, the index could start to rise if there is good news now.

I think we will likely see a rally next that tests the 200-day average and previous resistance in the 7600-7620 area.

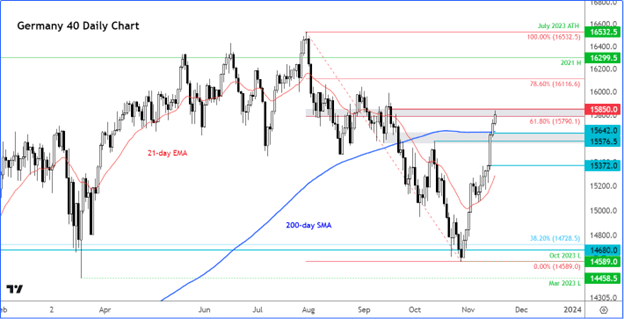

DAX: Outperforming German index tests key resistances

In contrast to the FTSE, the DAX is very close to reaching its all-time high set in July. Moreover, Germany’s stock index has risen more than 8% since its October low, while FTSE’s gain in the same period was only around 3%.

DAX is a good index for bulls to trade, but this does not necessarily mean that the outperformance will continue. The German index has now reached a potential resistance area around 15800-15850.

Here, the 61.8% Fibonacci retracement level to the all-time high coincides with the origin of the previous breakdown area.

Nevertheless, given the recent bullish momentum across global stock markets and the fact that several support levels have been broken, a sharp decline that would suggest that the trend has turned bearish again is unlikely. There is a possibility that we will only see a gradual decline and consolidation.

Therefore, I tend to look for push buys near support levels. The next important support area to look at is around 15575-15640. This area was previously resistant and the 200-day average comes into play here.

US stock index leads global stock markets on peak inflation and interest rate expectations

We are now in mid-November, and the US stock market is doing well. One of the best phases of the yearThis is thanks to optimism that with inflation now on a downward trajectory, interest rates will start to fall in the not-too-distant future.

However, the U.S. market, particularly the tech-heavy Nasdaq, appears slightly overbought after three weeks of sharp gains, so there is a risk of a pullback in the short term.

But with so many resistance levels broken in this selloff, we can’t call any potential short-term weakness a bearish reversal unless the charts indicate otherwise or the Fed begins to push back hard on rate cut expectations. They should not be confused. .

This week’s recent gains come after prices paid to U.S. producers unexpectedly fell in October by the most since April 2020, with Wednesday’s data showing signs of further easing of inflationary pressures. This is what I received.

This triggered massive movements across financial markets following the previous day’s weakness in the US consumer price index. A sharper-than-expected fall in UK inflation also helped lift European sentiment, as did signs that China’s economic recovery is starting to take hold.

Meanwhile, slightly better-than-expected U.S. retail sales and the Empire Manufacturing Index show the world’s largest economy continues to defy recession expectations.

It was first published moneyshow.com

Editor’s note: The summary bullet points in this article were selected by Seeking Alpha editors.