ayaberkut

This article appeared in Dividend Kings on Monday, May 8th.

————————————————– ———————-

It’s been a crazy few weeks for stocks, as you might not think just by looking at the S&P.

daily shot

S&P is It remained in the 3800 to 4200 trading range for several weeks despite all sorts of surprising economic data.

daily shot

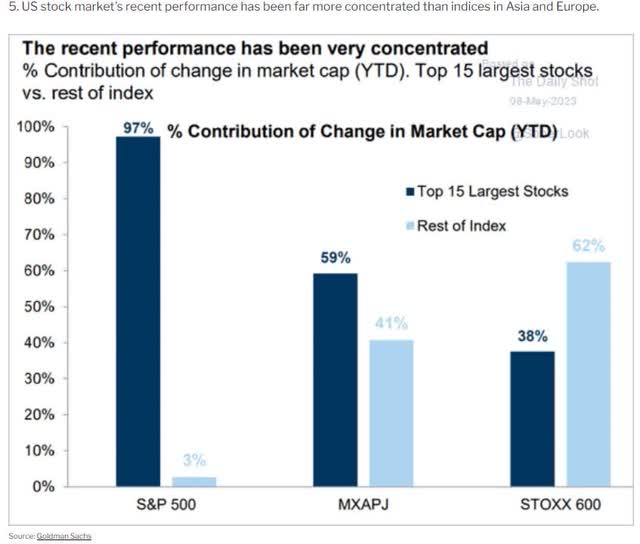

97% of market profits come from just 15 companies. This means that the eerie calm in the market hides a lot of turmoil in individual stocks.

Y-chart

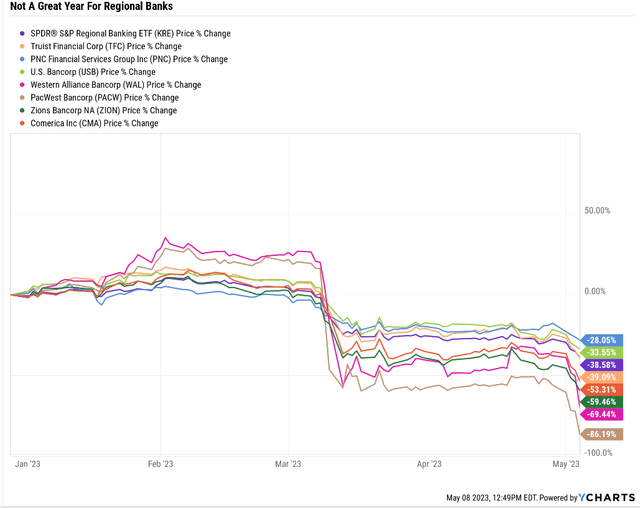

Riskier regional banks such as PacWest Bancorp (PACW), Western Alliance Bancorporation (WAL) and Zions Bancorporation (ZION) are falling off a cliff, while the strongest banks such as PNC Financial (PNC) and Truist Financial (TFC) Even super-regional banks and US Bancorp (USB) are trading as if the economy and its businesses are on fire.

how to be smart Can investors stay cool, sane, and rational when even America’s fifth-largest bank is trading like a memetic stock?

By focusing on what really matters.

Short-term stock prices are vanity, cash flows are sane, and dividends are real.

There’s nothing like a safe, steadily growing dividend to keep your eye on living a rich retirement dream.

“Do you know the only thing that pleases me? to see the dividends come in.” – John D. Rockefeller

But do you know the only thing better than a steady quarterly dividend? A monthly dividend! After all, our bills are billed monthly, and the more often they are paid, the less likely we are to freak out over such insane price fluctuations.

The problem with monthly dividend stocks, however, is that they are usually low quality and risky. High-yielding monthly dividend stocks are the realm of BDCs and mREITs.

It’s a complicated world of accounting where you really have to know what you’re buying and what management is doing.

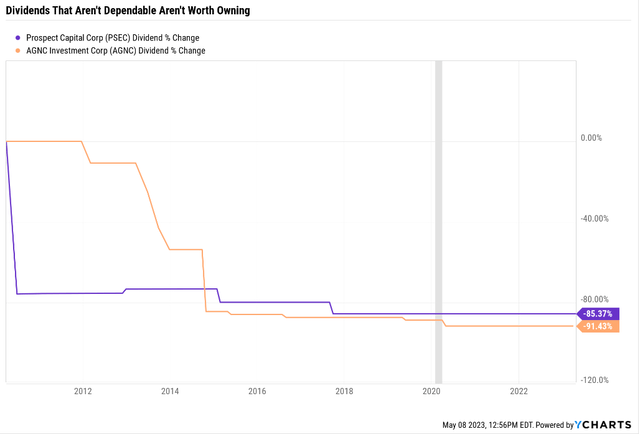

Consider Prospect Capital (PSEC) and AGNC (AGNC) as two popular examples of high-yielding monthly dividend traps.

- PSEC yields 11%

- AGNC 15%

They’re popular because they’re some of the first stocks you see when you sort out high-yield stocks.

Y-chart

These aren’t the kind of high yields that retirees should count on.

These are only suitable for traders who want to buy when they are heavily undervalued, collect a few months of dividends, and part before the price rebounds and the next dividend cut.

However, there are only a handful of reliable monthly payers.

How to easily find the best reliable monthly dividend stocks

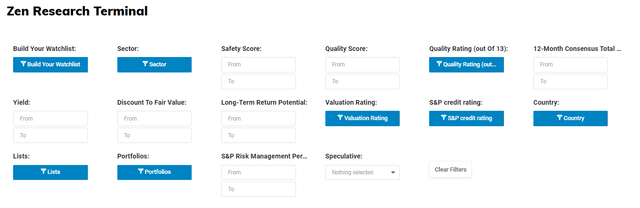

We show you how to screen the Dividend Kings Zen Research Terminal run from the DK 500 master list to find reliable monthly high yield stocks.

The Dividend Kings 500 Master List includes the world’s best companies, including:

- All Dividend Champions (25+ Years of Continuous Dividend Growth Including Foreign Aristocrats)

- Any Dividend Aristocrat

- All Dividend Kings (50+ Years of Continuous Dividend Growth)

- All Ultra SWAN (near perfect quality company as long as it exists)

- 20% of top quality REITs, according to iREIT

- The 40 fastest growing blue chip stocks in the world

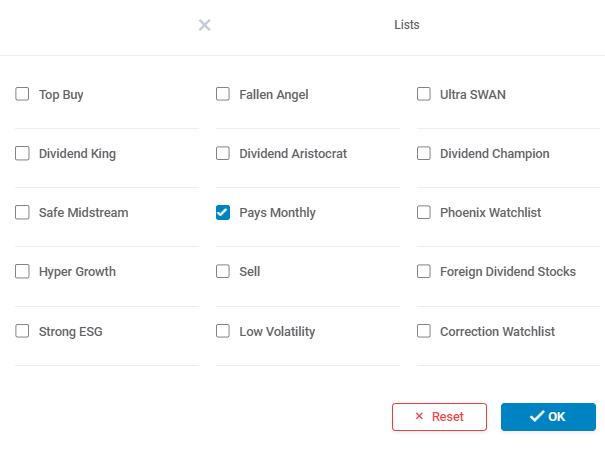

You can screen for dividend aristocrats, monthly dividend stocks and more on your watchlist.

Dividend King ZEN Research Terminal

Select any number of fundamental indicators (credit rating, growth rate, dividend streak, 30-year bankruptcy risk, etc.) and sort each watchlist by fundamentals such as yield, valuation, growth rate, total return potential, etc. , can be sorted. , credit rating, quality score, and country.

Dividend King ZEN Research Terminal

Click here for the monthly paid watch list.

Dividend King ZEN Research Terminal

There are six companies, one of which, STAG Industrial (STAG), is slightly overrated.

LTC is speculative due to industry stress.

- You can filter out speculative companies.

But the rest are all high quality, attractive value monthly dividend stocks that I can recommend.

So let’s take a closer look at them in order of highest safe yield.

4 High Yield Monthly Retirement Dream Blue Chips

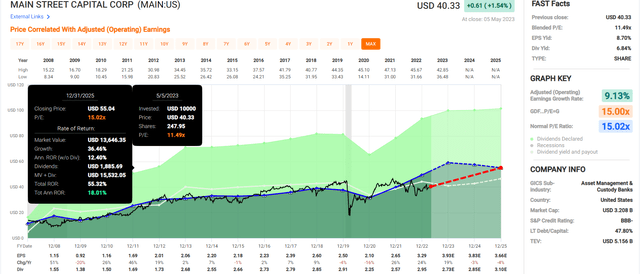

Main Street Capital (MAIN): BDC’s Gold Standard

References

- Main Street: Best of Breed BDC with 7% Yield

Why Main Street Is A Potentially Good Buy Today

Most business development firms are externally managed shadow banks. So management has an incentive to lend as much as possible, even if it’s not safe.

After all, they aren’t working for shareholders, they’re working for themselves, and shareholders pay them to manage their loans.

This creates an incentive to sell new shares or use maximum leverage to maximize the assets on which fees are paid.

MAIN is one of the few BDCs managed in-house. So management works for you and you have every incentive to make sure your dividends are safe and sustainable.

MAIN is one of the few BDCs with an investment grade credit rating, and its biggest claim to fame is being the only BDC not to cut its dividend in two recessions.

Not just a recession, but the two worst recessions in 70 years: the Great Financial Crisis and the Pandemic.

Basic summary

- DK Quality Score: 65% Medium Risk 10/13 Excellent BDC

- DK Safety Score: 73% Safe Dividend (2.7% Dividend Cut Risk in Deep Recession)

- Historical Fair Value: $48.13

- Current price: $41.10

- Discount to fair value: 15%

- DK Rating: Reasonable Purchase Potential

- Yield: 6.7%

- Long-term growth consensus: 8.0%

- Consensus long-term return potential: 14.7%

FAST graphs, FactSet

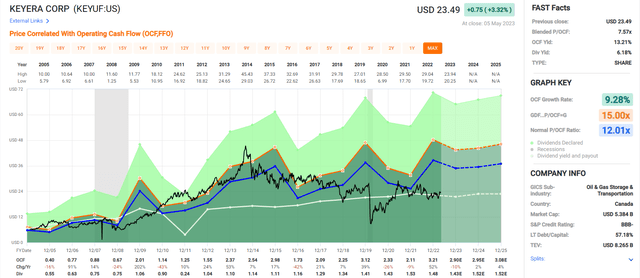

Keyera (OTCPK:KEYUF): One of the best midstream you’ve never heard of

References

- Keyera: 6.2% Yield Monthly Dividend Blue Chip Built for Turbulent Times

Why Keyera Is A Potentially Good Buy Today

Keyera was founded in Calgary, Canada in 1998. Offers a very attractive long-term, high-yield monthly value proposition.

It has an extensive transcontinental network of pipelines, storage facilities and gas processing plants (12 of which) that are mission critical to North America’s energy security.

KEYUF owns the assets that run the following commands:

-

20% of Alberta’s natural gas liquid fractionation capacity

-

35% of oil storage

-

15% of butane distribution

-

70% of oil sands condensate transport capacity

KEYUF has maintained one of the lowest leverage ratios in the industry since 2008, never exceeding 2.9x net debt/adjusted EBITDA.

-

In 2016, some midstreams were 8x

-

Including KMI at 7X

Keyera hasn’t cut its dividend since it started doing so in 2004.

How can you be sure KEYUF won’t cut even in a deep recession?

-

Avoided Pandemic Cut (Freeze) When Crude Oil Dropped to -$38

-

Worst oil disaster in human history

-

Avoided the cut (freeze) in the Great Recession

-

Management calls the dividend “non-discretionary.”

-

Dividends are 100% covered by fee-based earnings

-

Long-term payout ratio target of 65%

-

Consensus 65% payout percentage in 2022

The new project is focused on fee-based earnings rather than being tied to commodity prices.

-

70% by 2022

-

Rising to 77% by 2025

Basic summary

- DK Quality Score: 83% Medium Risk 13/13 Ultra SWAN Midstream

- DK Safety Score: 85% very safe dividend (1.6% risk of dividend cut in a deep recession)

- Historical Fair Value: $29.30

- Current price: $23.38

- Discount to fair value: 20%

- DK Rating: Strong Buy Potential

- Yield: 6.2%

- Long-term growth consensus: 5.0%

- Consensus long-term return potential: 11.2%

FAST graphs, FactSet

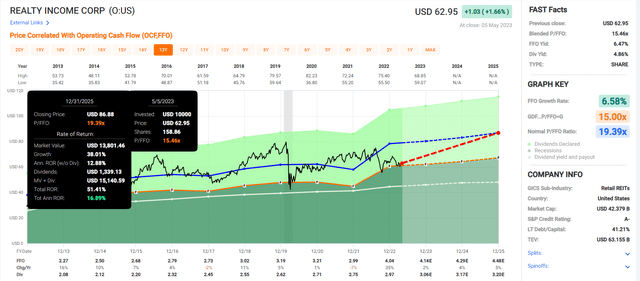

Property Income (O): Ultimate SWAN Monthly Dividend REIT

References

- Real estate income: boredom is beautiful

Why Real Estate Is A Potentially Good Buy Today

“If I could only own one REIT, it would definitely be real estate income.” – Brad Thomas

What makes Realty such a great REIT?

This is one of the most diversified REITs on the planet, with over 12,00 properties. In the US he has operations in 4 countries and all states.

As a triple net lease REIT, all tenants pay taxes, maintenance fees and insurance.

Realty is effectively a financial company. They leverage their conservative balance sheet and his one of only 17 A credit ratings in the sector to raise cheap capital.

We then purchase quality properties from companies and lease back their usage.

This creates one of the most stable free cash flow rich businesses on the planet. Realty’s free cash flow margin is 77%.

For context, this is three times Apple’s free cash flow margin.

Realty is a dividend aristocrat with 28 years of dividend growth with the most stable and recession-proof cash flow in the world.

Hats off if Realty doesn’t become a dividend king in 22 years.

Basic summary

- DK Quality Score: 97% Low Risk 13/13 Ultra SWAN Dividend Aristocrats

- DK Safety Score: 97% Very Safe Dividend (1.15% Dividend Cut Risk in Deep Recession)

- Historical Fair Value: $75.33

- Current price: $62.88

- Discount to fair value: 17%

- DK Rating: Strong Buy Potential

- Yield: 4.9%

- Long-term growth consensus: 3.5%

- Consensus long-term return potential: 8.4%

FAST graphs, FactSet

Agree Realty (ADC): SWAN-Abe REIT improving over time

References

- Agree on Real Estate: Why This Recession-Proof REIT Is a Strong Buy Today

Why Agree Realty Is Available Now

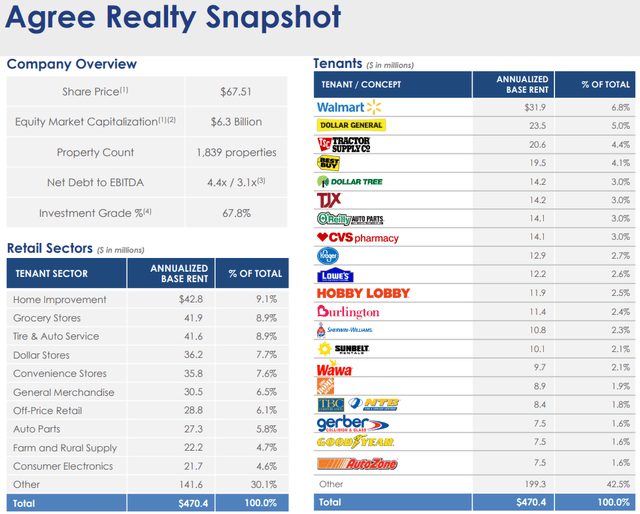

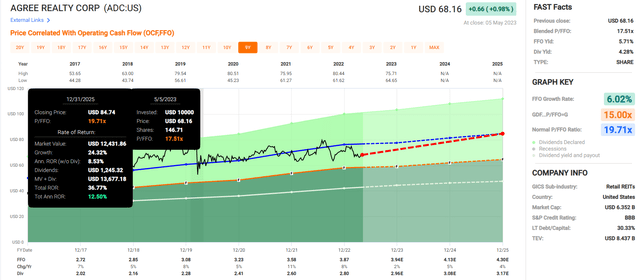

ADC isn’t as big as Realty Income, but its 1,800 properties make up for the small amount with incredible quality.

The top two tenants are Walmart and Dollar General. Not only companies that are recession-resistant, but also companies that can increase sales even in a moderate recession.

Presentation for investors

This is a BBB-rated balance sheet with a debt/EBITDA of 4.4x, the lowest leverage ratio in the industry.

In other words, ADC is what O was when it was much smaller, except with better quality, a more diverse tenant base, more investment grade tenants and a more conservative balance sheet. .

It will be a while before ADC can match O in reliability and creditworthiness, but if management sticks to knitting and stays on its current course, in 15 years ADC will be an aristocrat and eventually is the 18th A-rated REIT.

Basic summary

- DK Quality Score: 96% High Risk 12/13 Excellent REIT

- DK Safety Score: 96% very safe dividend (1.2% risk of dividend cut in a deep recession)

- Historical Fair Value: $74.71

- Current price: $67.58

- Discount to fair value: 10%

- DK Rating: Potential Buy

- Yield: 4.5%

- Long-term growth consensus: 5.3%

- Consensus long-term return potential: 9.8%

FAST graphs, FactSet

Bottom line: These four high-yielding monthly blue chip stocks are retirement dream stocks in times like this.

Just to clarify, I’m not calling MAIN, KEYUF, O, and ADC bottoms (I’m not a market timer). Neither does Warren Buffett.

Even the best companies in the world can fall quickly in a bear market.

Basics are everything that determines safety and quality and are my recommendations.

- Over 30 years, 97% of stock returns are a function of pure fundamentals, not luck

- In the short term, luck is 25 times stronger than fundamentals

- Fundamentals are 33 times stronger than luck in the long run

But here’s what I can tell you about the basics of MAIN, KEYUF, O, and ADC.

In my opinion, these are four of the most reliable, highest quality, high yield monthly blue chip stocks on the planet.

You can also own other monthly stocks such as CEFs and fixed income ETFs. But if monthly paying stocks are your goal, these four are very solid options to buy now.

In a downturn, investors of all ages will appreciate the company’s strong balance sheet, proven management team, and most of all, its proven reliability of dividend growth.

Editor’s Note: This article describes one or more securities that are not traded on any major US exchange. Please be aware of the risks associated with these stocks.